Proxy Corporate Resolutions For Llc In San Bernardino

Description

Form popularity

FAQ

Yes- Corporate Resolutions are a necessary part of proper LLC management strategies. On a regular basis, your small business will make decisions that affect the structure or activities of your business.

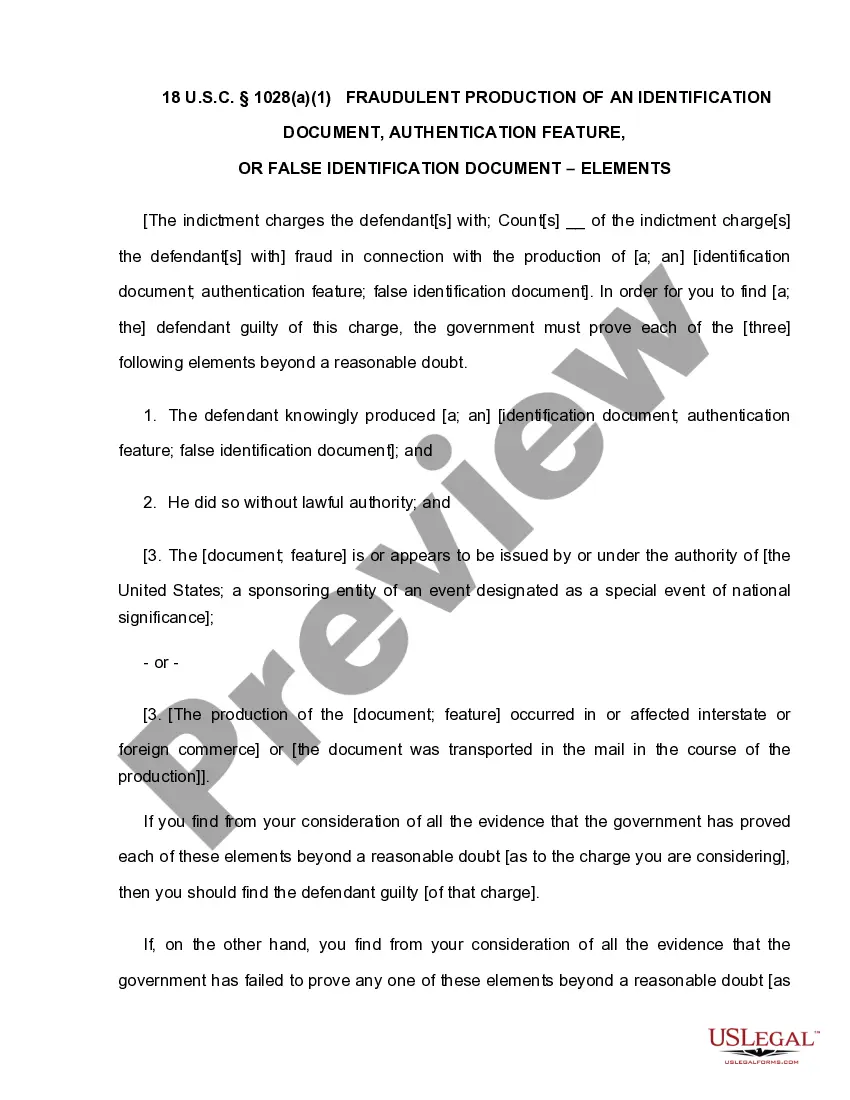

Typically, corporations require these documents when an agreement between the owners and the board may enable business transactions and decisions.

Do I need a Banking Resolution for my LLC or Corporation? This document is typically not required to be filed with your Registered Agent or your state of formation. However, it does make certain processes easier, like opening a bank account and assigning privileges or authorization.

