Donation Receipt From Salvation Army In Philadelphia

Description

Form popularity

FAQ

Most charitable organizations that run thrift stores have receipts available to print from their websites. You need to make a list of what was donated, and assign the value (the organization cannot value your donation).

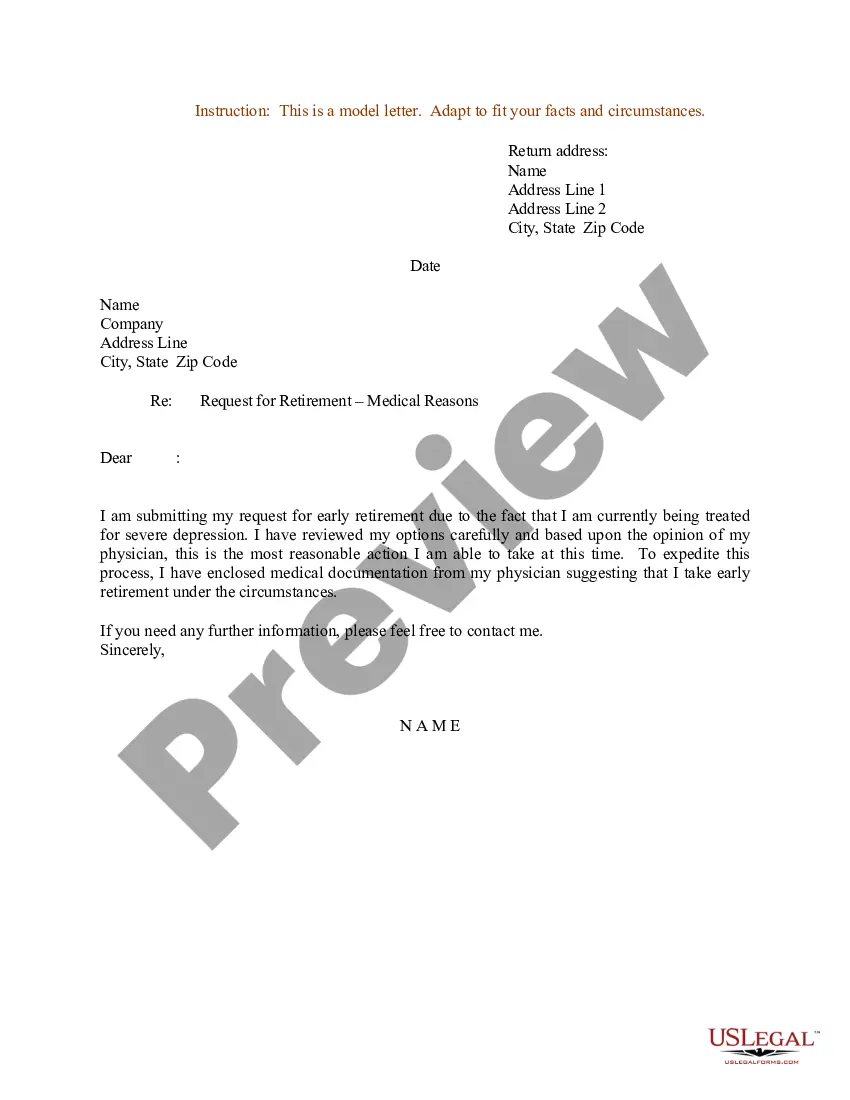

Start by obtaining a donation receipt form from the Salvation Army. These forms are usually available at their donation centers or can be downloaded from their website. Provide your personal information, including your name, address, and contact details, at the top of the receipt form.

You can qualify for taking the charitable donation deduction without a receipt; however, you should provide a bank record (like a bank statement, credit card statement, or canceled check) or a payroll deduction record to claim the tax deduction.

Do not donate anything that is broken, clothes that are worn to the point that you would not wear them yourself, missing pieces, , contaminated, prescription medications or medical supplies, live animals, or your children.

What do you need to include in your donation acknowledgment letter? The donor's name. The full legal name of your organization. A declaration of your organization's tax-exempt status. Your organization's employer identification number. The date the gift was received. A description of the gift and the amount received.

Nonprofit or charitable organizations typically create donation invoices after they've processed incoming donations. These organizations then send the donation invoices back to their donors.

Yes, it's generally a good practice to launder or dry clean clothing before donating it to organizations like Goodwill or the Salvation Army. Here are a few reasons why: Hygiene: Clean items are more hygienic and considerate for the next person who will wear them.

Yes, you can claim deductions if you don't have receipts. For general expenses, you'll need an alternative record showing the transaction date, amount, and purpose.

What to include in a donation receipt Charity information including your address and foundation number (if you have one) Your donor's name. A summary or description of their contribution. The total of their contribution. The signature and name of an authorised representative.

Look for Established Organizations: National charities like Goodwill, Salvation Army, Habitat for Humanity, and Vietnam Veterans of America are well-known for accepting clothing and furniture donations.