Lien Release Letter For Car Template In Wake

Description

Form popularity

FAQ

A: A Release of Interest is an agreement that legally terminates an existing interest that one party holds in a piece of property or a contractual agreement. It serves as a document that officially releases the parties from any further obligations related to the agreement.

If you don't have a title in hand you'll have to process the lien release before you can sell it.

We would like to release the lien in respect of the below mentioned units pledged in our favour by the Investor, and we therefore, request you to kindly release the lien marked on the below mentioned units.

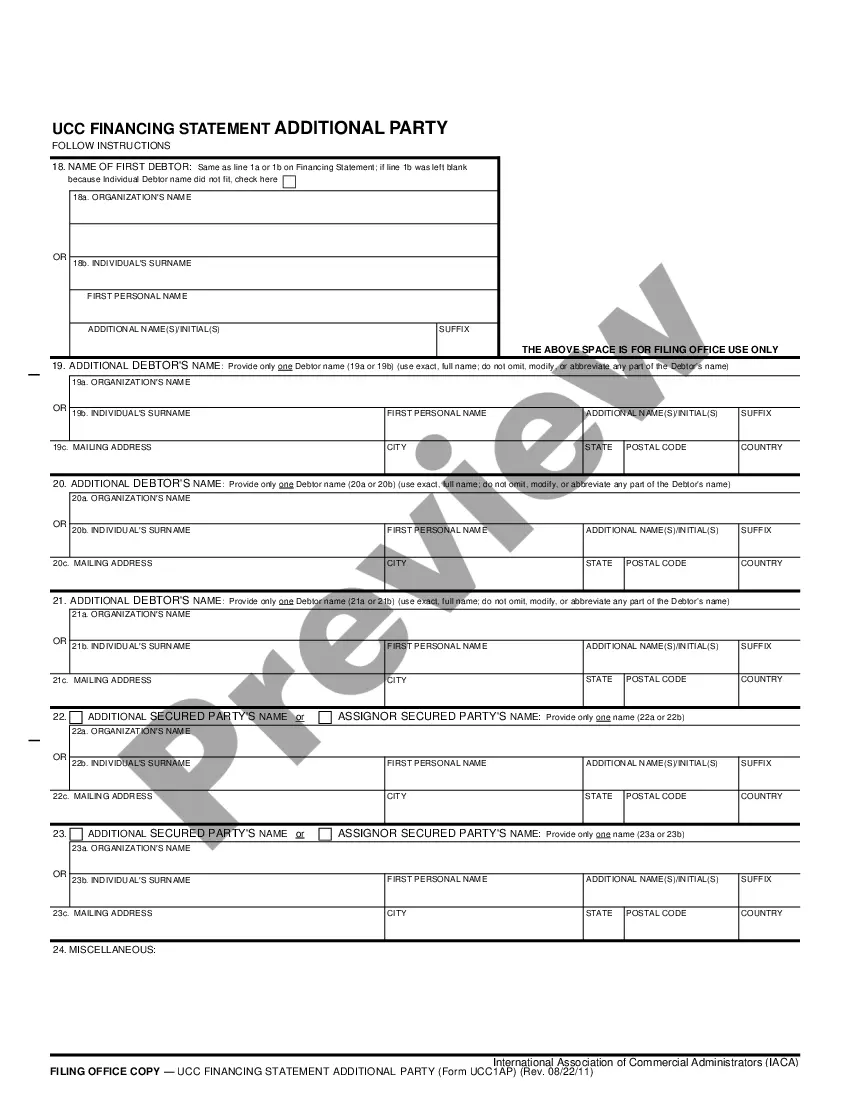

Obtaining a Lien Release 1 Confirm the FDIC has the authority to assist with a lien release. 2 Compile Required Documents and Prepare Request for a Lien Release. 3 Register/Mail request to FDIC DRR Customer Service and Records Research.

If you don't have a title in hand you'll have to process the lien release before you can sell it.

If there truly is no one with the legal authority to release the lien, then the remedy lies with the court. The property owner will need to file a lawsuit to quiet title. There are unique challenges involved with suing a defunct entity, but an experienced real estate attorney will be able to navigate those challenges.

The purpose of a lien letter is to certify that there are no municipal claims such as water, sewage, sewer assessment, etc. against the property being sold, transferred, or refinanced. If there is a claim on the property in question, the letter will provide the amount necessary to cover the claim(s).

In most cases, the lien holder must sign and date two (2) release of lien forms to remove the lien. Send one (1) signed and dated copy of a lien release to the debtor and one (1) signed and dated copy to the Oklahoma Tax Commission, P.O. Box 269061, Oklahoma City, OK 73126.

How long does it take to get your car title from the bank? Generally, it takes two to six weeks, but it will depend on your state's processes.