Payoff Letter For Promissory Note In Riverside

Description

Form popularity

FAQ

Canceling a promissory note requires the lender's agreement and must follow proper legal documentation, often through a Release of Promissory Note. Legal grounds for cancellation include full repayment, debt forgiveness, refinancing, and contract disputes.

Under the Code, the maker of a note can be discharged only by payment, cancellation,7 real defenses,8 or the running of the statute of limitations.

A promissory note release form is issued by a lender to a borrower after the final payment on the note. This would absolve the borrower from any future obligations. It is usually issued after all the terms of the note are satisfied.

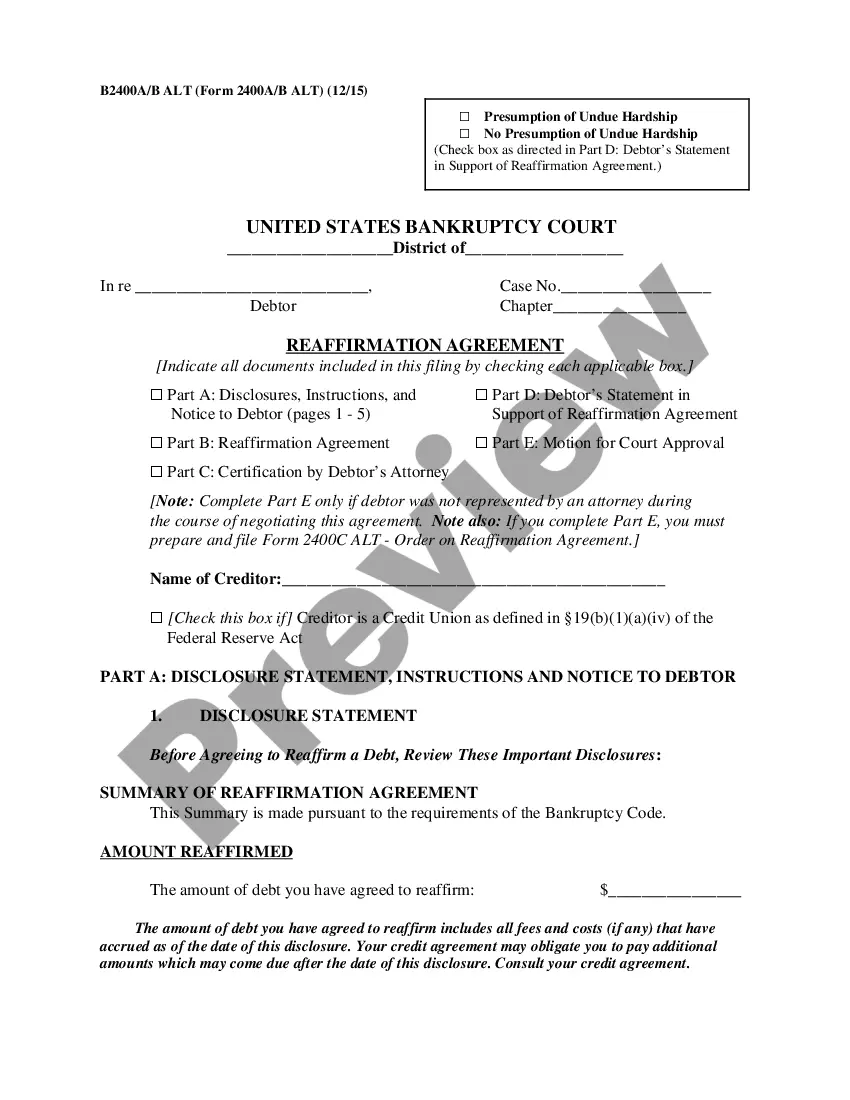

Promissory notes come in many forms. One can pertain to a mortgage. In some cases the remaining debt of a mortgage promissory can be discharged under Chapter 7 bankruptcy. If there is currently a lien against the property, the promissory note may not be eligible for discharge under Chapter 7.

A simple promissory note might be for a lump sum repayment on a certain date. For example, let's say you lend your friend $1,000 and he agrees to repay you by December 1st. The full amount is due on that date, and there is no payment schedule involved.

But what exactly do you need to write a promissory note? Include their full legal names, addresses, and contact numbers—include any co-signers if applicable. The terms of this note should specify the amount borrowed, repayment terms (including interest rate, if applicable), and the due date or schedule of payments.

But what exactly do you need to write a promissory note? Include their full legal names, addresses, and contact numbers—include any co-signers if applicable. The terms of this note should specify the amount borrowed, repayment terms (including interest rate, if applicable), and the due date or schedule of payments.

A simple promissory note might be for a lump sum repayment on a certain date. For example, let's say you lend your friend $1,000 and he agrees to repay you by December 1st. The full amount is due on that date, and there is no payment schedule involved.

A promissory note should include the principal amount, interest rate, repayment terms, conditions for default, and signatures of both parties. These elements help ensure clarity and enforceability, protecting both the lender and borrower.