Loan Payoff Letter Example For Resume In Pima

State:

Multi-State

County:

Pima

Control #:

US-0019LTR

Format:

Word;

Rich Text

Instant download

Description

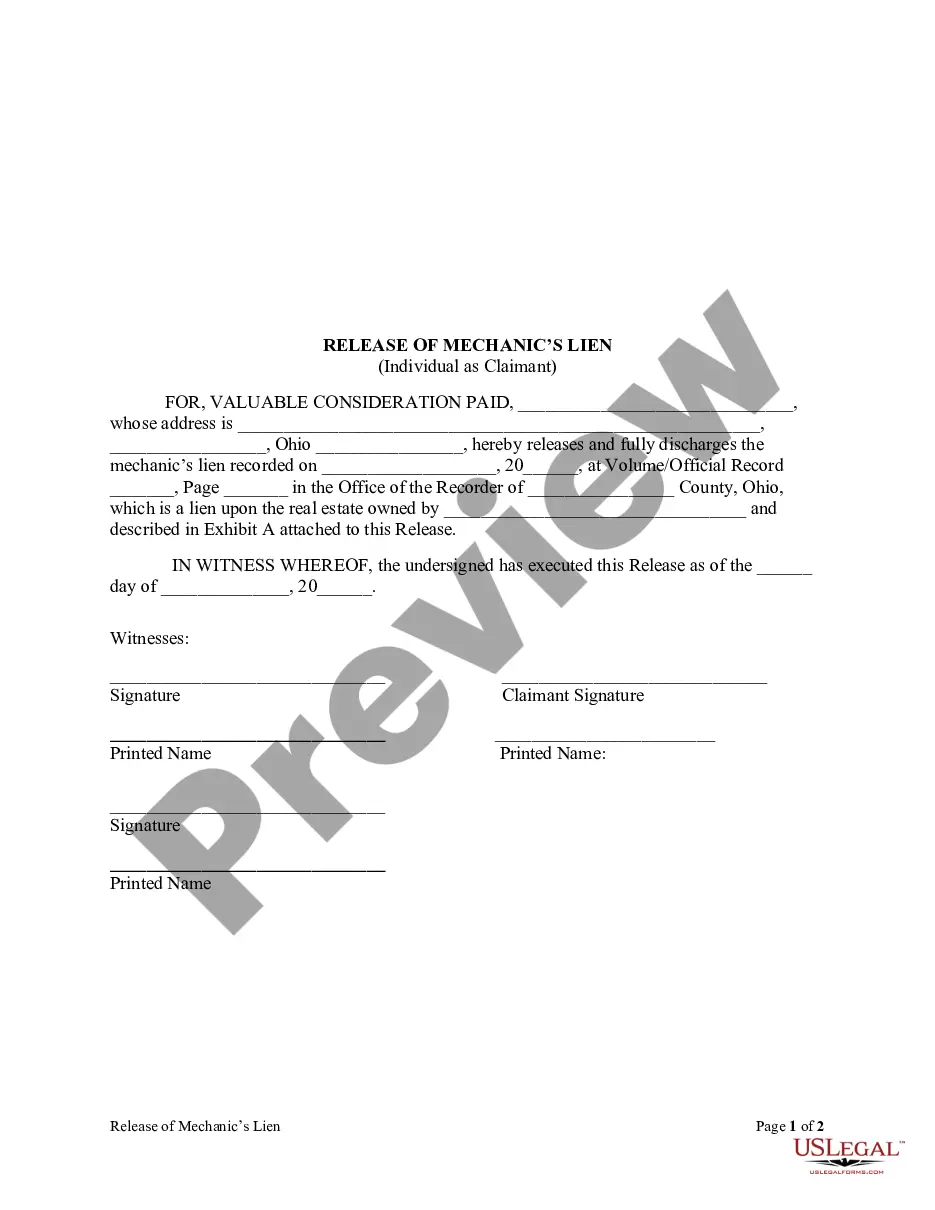

The Loan Payoff Letter Example for Resume in Pima serves as a formal template for individuals needing to communicate the status of a loan payoff to a lender or related party. This document outlines the necessary information, including the loan details, outstanding amounts, and any accrued interest that may affect the total payoff. It encourages the recipient to provide an update on the payment status and emphasizes the importance of timely mortgage payments. Key features of the letter include placeholders for specific dates, names, and amounts that users should fill in according to their circumstances. It also emphasizes the necessity of addressing changes in escrow requirements due to added insurance needs. This form proves beneficial for a diverse audience including attorneys, partners, owners, associates, paralegals, and legal assistants, as it provides a standard method to ensure clear communication regarding financial obligations. By following the simple instructions for filling out and editing the document, users can create a professional letter that aids in effective loan management and reinforces the importance of financial accountability.

Form popularity

FAQ

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions. (12 C.F.R. § 1026.36.)

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.