Erisa Retirement Plan Beneficiary In Washington

Description

Form popularity

FAQ

The Spouse Is the Automatic Beneficiary for Married People A federal law, the Employee Retirement Income Security Act (ERISA), governs most pensions and retirement accounts.

Surviving spouse, at full retirement age or older, generally gets 100% of the worker's basic benefit amount. Surviving spouse, age 60 or older, but under full retirement age, gets between 71% and 99% of the worker's basic benefit amount.

In general, ERISA does not cover plans established or maintained by governmental entities, churches for their employees, or plans which are maintained solely to comply with applicable workers compensation, unemployment or disability laws.

Generally, an ERISA plan participant can select just about anyone to be their beneficiary. Typically, a plan participant selects their spouse, children, or other family members.

Spouse benefit provisions of private pension plans reflect the influence of the Employee Retirement Income Security Act of 1974 (ERISA) . Pension plans are not required by law, but once established, ERISA requires that they provide for annuities to spouses of deceased employees.

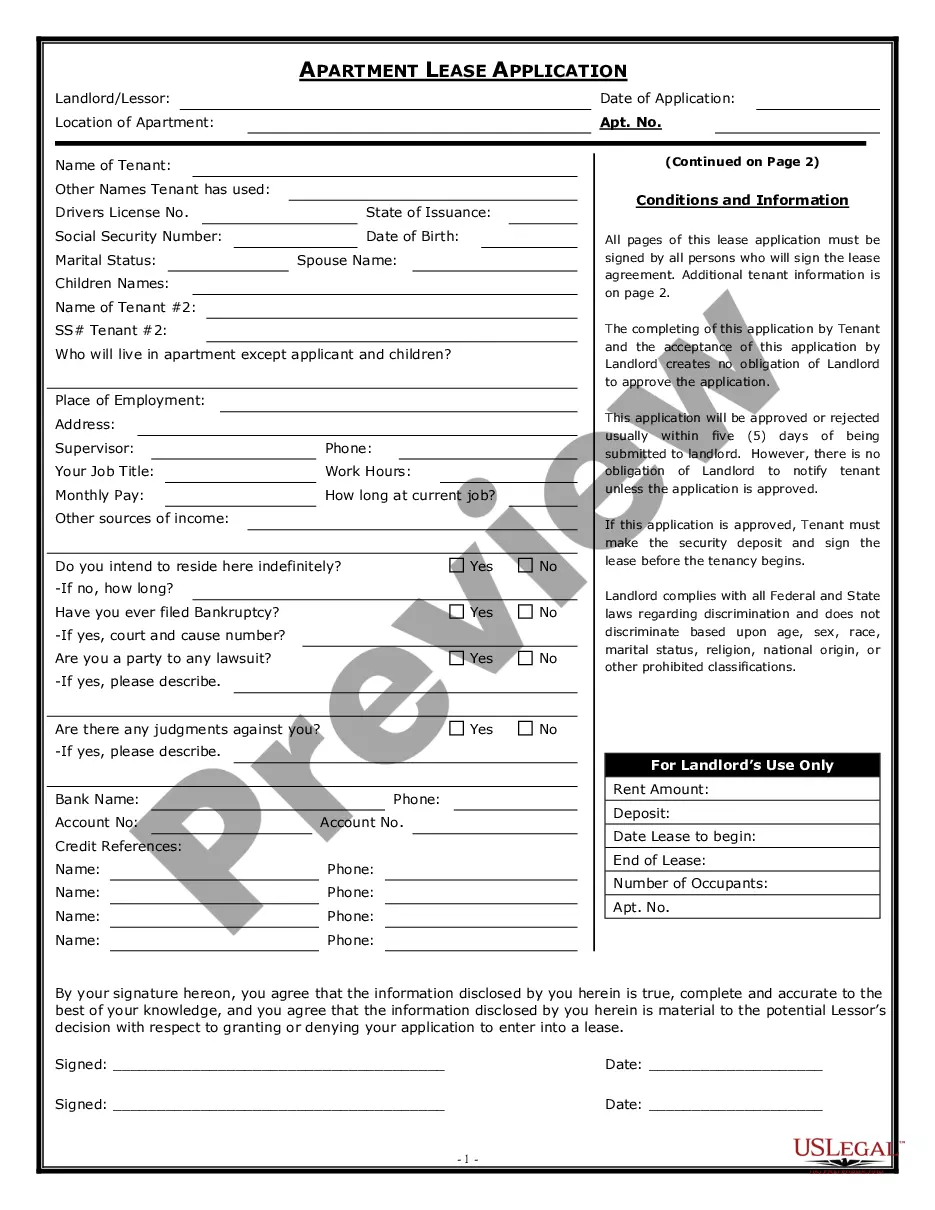

How to name a beneficiary on your 401(k) account Fill out the beneficiary designation form supplied by your 401(k) provider. Set your beneficiary designations directly through an online portal on your provider's website. Call your provider and choose your beneficiaries over the phone.

An eligible designated beneficiary (EDB) must be an individual, and not a nonperson entity such as a trust, an estate, or a charity (which would be not designated beneficiaries).

For life insurance policies, retirement accounts (i.e., 401ks/403bs, IRAs, etc.), Health Savings Accounts (HSAs), and trusts, the beneficiary you name inherits the account assets, generally regardless of what your will states. For checking or savings accounts, or CDs, you may name a payable on death (POD) beneficiary.