Deed Of Donation Without Land Title In Clark

Description

Form popularity

FAQ

Fees typically range from ₱5,000 to ₱50,000, and there may be additional costs related to taxes, notarization, and title transfer. Consulting a lawyer is essential to ensure that the donation is legally compliant and properly documented.

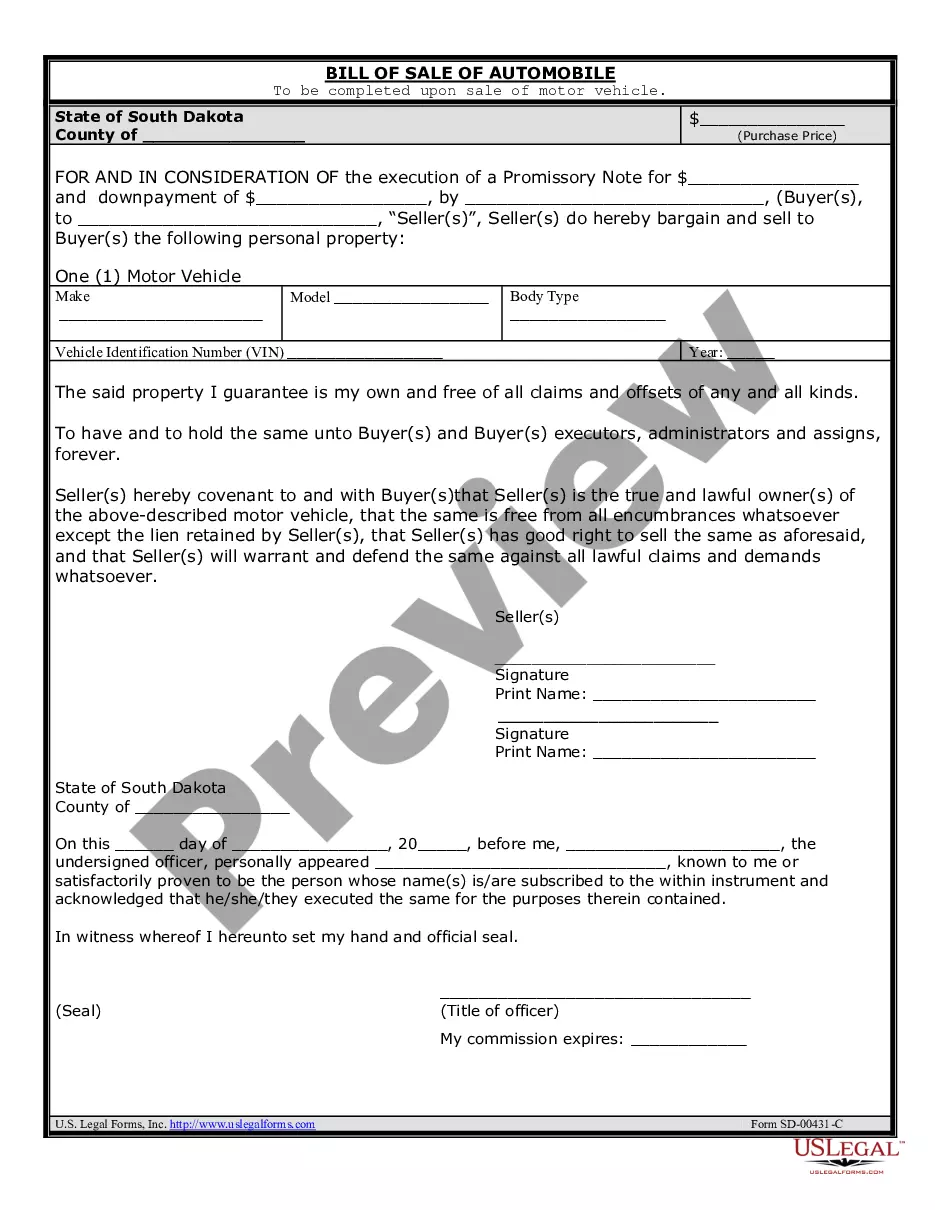

When you buy a home, you need both the deed and the title; one isn't better than the other. The title is the concept of legal ownership while the deed is the document that proves ownership. Moreover, you can't have a valid house deed if you don't hold title.

It involves drafting key legal paperwork, having your land appraised, finding an eligible land trust or nonprofit to enforce the easement, and consulting with a CPA to maximize your tax deduction. Fortunately, Giving Property specializes in working with donors to make the process as easy as possible.

Donor's Tax: One of the main costs in a Deed of Donation is the donor's tax. Under the current Philippine Tax Code, donations between parents and children are taxed at a flat rate of 6% of the fair market value (FMV) or zonal value of the property, whichever is higher.

