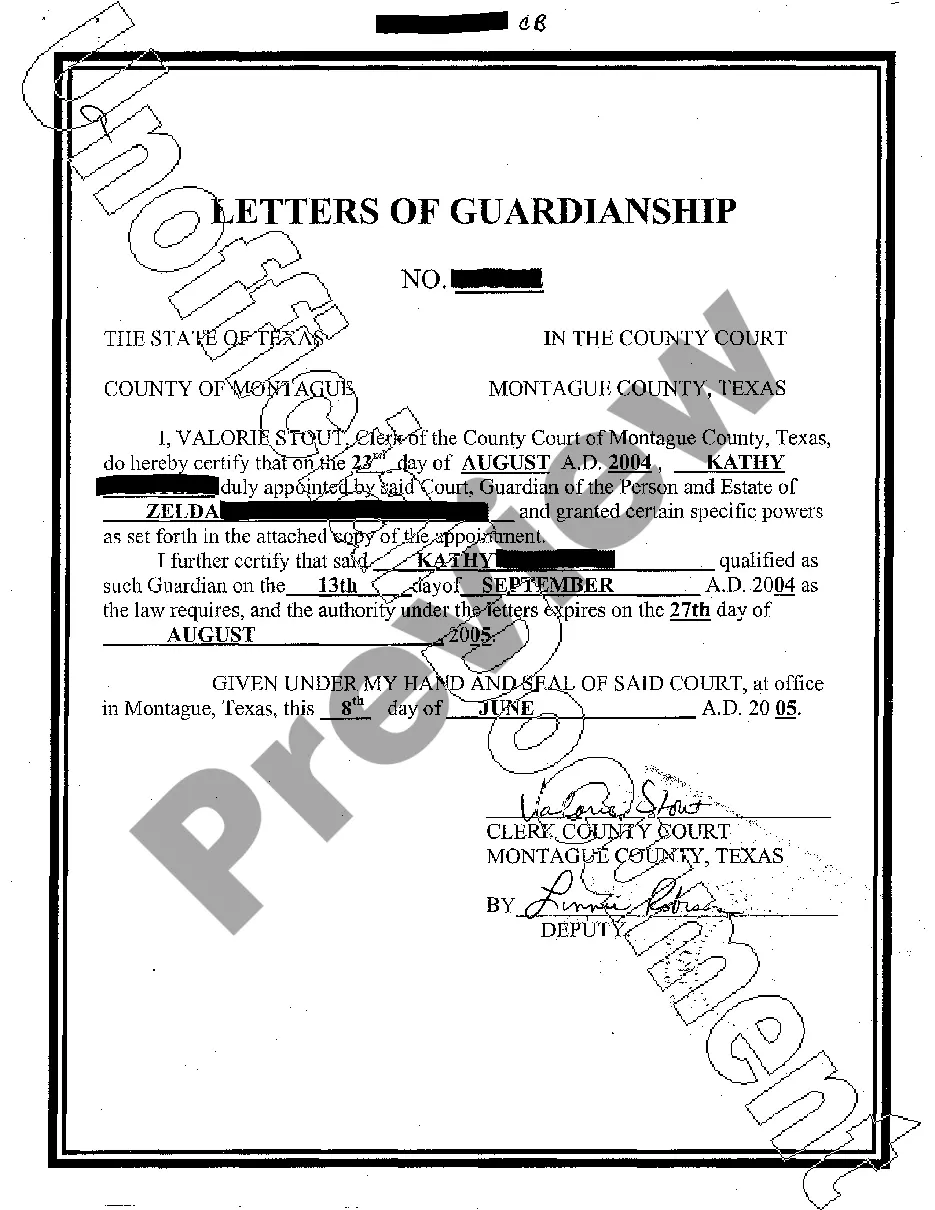

This Handbook provides an overview of federal laws affecting the elderly and retirement issues. Information discussed includes age discrimination in employment, elder abuse & exploitation, power of attorney & guardianship, Social Security and other retirement and pension plans, Medicare, and much more in 22 pages of materials.

Erisa Retirement Plan For Self Employed In Santa Clara

Description

Form popularity

FAQ

403(b) plans and 401(k) plans are very similar but with one key difference: whom they're offered to. While 401(k) plans are primarily offered to employees in for-profit companies, 403(b) plans are offered to not-for-profit organizations and government employees.

1. 401(k) Plan. This is the most common type of employer-sponsored retirement plan. Most large, for-profit businesses offer this type of plan to employees.

The Authority is a public entity that contracts with CalPERS for retirement benefits for its eligible employees. The Authority was established in 1995 by an ordinance enacted by the Santa Clara County Board of Supervisors to develop the expansion of Medi-Cal Managed Care.

Social Security benefits replace a percentage of a worker's pre-retirement income. The amount of your average wages that Social Security retirement benefits replace varies depending on your earnings and when you choose to start benefits.

SEP IRA. Best for: Self-employed people or small-business owners with no or few employees. Contribution limit: The lesser of $69,000 in 2024, or up to 25% of compensation or net self-employment earnings, with a $345,000 limit on compensation that can be used to factor the contribution.

The solo 401k is the answer for a self employed individual, but Roth IRA is still a better investment vehicle first. You use the solo 401k to lower your taxable income. If you call up any financial institution (I used vanguard), they should be happy to help you set it up.

If you are self-employed, it's in your hands to set up a retirement plan for yourself. You have many options to choose from including an IRA/Roth IRA, SEP or SIMPLE IRA, but the best best choice, if you qualify, is the Solo 401(k) plan. Learn why! -- Learn more about the Solo 401(k): .

If you're self employed you should use a sep ira, in most cases. It's possible to save more with a 401k but costs are a lot higher and you don't have a full selection of investment options. 90% of self employed people should be using a SEP IRA. Just stop contributing if you ever hire someone.

The Employee Retirement Income Security Act of 1974 (ERISA) is a federal law that sets minimum standards for most voluntarily established retirement and health plans in private industry to provide protection for individuals in these plans.

What IS an Expense Account, also known as an ERISA Account, ERISA Budgets Account, or Revenue- Sharing Account? Simply put, it's an account to which your plan provider/recordkeeper deposits the excess revenue sharing dollars they collect from the investment products used by your plan.