Donation For Land In Virginia

Description

Form popularity

FAQ

Income tax strategies—Donations to 501(c)(3) public charities qualify for an itemized deduction from income. Because the tax rate is then applied to a reduced income, this can minimize your overall tax liability.

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A corporation may deduct qualified contributions of up to 25 percent of its taxable income. Contributions that exceed that amount can carry over to the next tax year.

If you give property to a qualified organization, you can generally deduct the fair market value (FMV) of the property at the time of the contribution.

Donation land is a piece of land that is given as a gift to someone by the government. This is usually done to reward someone for their service or to encourage people to settle in a remote area. It is a type of public land, which means it belongs to the government.

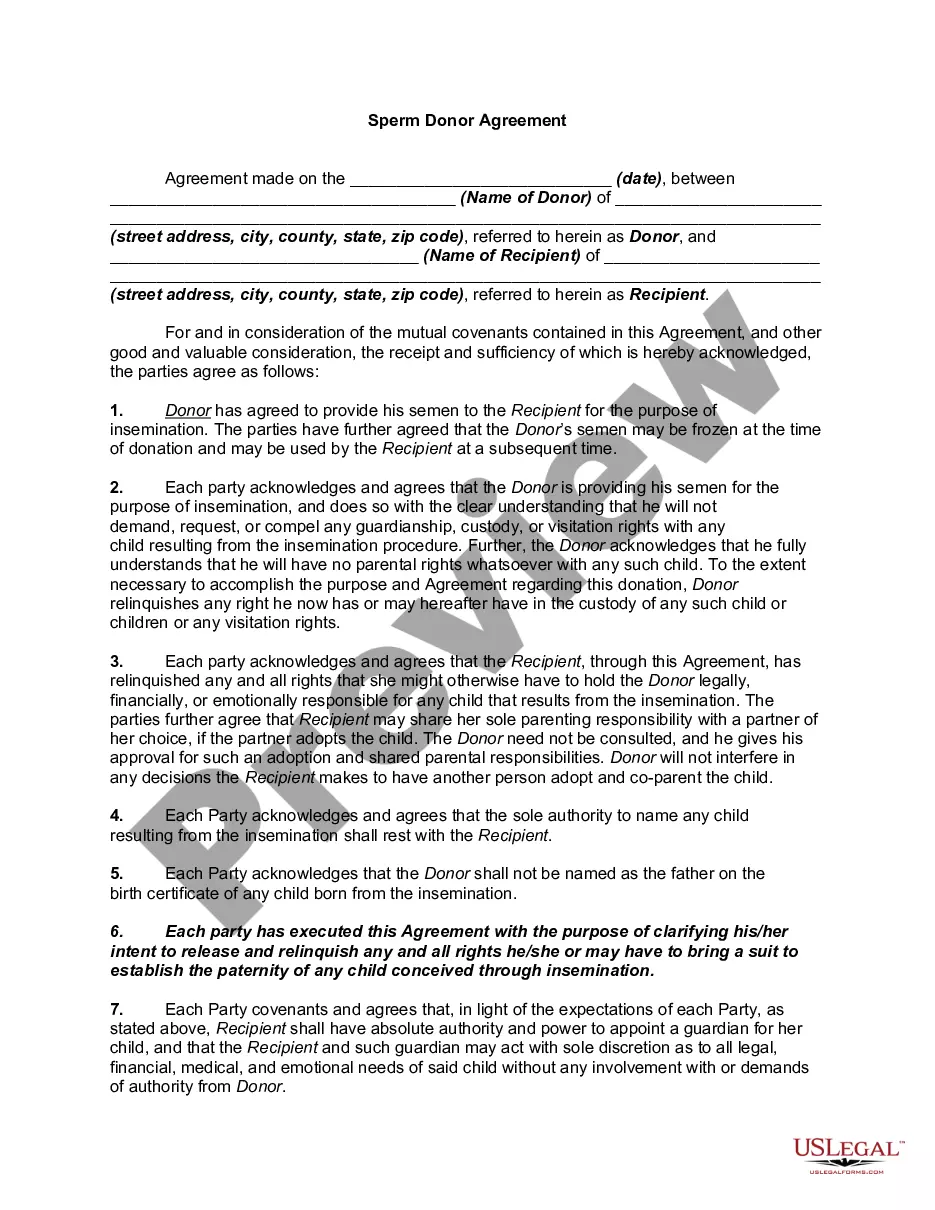

Deed of Gift Transfers in Virginia Voluntary Transfer: The donor must willingly transfer the property. Donative Intent: The donor must clearly intend to make the gift. Acceptance by the Donee: The donee must accept the gift. Delivery: The donor must deliver the deed to the donee.

This legal construct allows for a trustee to hold and manage the assets on behalf of the beneficiaries, keeping the actual ownership confidential. In Virginia, the law requires an in-state trustee when forming a land trust to hold title to property, whether within or outside the state.

For a squatter to prove adverse possession and claim legal ownership of a property in Virginia, they must occupy the property or land for at least 15 consecutive years Virginia Code - Ann. § 8.01-236,237.

Often, individuals will start using land without the owner's consent. Under Virginia law, after 15 years, that person may have grounds to claim the property as their own. The courts will have to review any claims related to adverse possession carefully.

Income Tax Incentives for Land Conservation When landowners donate a conservation easement, they give up part of the value of their property — often their family's biggest asset. Tax incentives offset some of that loss in property value, making conservation a viable option for more landowners.