Erisa Law For Dummies In Travis

Description

Form popularity

FAQ

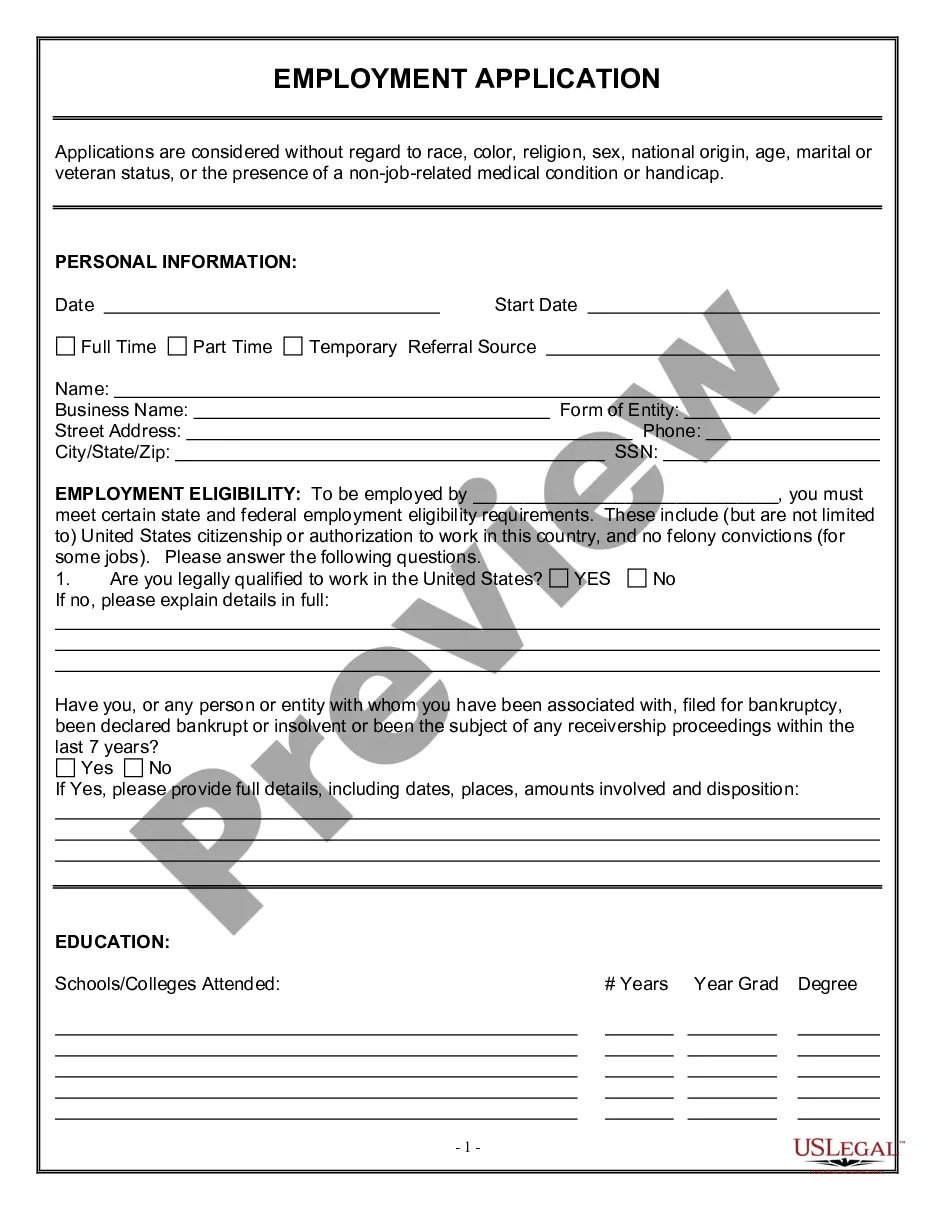

Basic ERISA compliance requires employers provide notice to participants about plan information, their rights under the plan, and how the plan is funded. This includes ensuring plans comply with ERISA's minimum standards, recordkeeping, annual filing and reporting, and fiduciary compliance.

