Judgment Lien Foreclosure In Virginia

Description

Form popularity

FAQ

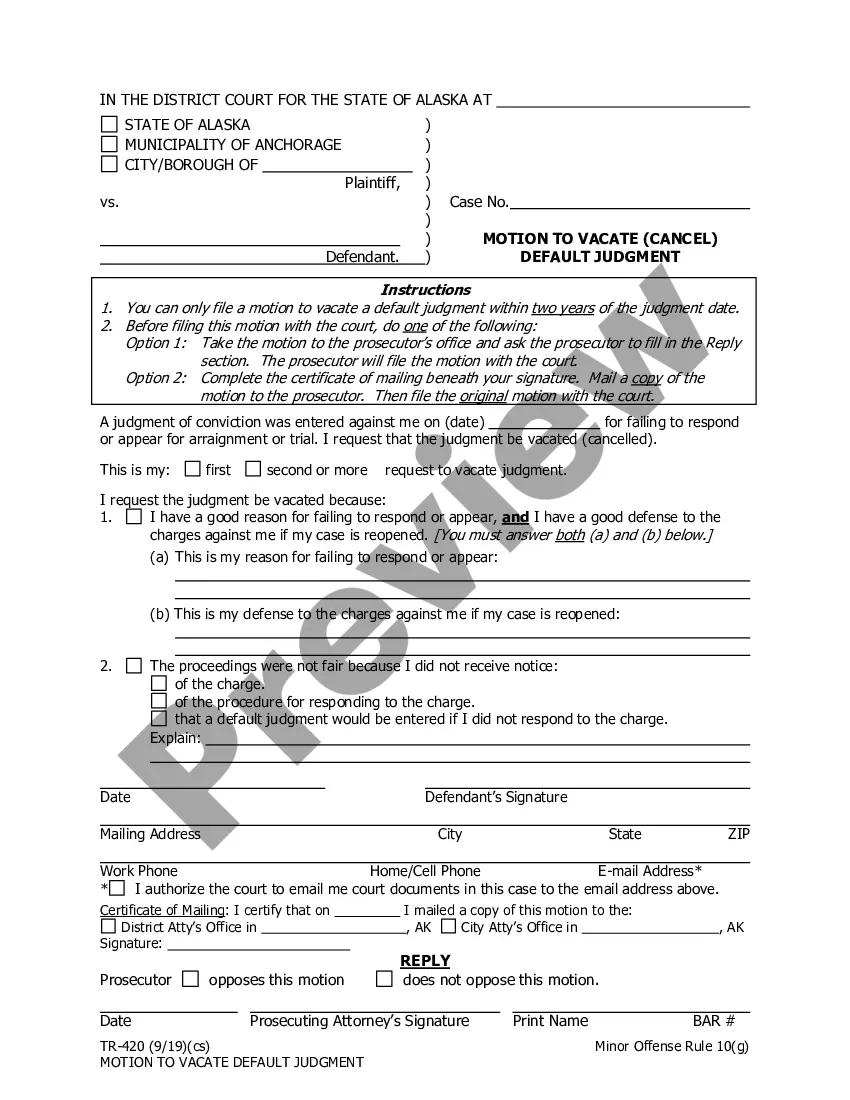

A circuit court judgment entered before July 1, 2021 lasts for 20 years from the date of original entry, unless extended as described below. Virginia law lets you extend judgment liens for up to two successive 10-year periods.

The judgment lien is not going to impact a homesteaded property so the mortgage lender would be able to obtain a first lien on your property. So, as long as you otherwise qualify for a mortgage, the judgment lien should not be a problem.

Duration: Once a judgment has been entered, creditors are granted a 10-year period to pursue collection efforts. This period can be renewed twice, extending the potential collection timeline to a maximum of 30 years.

In Virginia, a potential lien claimant must file a mechanics lien within 90 days from the last day of the last month in which he furnished labor and/or materials to the project (it must also be within 90 days from the completion or termination of the project).

