Judgment Against Property With Find In Collin

Description

Form popularity

FAQ

Except as provided by Section 52.0011 or 52.0012, a first or subsequent abstract of judgment, when it is recorded and indexed in ance with this chapter, if the judgment is not then dormant, constitutes a lien on and attaches to any real property of the defendant, other than real property exempt from seizure or ...

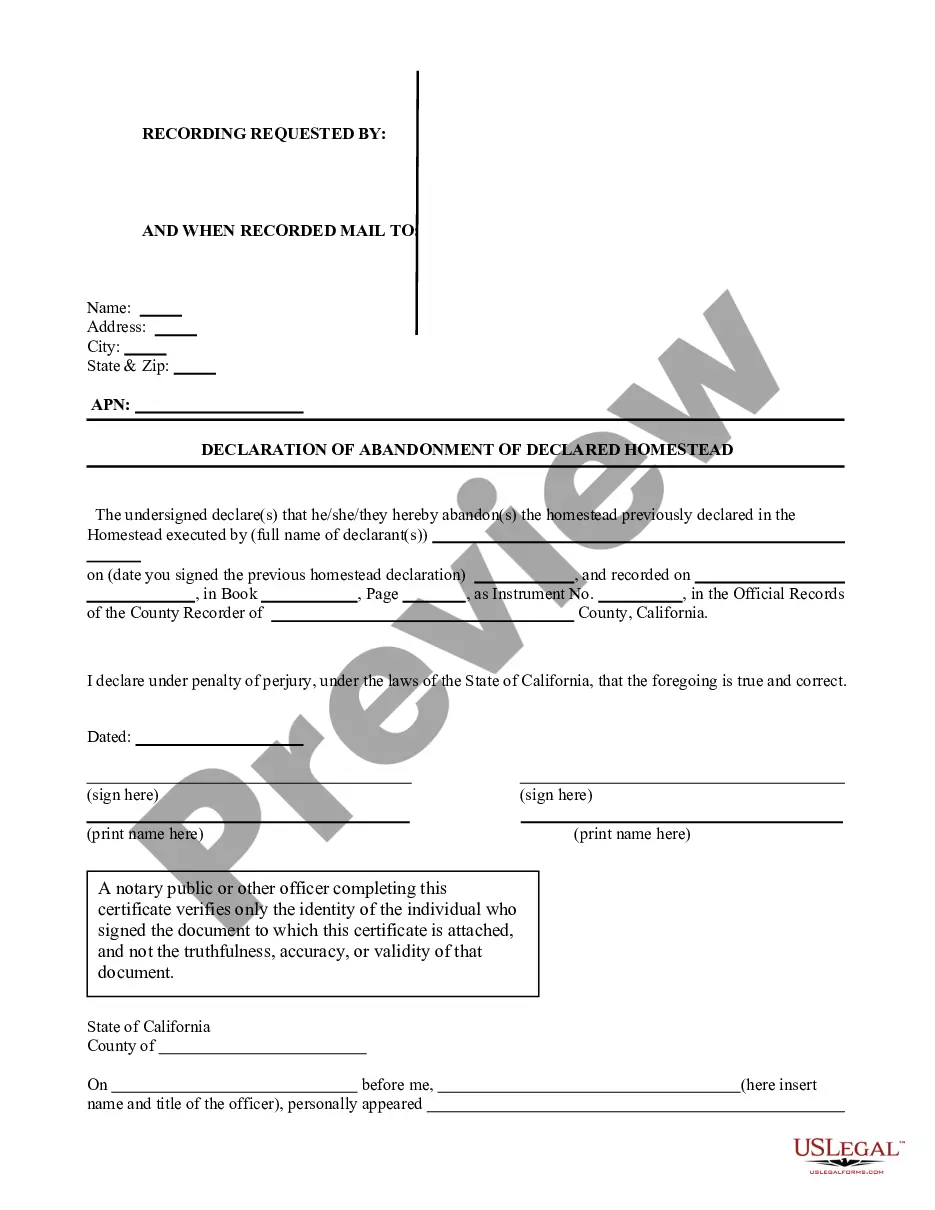

Texas exempts only two types of real property: (1) one or more cemetery plots: and (2) a homestead. Texas Property Code § 41.001(a). Either families or single adults may claim homesteads. The homestead may be either rural or urban.

If you do not have any assets that are not exempt from seizure, such as your primary place of residence, household items, your car, and the tools of your trade, someone who has obtained a judgment against you may be unable to collect on it.

What does it mean to be "judgment proof"? If you do not have any assets that are not exempt from seizure, such as your primary place of residence, household items, your car, and the tools of your trade, someone who has obtained a judgment against you may be unable to collect on it.

Texas exempts only two types of real property: (1) one or more cemetery plots: and (2) a homestead. Texas Property Code § 41.001(a). Either families or single adults may claim homesteads. The homestead may be either rural or urban.

Judgment creditors can only seize property that isn't protected by an exemption. This includes real property and personal property.

Real Property Exemptions: Chapter 41 of the Property Code Texas exempts only two types of real property: (1) one or more cemetery plots: and (2) a homestead. Texas Property Code § 41.001(a). Either families or single adults may claim homesteads. The homestead may be either rural or urban.

If your local courts do not have an online record search system or if only some of them do, you can try calling your court and asking the clerks there to check their records for a judgment (or active case) naming you as a defendant.

If your local courts do not have an online record search system or if only some of them do, you can try calling your court and asking the clerks there to check their records for a judgment (or active case) naming you as a defendant.

Do judgments expire in Texas? Judgments awarded in Texas to a non-government creditor are generally valid for ten years but can be renewed for longer. If a judgment is not renewed, it will become dormant. A creditor can request to revive a dormant judgment to continue to try and collect the debt.