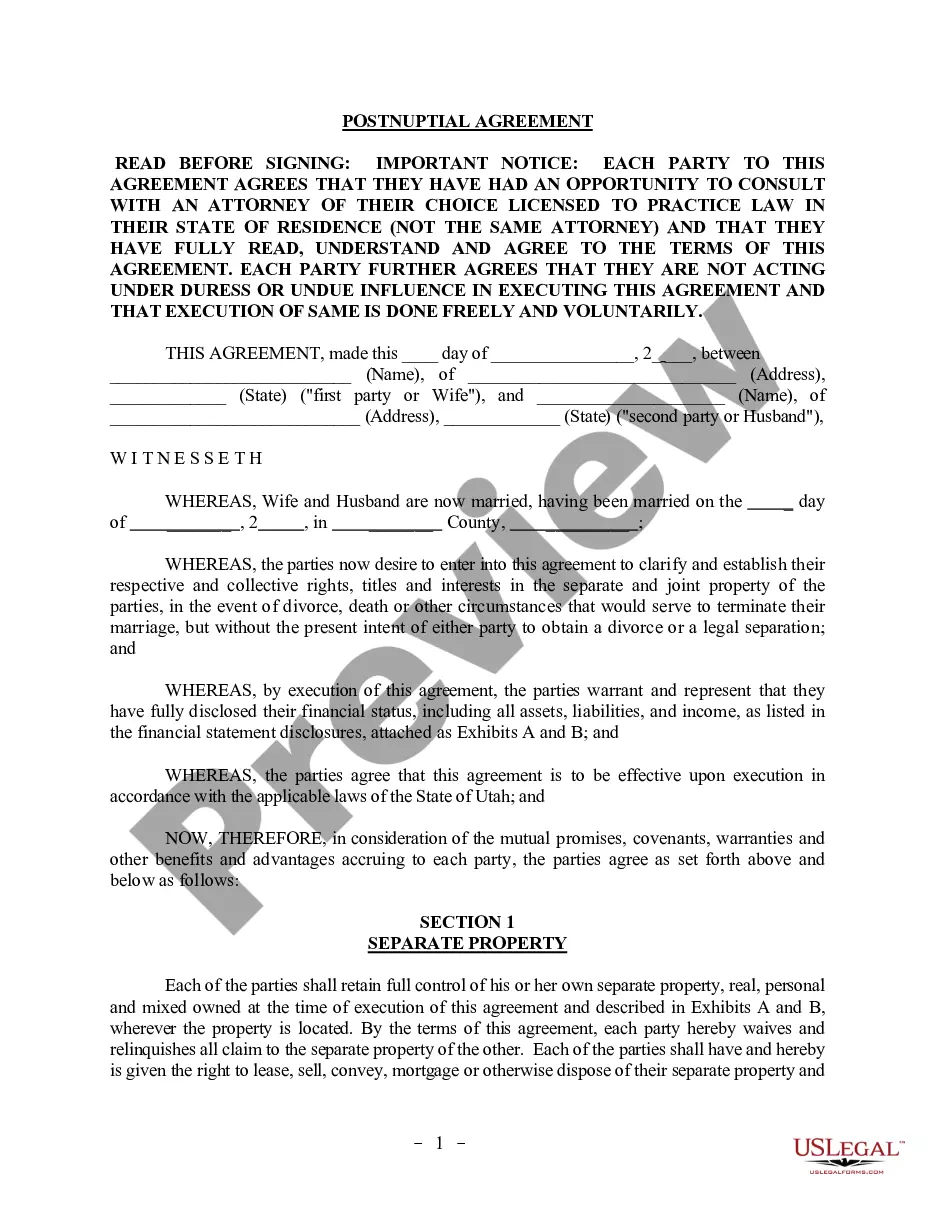

Employee Retirement Income Security Act (ERISA) The Employee Retirement Income Security Act of 1974 (ERISA) is a federal law that sets minimum standards for most voluntarily established retirement and health plans in private industry to provide protection for individuals in these plans.

The plan document should contain: Name of the plan administrator. Designation of any named fiduciaries other than the plan administrator under the claims procedure for deciding benefit appeals. A description of the benefits provided. The standard of review for benefit decisions.

The written plan document must clearly identify certain basic information about the plan, including the following: The named fiduciary who will have the authority and responsibility to administer the plan. Procedures for amending and terminating the plan. The source of plan contributions.

