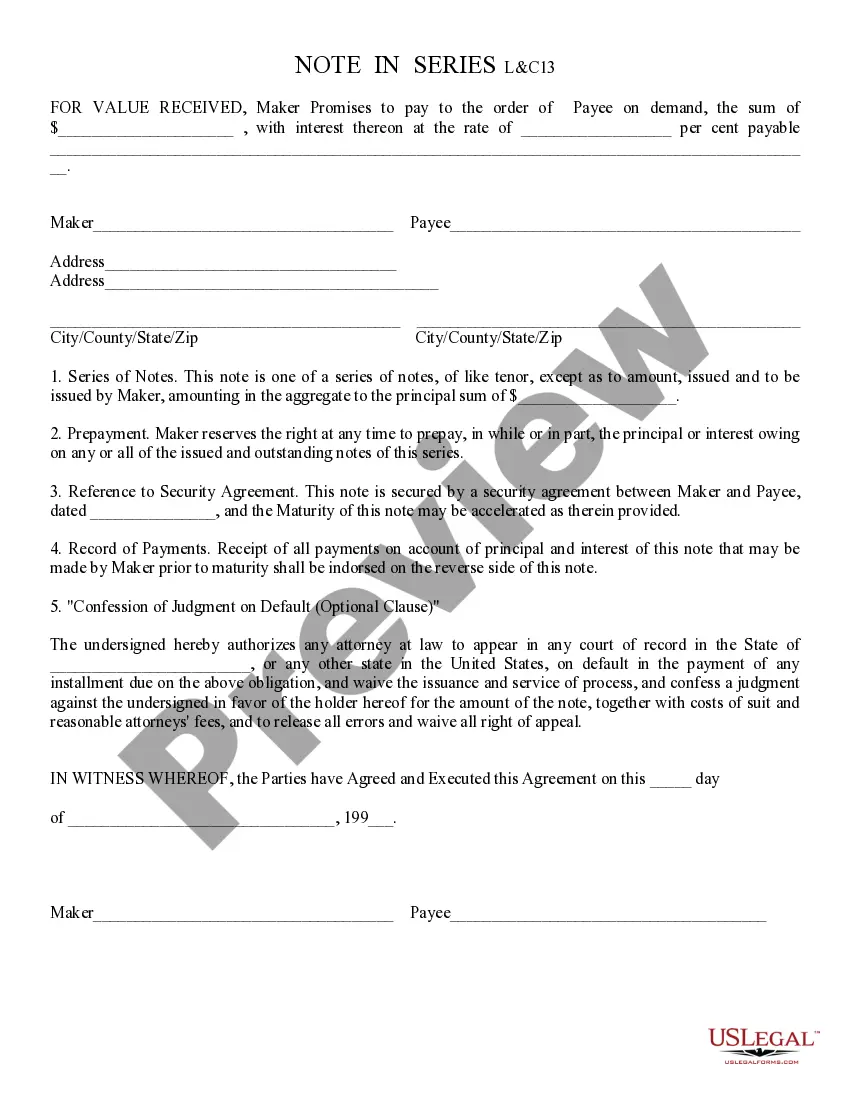

Payoff Statement Template For Self Employed In Montgomery

State:

Multi-State

County:

Montgomery

Control #:

US-0019LTR

Format:

Word;

Rich Text

Instant download

Description

The Payoff statement template for self employed in Montgomery is a crucial document that facilitates the loan payoff process for individuals operating as self-employed professionals. This template includes sections for date, recipient's name and address, and detailed instructions regarding the loan payoff amount. Users are guided to personalize the template to fit specific circumstances by inserting relevant information such as the loan holder's name, owed amounts, and interest details. Key features of the document include a section to specify accrued interest and adjustments needed due to negative escrow. The utility of this form is particularly beneficial for attorneys, partners, and owners as it provides a clear communication method to manage outstanding loan payments efficiently. Paralegals and legal assistants can also utilize the template for preparing client documents, ensuring sound practices in debt resolution. Overall, the template serves as an essential tool for self-employed individuals in Montgomery to maintain transparency with lenders and ensure timely payment resolutions.

Form popularity

FAQ

TILA requires that a mortgage lender or servicer send ''an accurate payoff balance within a reasonable time, but in no case more than seven business days'' after receiving the borrower's request. 15 U.S.C. § 1639g.

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions. (12 C.F.R. § 1026.36.)