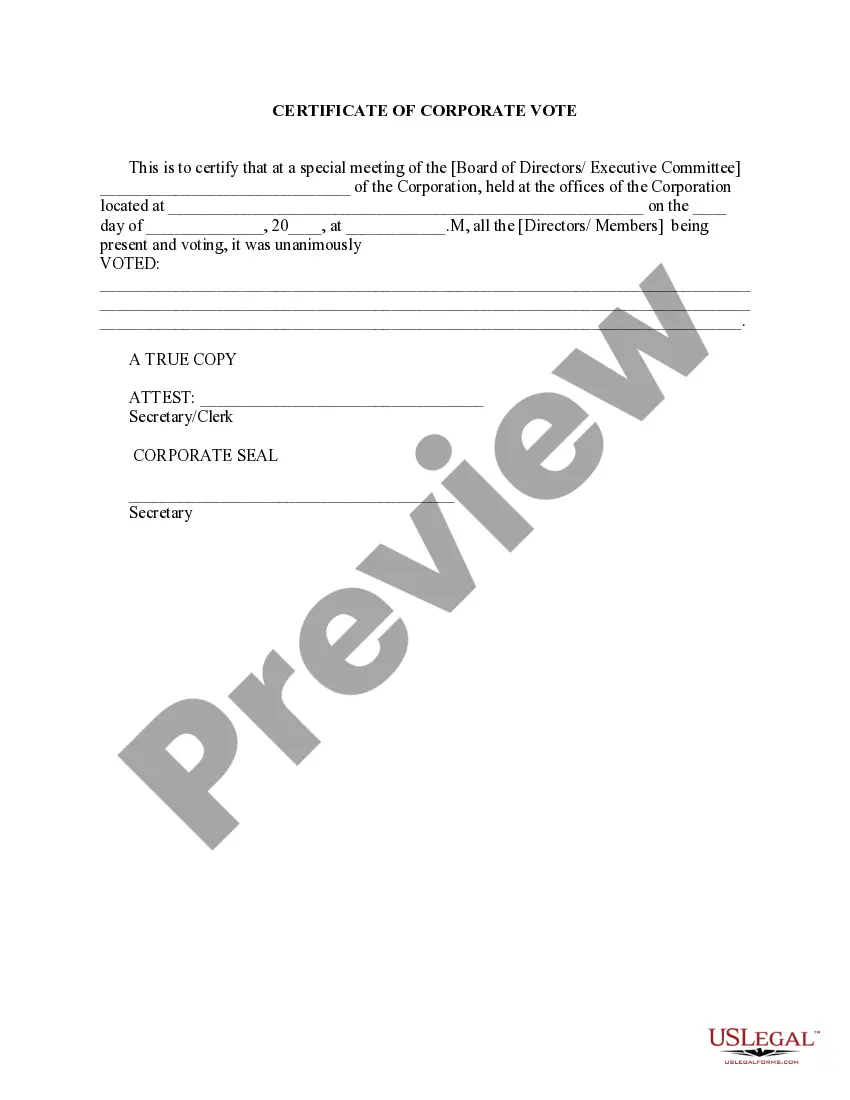

Typically, a board of directors will create corporate resolutions and sign them at a board meeting. Before the meeting, all board members should receive a meeting agenda that includes any decisions or actions to be resolved. Resolutions must follow a format approved by the state where the business is registered.