The main components of ERISA law revolve around employer-sponsored retirement plans and employee benefit plans. These comprehensive plans encompass various elements, including health insurance plans, retirement accounts, and other forms of employee benefits.

Upon enrolling in the Certificate in ERISA Compliance, you will get access to five e-learning courses. To earn the certificate, you must complete two required courses and one elective course of your choice. You will retain access to the remaining two elective courses that you don't choose to complete if/when you want.

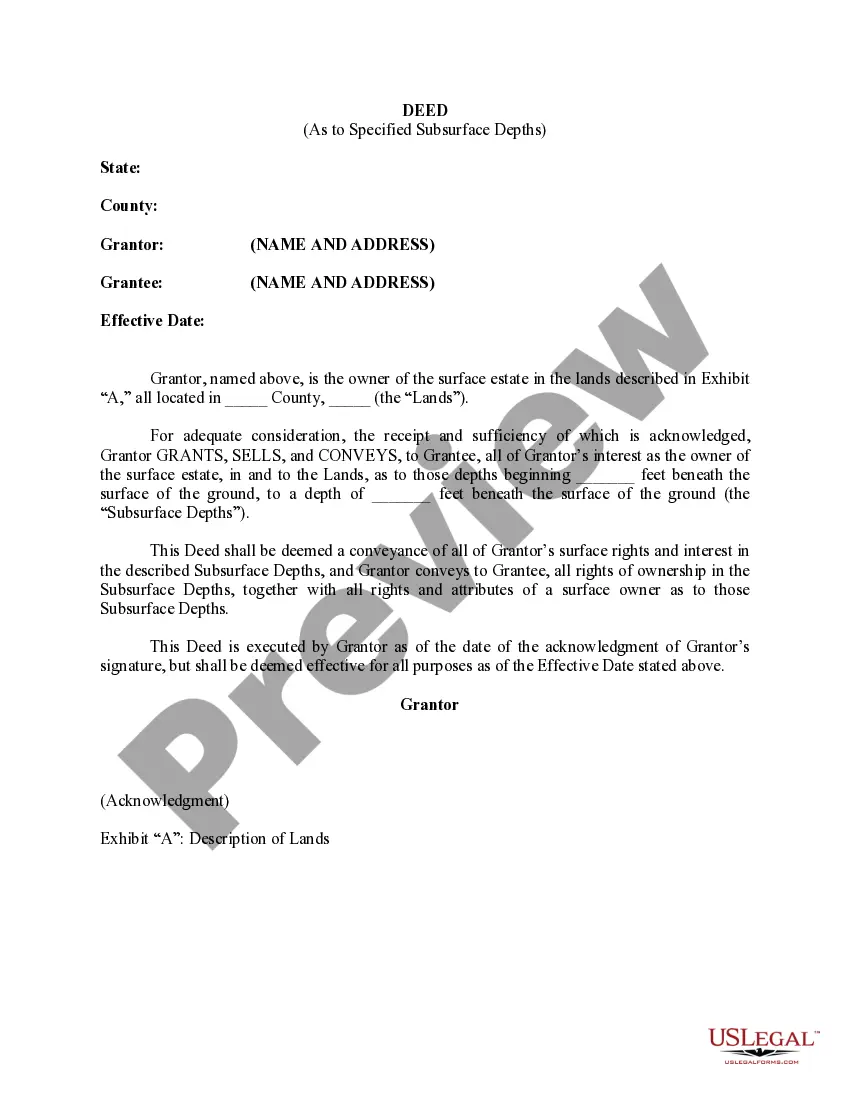

More specifically, a wrap document provides the information required by ERISA by incorporating (or “wrapping” itself around) the insurance policy or similar third-party contract. When a wrap document is utilized, the insurance policy or contract remains part of the plan document.

ERISA requires a plan administrator to furnish copies of the summary plan description, Form 5500, bargaining agreement, trust agreement, contract, or other instruments under which the plan is established or operated, to a participant within 30 days after the participant's written request.

Under the ACA, employers with a certain number of employees must offer affordable health insurance coverage to their eligible employees. ERISA provides the framework for employers to meet these obligations, ensuring that employers properly administer health benefit plans and adhere to the ACA's coverage requirements.