Sample Payoff Letter From Lender In Virginia

State:

Multi-State

Control #:

US-0019LTR

Format:

Word;

Rich Text

Instant download

Description

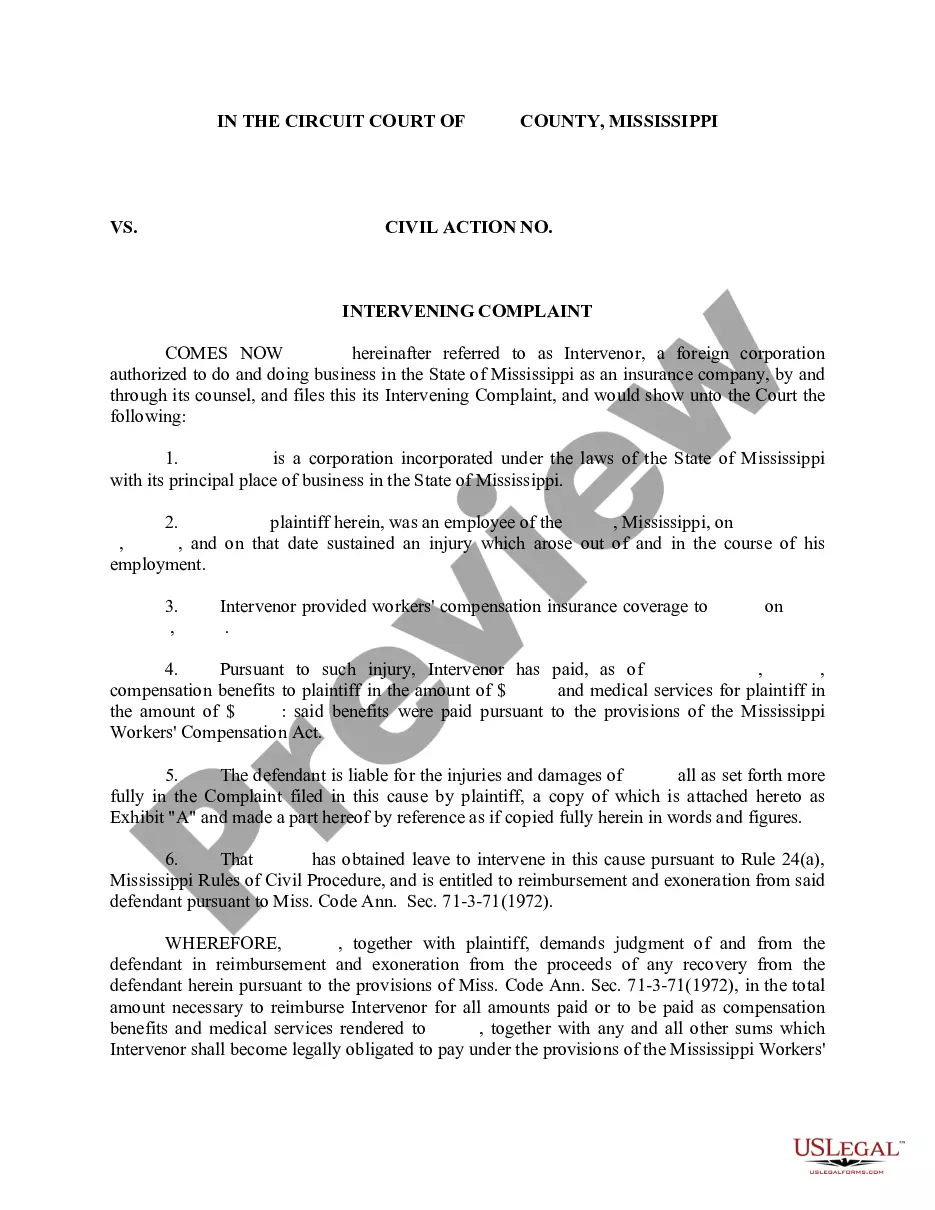

The Sample Payoff Letter from Lender in Virginia is a formal correspondence template designed for lenders and borrowers regarding unpaid loan balances. Key features include spaces for the date, lender's name, borrower details, and specific loan information. The letter outlines the situation of an overdue payment and requests confirmation of payment status. It highlights that the payoff amount has increased due to additional insurance costs and accumulated interest. This form is particularly useful for attorneys, paralegals, and legal assistants managing loan transactions, as well as partners and owners in real estate deals. When filling out the form, ensure to customize it with accurate details. Editing adjustments may be necessary to reflect specific lender and borrower circumstances. Overall, this template facilitates clear communication regarding loan payoffs, ensuring all parties are informed of changing amounts and timelines.

Form popularity

FAQ

TILA requires that a mortgage lender or servicer send ''an accurate payoff balance within a reasonable time, but in no case more than seven business days'' after receiving the borrower's request. 15 U.S.C. § 1639g.

First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

(c) A beneficiary, or his or her authorized agent, shall, on the written demand of an entitled person, or his or her authorized agent, prepare and deliver a payoff demand statement to the person demanding it within 21 days of the receipt of the demand.