Loan Payoff Process In Nevada

Description

Form popularity

FAQ

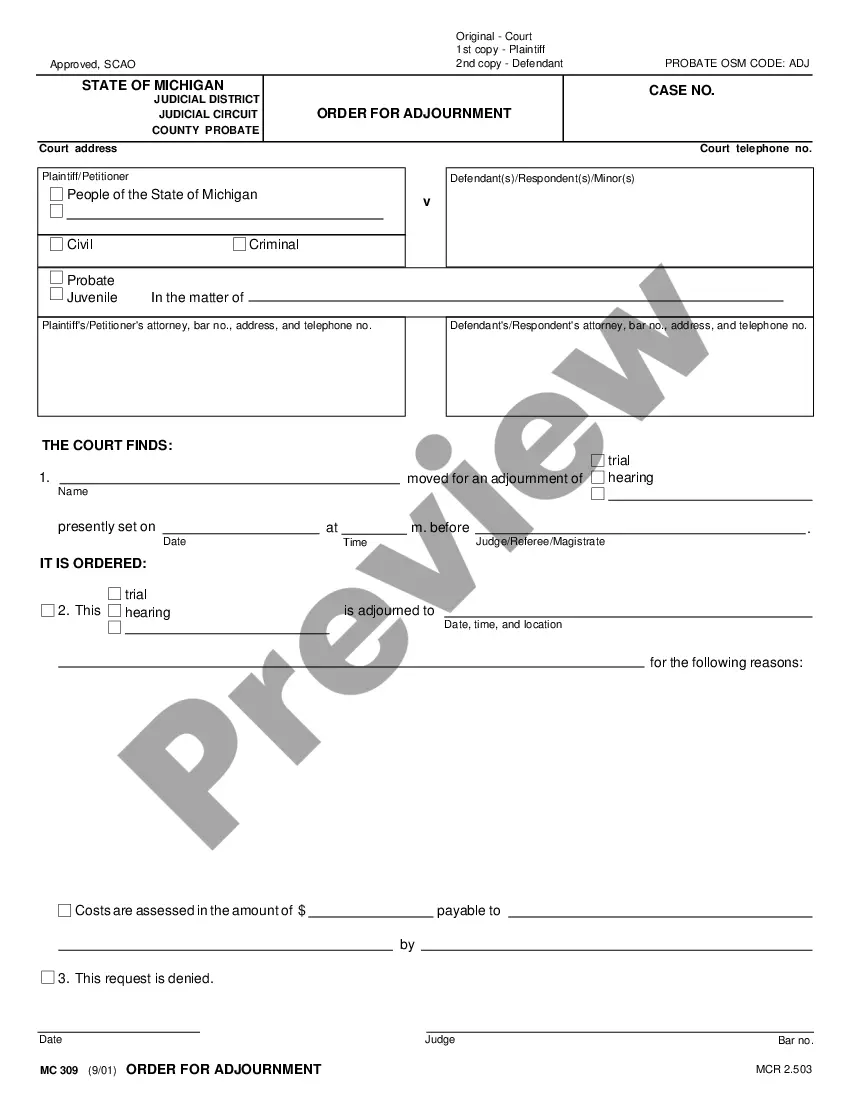

If the title is an electronic record, the lienholder must release their lien electronically. After electronic receipt of lien release the DMV will create a new title without the lienholder listed and mail the clear title to the registered owner. Signatures must be originals. Photocopies are not acceptable.

