Judgment Lien Forms For California In Franklin

Description

Form popularity

FAQ

A property owner can choose to place a lien on their property. A voluntary lien is a claim over the property that a homeowner agrees to give to a creditor as security for the payment of a debt. A mortgage lien is the most common type of voluntary real estate lien, also called a deed of trust lien in some states.

Enforcing Your Judgment Get in touch with the judgment debtor. Levy (seize) assets that you have personal knowledge of. Examine judgment debtor in court to locate unknown assets. Suspend the judgment debtor's driver's license if the judgment is for auto accident.

Most judgments (the court order saying what you're owed) expire in 10 years. This means you can't collect on it after 10 years. To avoid this, you can ask the court to renew it. A renewal lasts 10 years.

Once a Notice of State Tax Lien is recorded or filed against you, the lien: Becomes public record. Attaches to any California real or personal property you currently own or may acquire in the future. Is effective for at least 10 years (may be extended)

Most judgments (the court order saying what you're owed) expire in 10 years. This means you can't collect on it after 10 years. To avoid this, you can ask the court to renew it. A renewal lasts 10 years.

In other words, in California judgments expire 10 years from the date they are entered by the court. Upon expiration of the 10-year period, all enforcement procedures must cease; any liens based upon the judgment are automatically extinguished.

Ing to California State Law, documents can only be viewed in the Clerk Recorder office. You will be able to view the images of recorded documents involving your name to find out if a lien has been placed against you or if a recorded lien has been released.

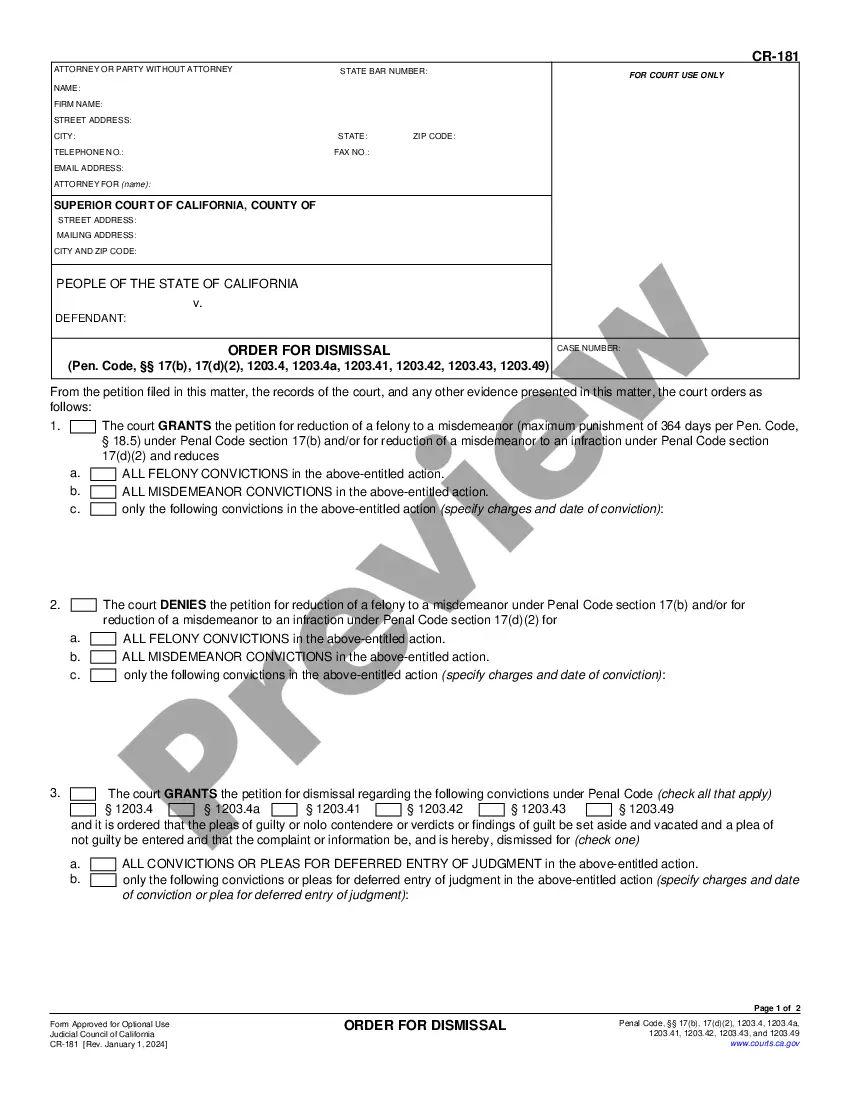

To do this, fill out an EJ-001 Abstract of Judgment form and take it to the clerk's office. After the clerk stamps it, record it at the County Recorder's Office in the county where the property is located. Place a lien on a business.

How to ask for a default Fill out request for default. Request for Entry of Default (form CIV-100) ... If ready, also fill out forms to ask for a judgement. Judgment (form JUD-100) ... Mail copies to the defendant. Make at least 2 copies of everything. File forms. Bring the Request for Default to the court clerk.