Judgment Against Property For Debt In Fulton

Description

Form popularity

FAQ

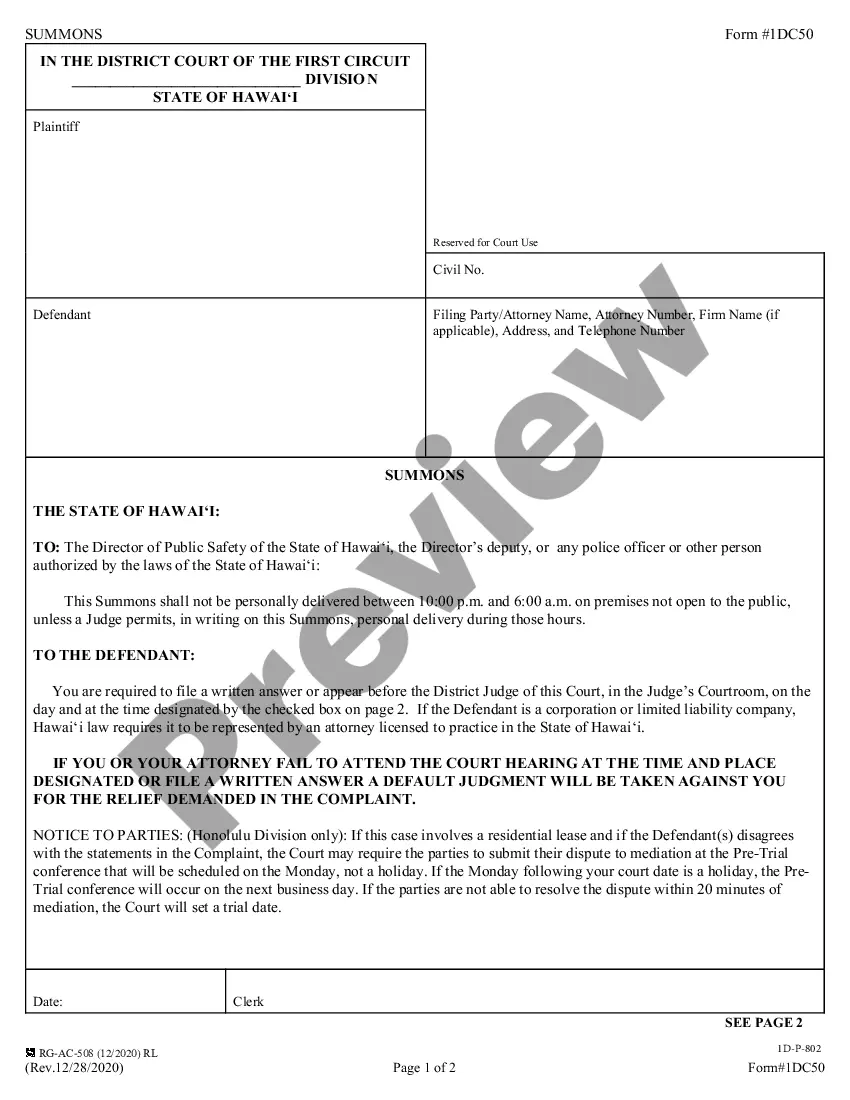

The party seeking entry of a default judgment in any action shall certify to the court the following: the date and type of service effected; that proof of service was filed with the court; the date on which proof of service was filed; and that no defensive pleading has been filed by the defendant as shown by court ...

Steps of the Garnishment Process Prepare a Service Sheet. Attach a self-addressed, stamped envelope to the Service Sheet. Court Receives Garnishment Funds. Additional Summons of Garnishment. Garnishment Calculations. Await a Filed Answer. Mailing of Funds. Holding of Funds.

What is a default judgment? Default means a party has not done what is required of them in the time allowed. For example, a defendant (or respondent) did not file an answer to a complaint within the required time, or a plaintiff (or petitioner) did not answer a counterclaim within the required time.

Regardless of how the judgment is obtained, there are three main options to consider in attempting to collect on the judgment. Filing a Garnishment. First, a party may pursue a garnishment. Recording a Writ of Fieri Facias. Conducting Post-Judgment Discovery.

For that purpose the judgment debtor should approach the plaintiff/judgment creditor or his/her/its attorney to obtain the written consent to rescission of judgment. There is however no requirement in law that obliges a plaintiff/judgment creditor to give a consent to rescission of judgment.

Default. If the defendant fails to file an answer within 45 days, the plaintiff may request a default judgment. A plaintiff wishing to obtain a default judgment should file for an Affidavit for Default Judgment with the Clerk of Magistrate Court.

A writ of possession is issued to evict an occupant from the property. The dispossessory complaint is filed under oath by the owner (landlord), testifying to the unlawful possession of the owners property by a tenant.

A Writ of Fieri Facias (or Writ of Fi Fa) is a document issued by the Clerk of Magistrate Court for the purpose of recording a lien on the judgment debtor's property. It is also a legal instrument by which the sheriff of a county may seize the assets of a judgment debtor.

In Georgia, a creditor can garnish the lesser of 25% of your disposable income or the amount by which your disposable earnings exceed 30% of federal minimum wage. If your disposable income is less than 30 times minimum wage, it cannot be garnished at all.