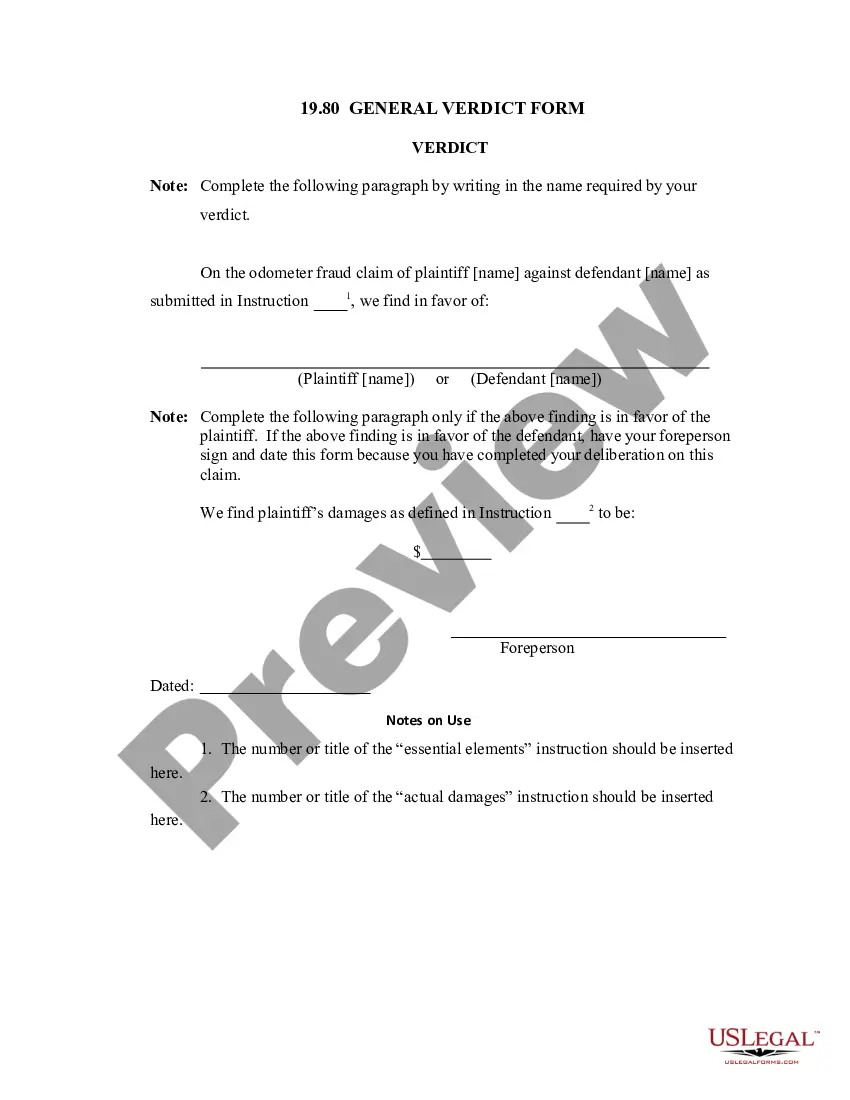

Voting Resolutions: Voting resolutions are used to make important decisions in the LLC. Voting resolutions require the approval of a certain number of members for the resolution to pass. Consent Resolutions: Consent resolutions are used when all members of the LLC agree to a certain action or decision.

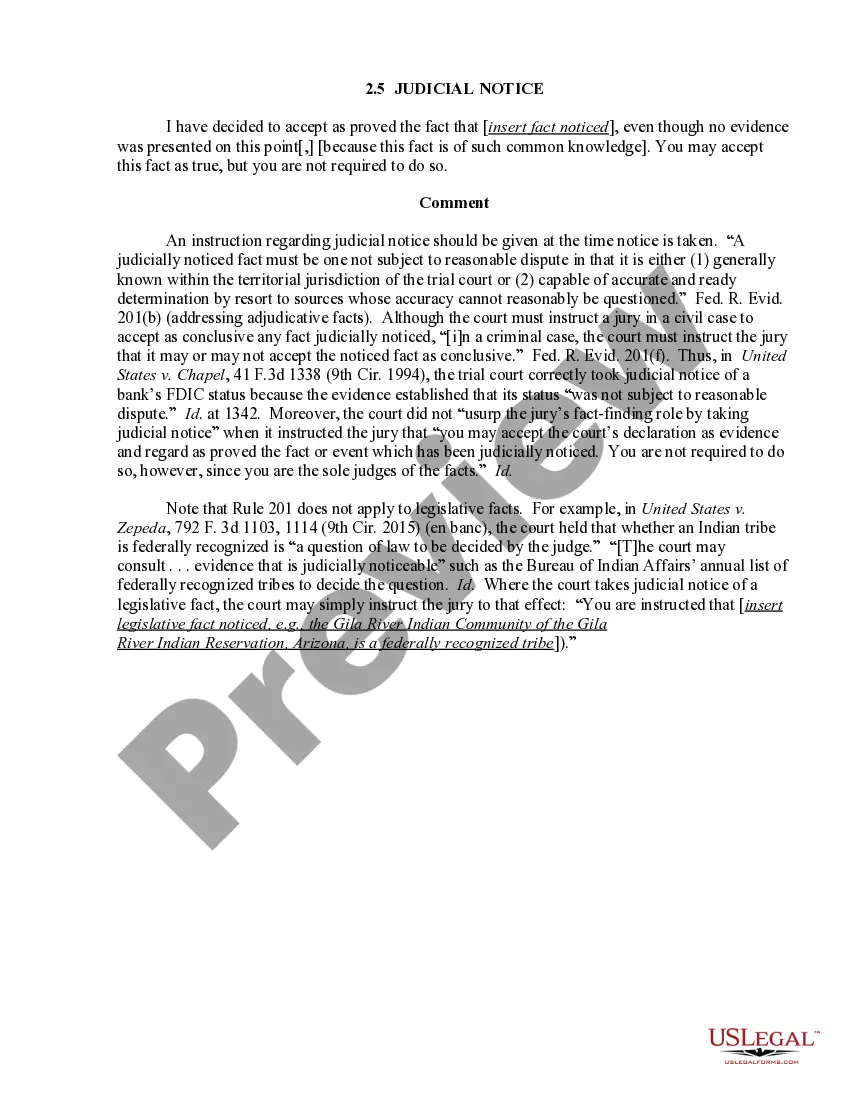

LLC member resolutions are written documents that confirm and record decisions and actions taken by the members. Having written proof of decisions helps avoid disputes and misunderstandings between members down the line.

A Statement of Information must be filed either every year for California stock, cooperative, credit union, and all qualified out-of-state corporations or every two years (only in odd years or only in even years based on year of initial registration) for California nonprofit corporations and all California and ...

Failure to file the required Statement of Information with the Secretary of State as outlined in statute may result in penalties being assessed by the Franchise Tax Board and suspension or forfeiture.

In California, the annual filing (Statement of Information) is not due on a specific date. Rather, it must be filed every two-years during a six-month”filing window”, which is based on the month the LLC was formed. If the LLC was formed in an even year, the form is due every even year.