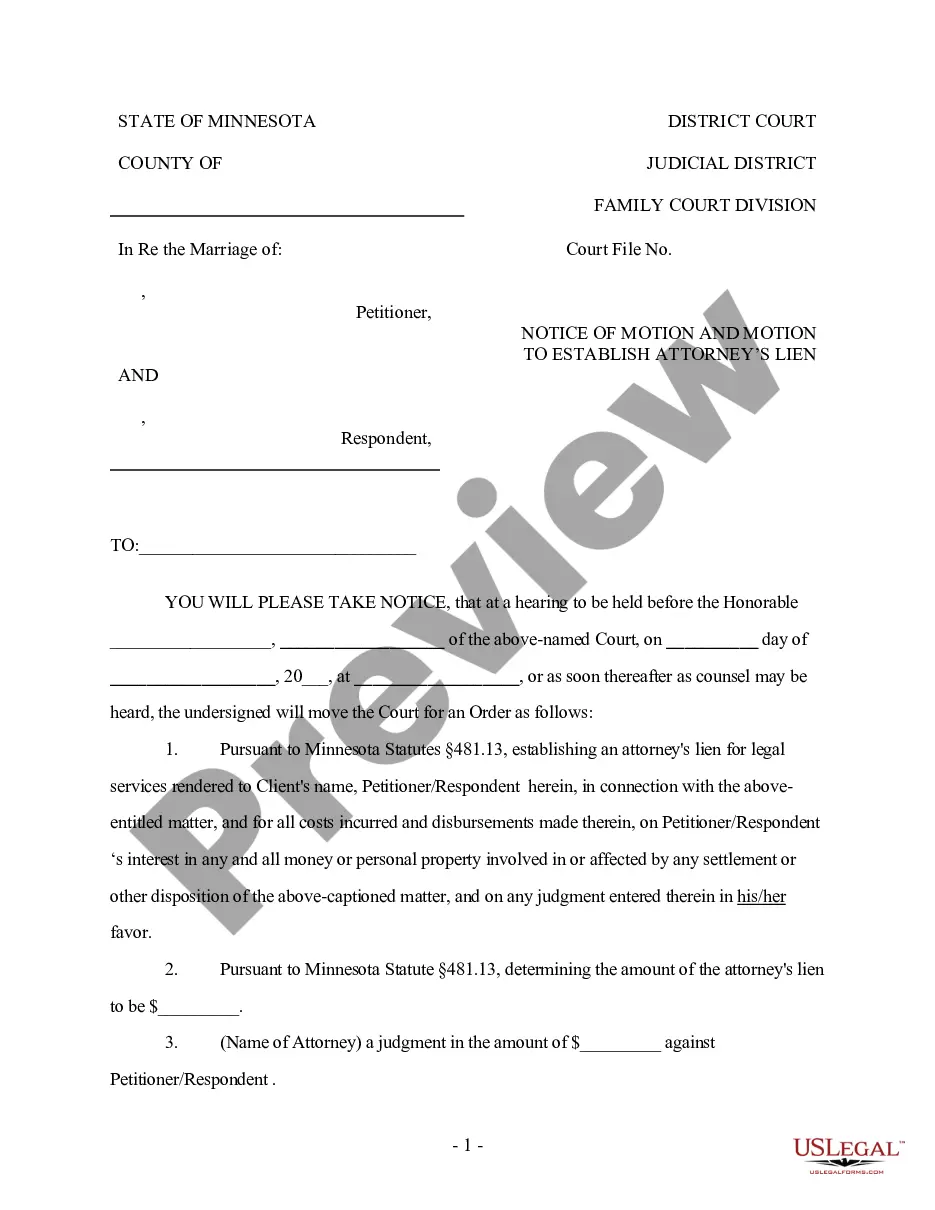

Before you can lien the car, you have to file and serve a notice of lien. Then you have to advertise the car for sale, but before you do that you have to send a certified letter to the known title holder. That would be you if the title were filed with DMV but the registered owner has to be notified as well.

Here is a general guide to help you understand the process: Step 1: Understand Nevada Auto Mechanics Lien Laws. Step 2: Verify Eligibility and Documentation. Step 3: Serve a Notice of Intent. Step 4: Prepare and File the Auto Mechanics Lien. Step 5: Serve the Auto Mechanics Lien. Step 6: Pursue Legal Action if Necessary.

Involuntary Lien: An involuntary lien is placed on your vehicle without your consent, usually due to unpaid obligations such as taxes, mechanic's service charges, or other debts.

First: Nevada mechanics lien claimants must send a Notice of Intent to Lien before filing a lien on residential property. That Notice of Intent must be sent at least 15 days before the lien gets filed. So, in order to file a valid lien, that step will need to be taken.

The Electronic Lien and Title (ELT) program enables the DMV and lending institutions (lienholders) to exchange vehicle and title information electronically. Lienholder participation is mandatory! The DMV no longer processes non-ELT titles from dealers or financial institutions.