Judgment Lien On Personal Property In Harris

Description

Form popularity

FAQ

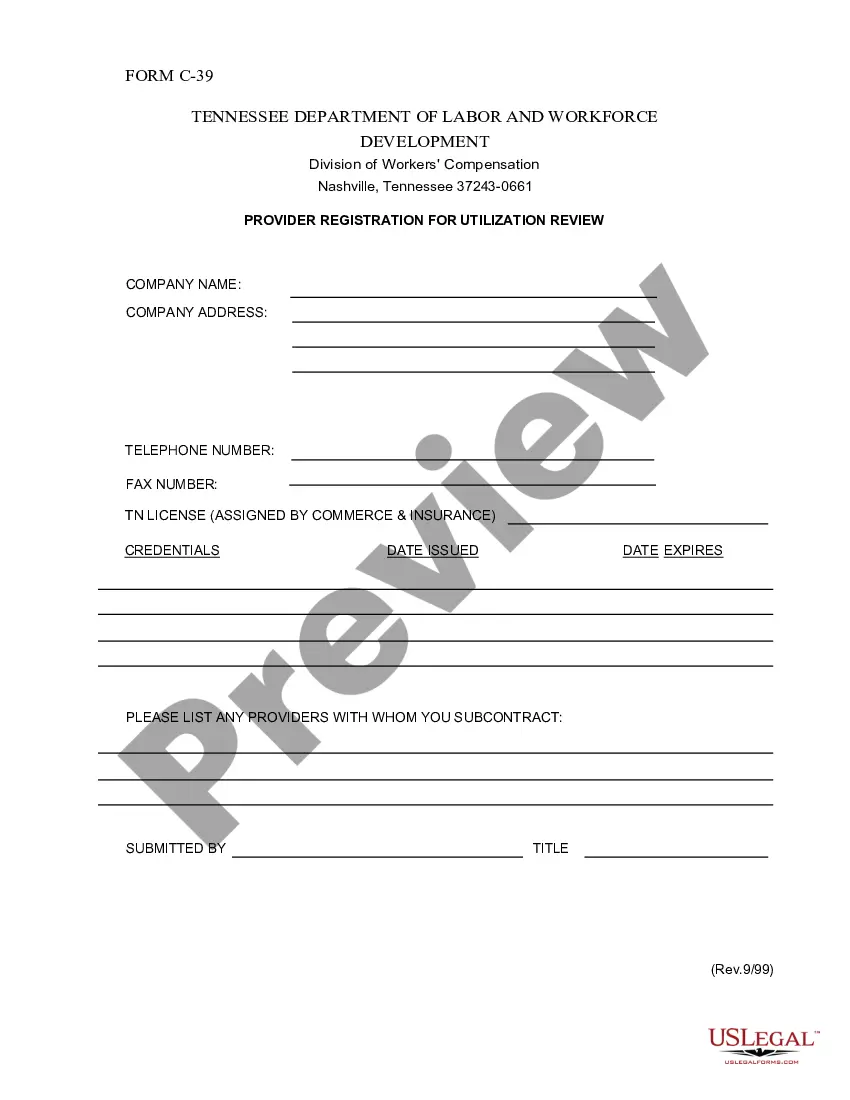

Contact the Harris County clerk's office to get the required form, or check out Texas Easy Lien online options. Once you've collected the information listed above, follow these steps: Fill out the form completely. Attach a copy of your contract, if relevant.

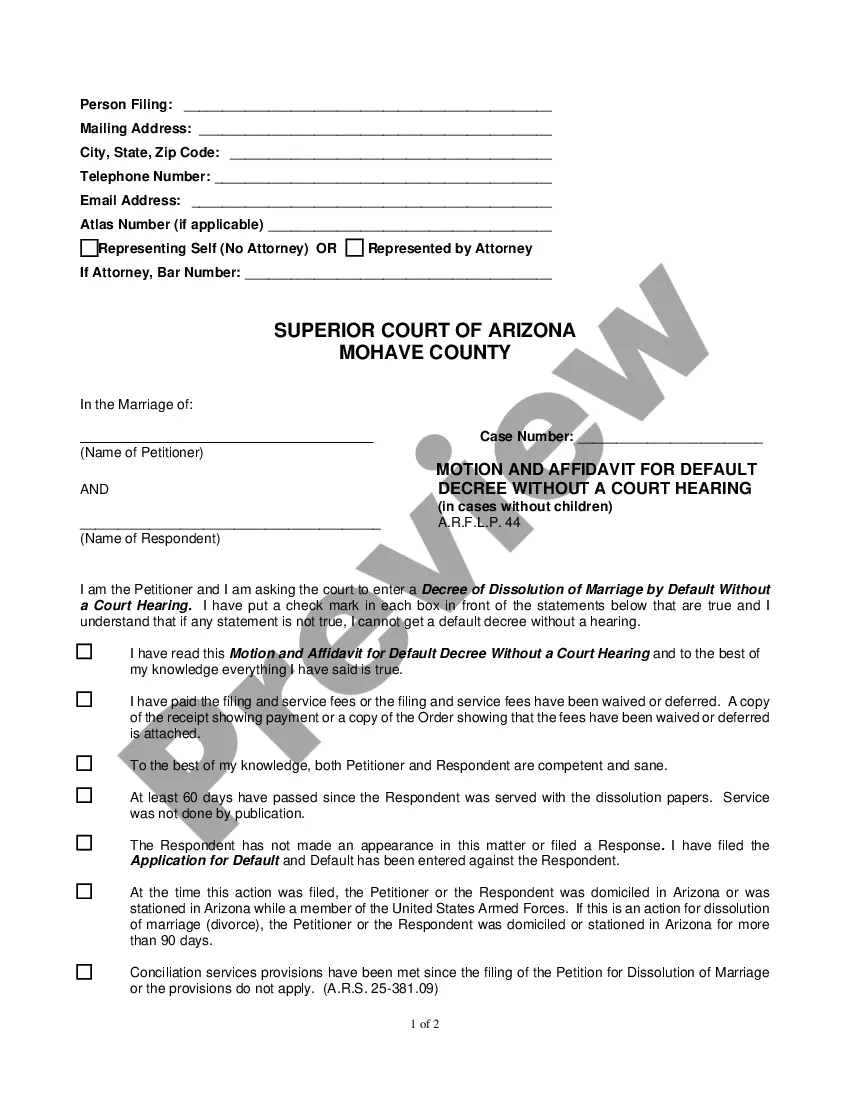

Generally, to file a judgment lien, an abstract of judgment must be issued by the justice court. Some justice courts have a form available on their website to request an abstract of judgment.

After a creditor obtains a judgment against a debtor, they may then take action to seize the debtor's assets, including funds in bank accounts, vehicles, or other personal property.

Harris County Clerk Real Property Department Harris County Civil Courthouse. 201 Caroline, Suite 320. Houston, TX 77002. (713) 274-8680.

To file a lien claim, you will need: Property owner's name (or company name) and mailing address. Project address and the county where it is located. The amount owed for each month you performed the work that remains unpaid. A brief description of the work you performed.

Contact the Harris County clerk's office to get the required form, or check out Texas Easy Lien online options. Once you've collected the information listed above, follow these steps: Fill out the form completely. Attach a copy of your contract, if relevant.

Verify the Lien: Ensure the lien is valid and check for any errors that could invalidate it. Satisfy the Judgment: Paying the debt in full is the most straightforward way to remove the lien. Obtain a satisfaction of judgment from the creditor and file it with the court.