Payoff Statement Template With Interest In Tarrant

Description

Form popularity

FAQ

Overview of Tarrant County, TX Taxes Tarrant County, Texas, whose county seat is Fort Worth, is one of the most populous counties in the country. At 2.26%, the county also has one of the highest average effective property tax rates of Texas' counties.

Person Age 65 or Older (or Surviving Spouse) Exemption An over 65 exemption is available to property owners the year they become 65 years old. By state law, this exemption is $10,000 for school districts. Other taxing units may adopt this exemption and determine its amount.

Texas Property Tax Rates CountyMedian Home ValueAverage Effective Property Tax Rate Bell $153,500 2.19% Bexar $171,200 2.35% Blanco $261,300 1.05% Borden $156,300 0.50%81 more rows

Texas property tax rates are among the highest in the United States. The Lone Star State has a property tax rate of 1.83% which is quite a bit higher than the national average rate of 1.08%.

The median property tax rate in Keller, TX is 1.68%, considerably higher than both the national median of 0.99% and the Texas state median of 1.67%. With the median home value in Keller, the typical annual property tax bill reaches $8,383, far exceeding the national median of $2,690.

To qualify for the age 65 or older residence homestead exemption, the individual must be age 65 or older, have an ownership interest in the property and live in the home as his or her principal residence.

For questions about property tax bills and collections, call the Property Tax Assistance Division's Information Services Team at 512-305-9999 or 1-800-252-9121 (press 3).

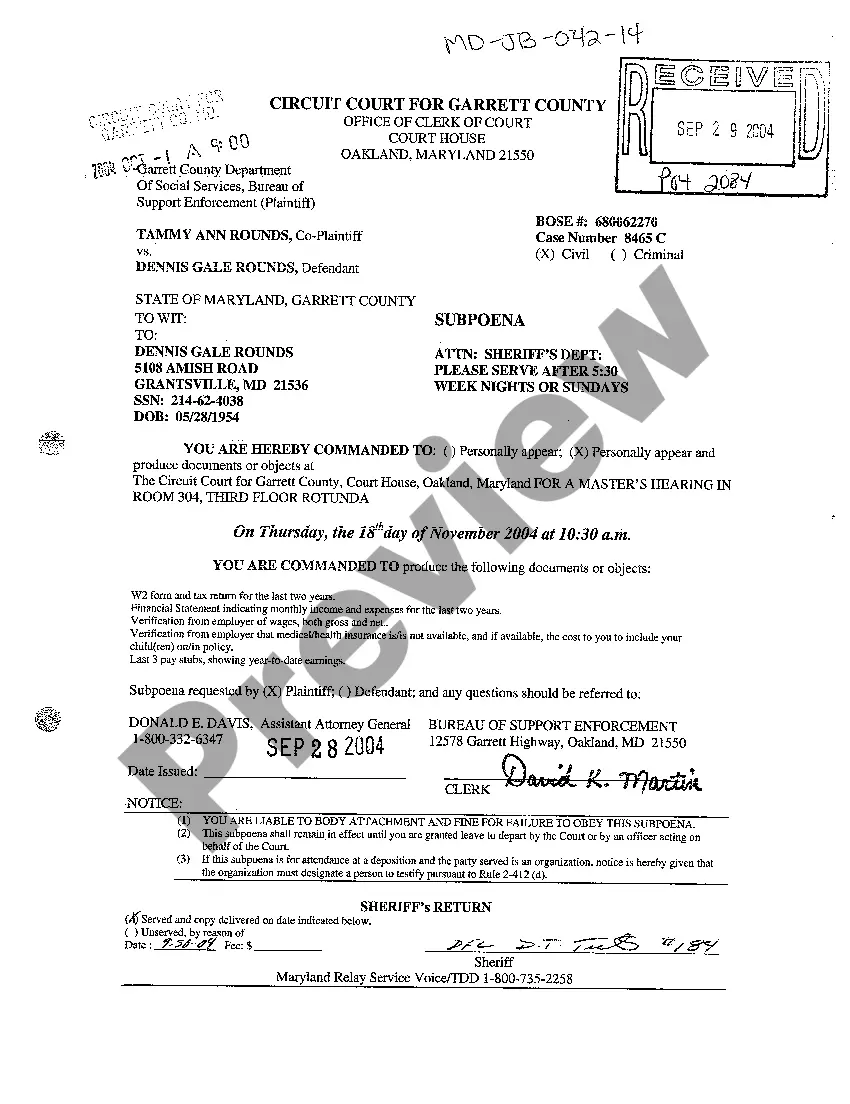

Use the Search feature to find your account. Then select the E-STATEMENT button to access your statement. You may also contact our office at 817-884-1100 to request a statement or email us at taxoffice@tarrantcountytx.

Please Note: Property taxes become delinquent on February 1 for the current tax year. Failure to receive a statement does not relieve the taxpayer of tax, penalty or interest liability. When should I receive my property tax statement(s)? Property tax statements are usually mailed the first week of October.

If the piece of property you're looking to buy is in a county that doesn't have an online database, you can always call the county's Treasurer's office and give them the parcel number. They will be able to look up any back taxes and tax liens for you.