For simpler donations involving personal property or low-value real property, fees may range from ₱5,000 to ₱15,000. For more complex cases, particularly involving real estate or significant assets, fees could reach ₱20,000 to ₱50,000 or more, depending on the lawyer and the specifics of the case.

In summary, while a deed of donation does not have an automatic expiration, it can be subject to revocation or invalidity under specific circumstances, primarily due to failure to meet conditions, ingratiude of the donee, or legal limitations.

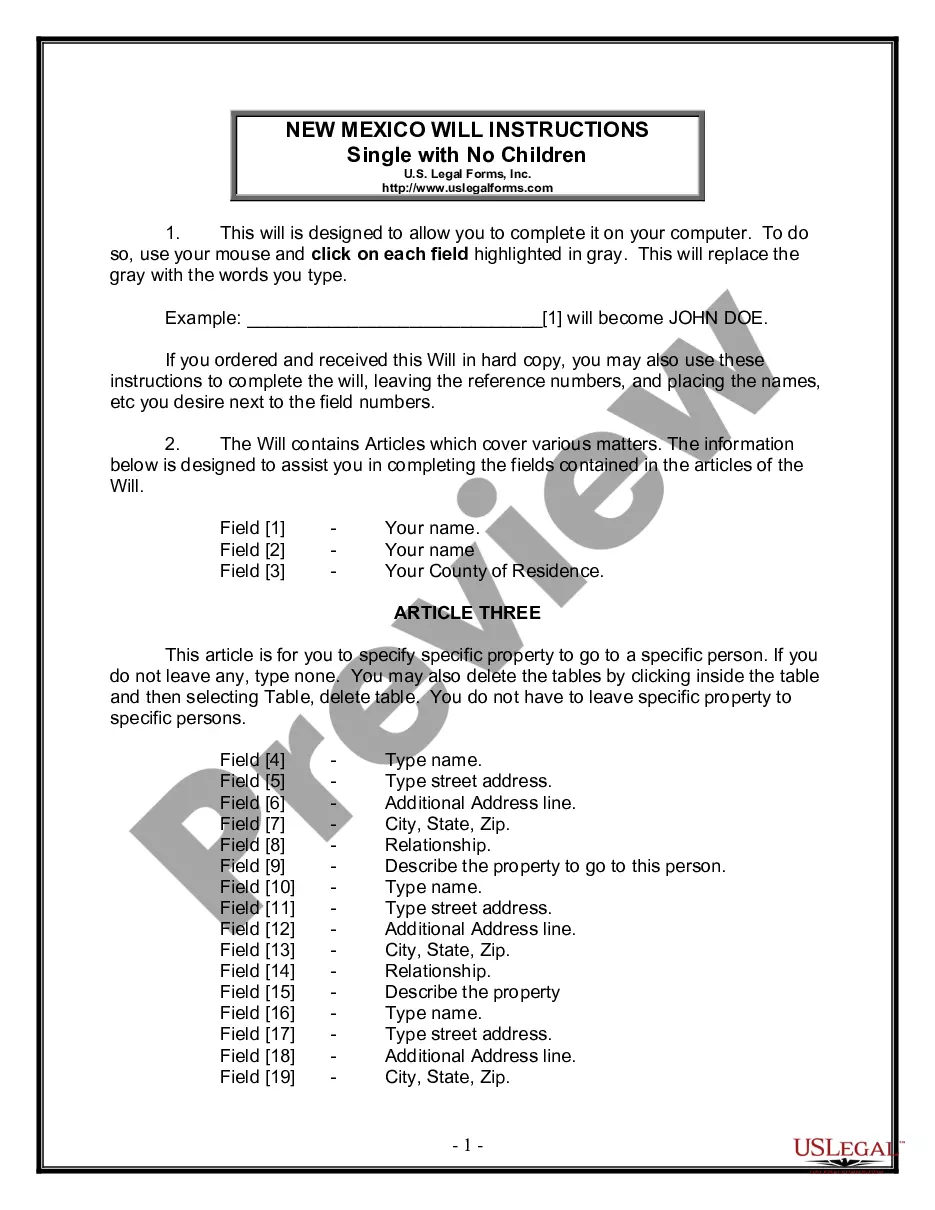

Requirements for Deed of Donation in the Philippines Capacity of the Donor and Donee. Both parties must be legally capable to enter into contracts. Written Form. Acceptance by the Donee. Notarization and Witnesses. Required Documents. Donation Taxes. Transfer of Ownership. Conclusion.

For Deeds, Mortgages or other property related records, consult the County Recorder of the county where the transaction occurred. See for county recorder contact information.

Donor's Tax: One of the main costs in a Deed of Donation is the donor's tax. Under the current Philippine Tax Code, donations between parents and children are taxed at a flat rate of 6% of the fair market value (FMV) or zonal value of the property, whichever is higher.