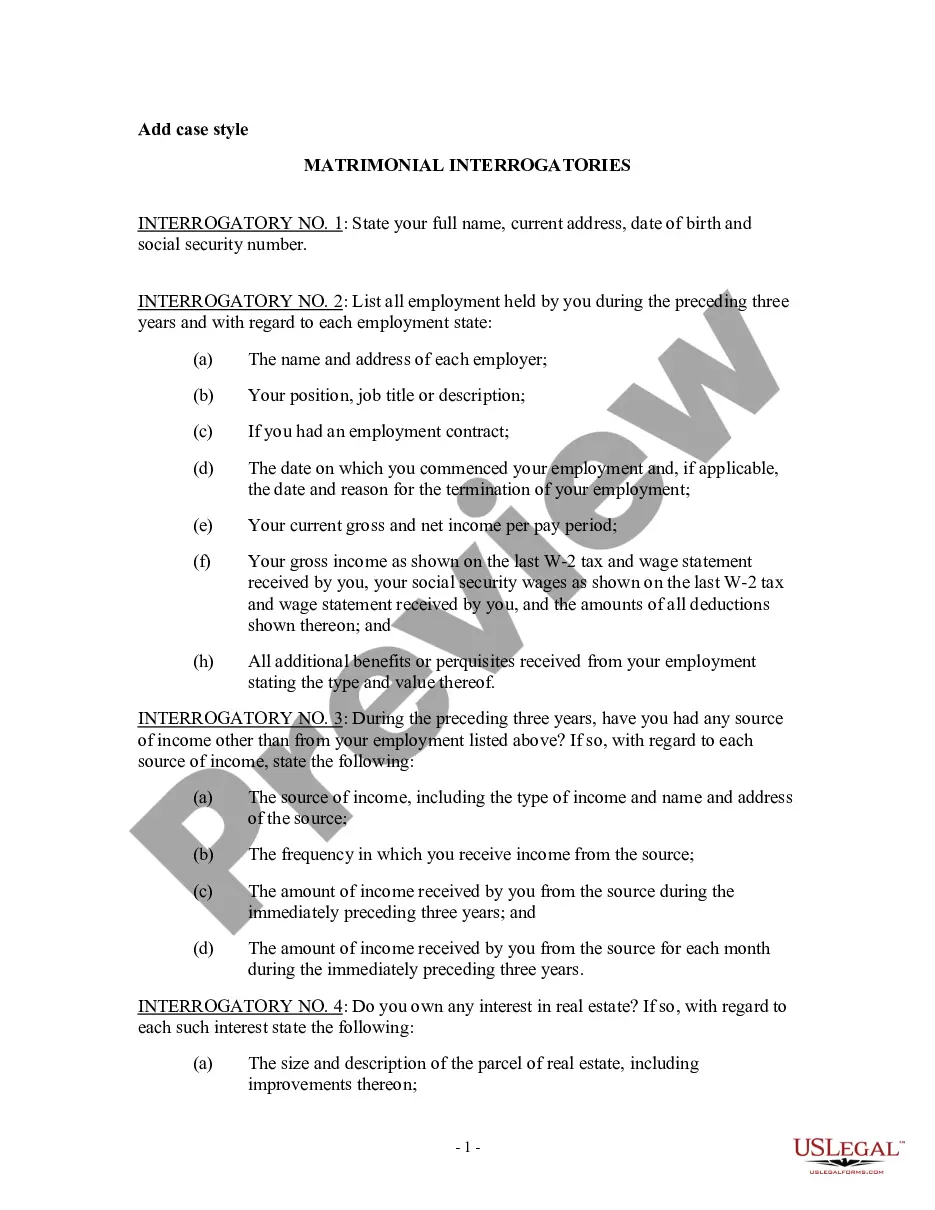

A judgment-creditor may ask the court for these things to help collect a judgment. Summons to answer debtor interrogatories. Garnishment of your income. Levy (or attachment) to sell your personal property.

When you receive the title, you need to visit a DMV customer service center to apply for a substitute title and have the lien removed from DMV records. If you do not get a substitute title at DMV, you'll need to get a lien release letter from the lender and a new title from DMV if your title is ever lost or destroyed.

How does a creditor go about getting a judgment lien in Virginia? To attach the lien, the creditor records the judgment on the county recorder's lien docket in any Virginia county where the debtor owns property now or may own property in the future.

The Virginia lien law states that the memorandum should be recorded in the clerk's office in the county or city in which the building, structure or railroad, or any part thereof is located. If the property spans more than one county, your claim should be filed in both.

How does a creditor go about getting a judgment lien in Virginia? To attach the lien, the creditor records the judgment on the county recorder's lien docket in any Virginia county where the debtor owns property now or may own property in the future.