Loan Paid In Full Letter Template Without Signature In King

Description

Form popularity

FAQ

First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

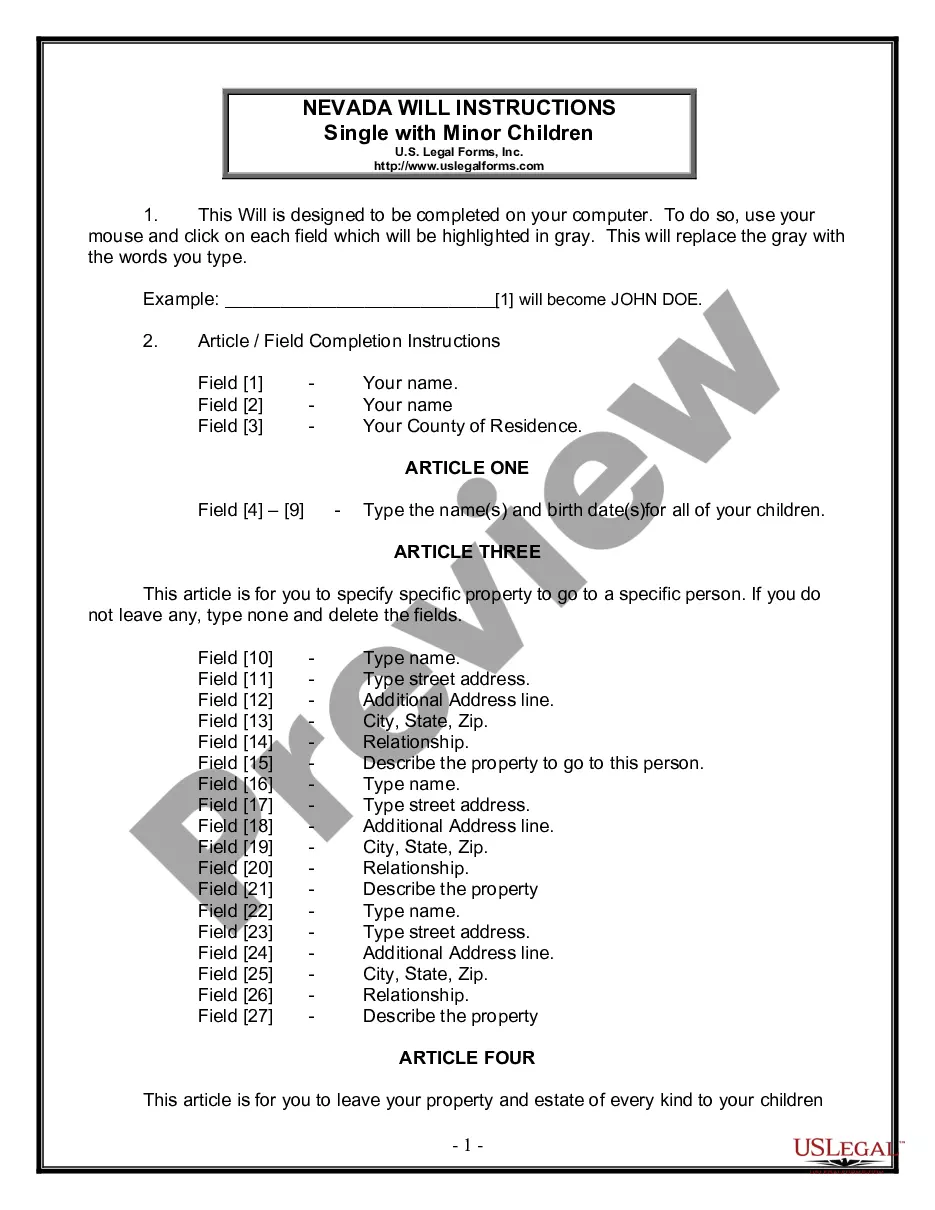

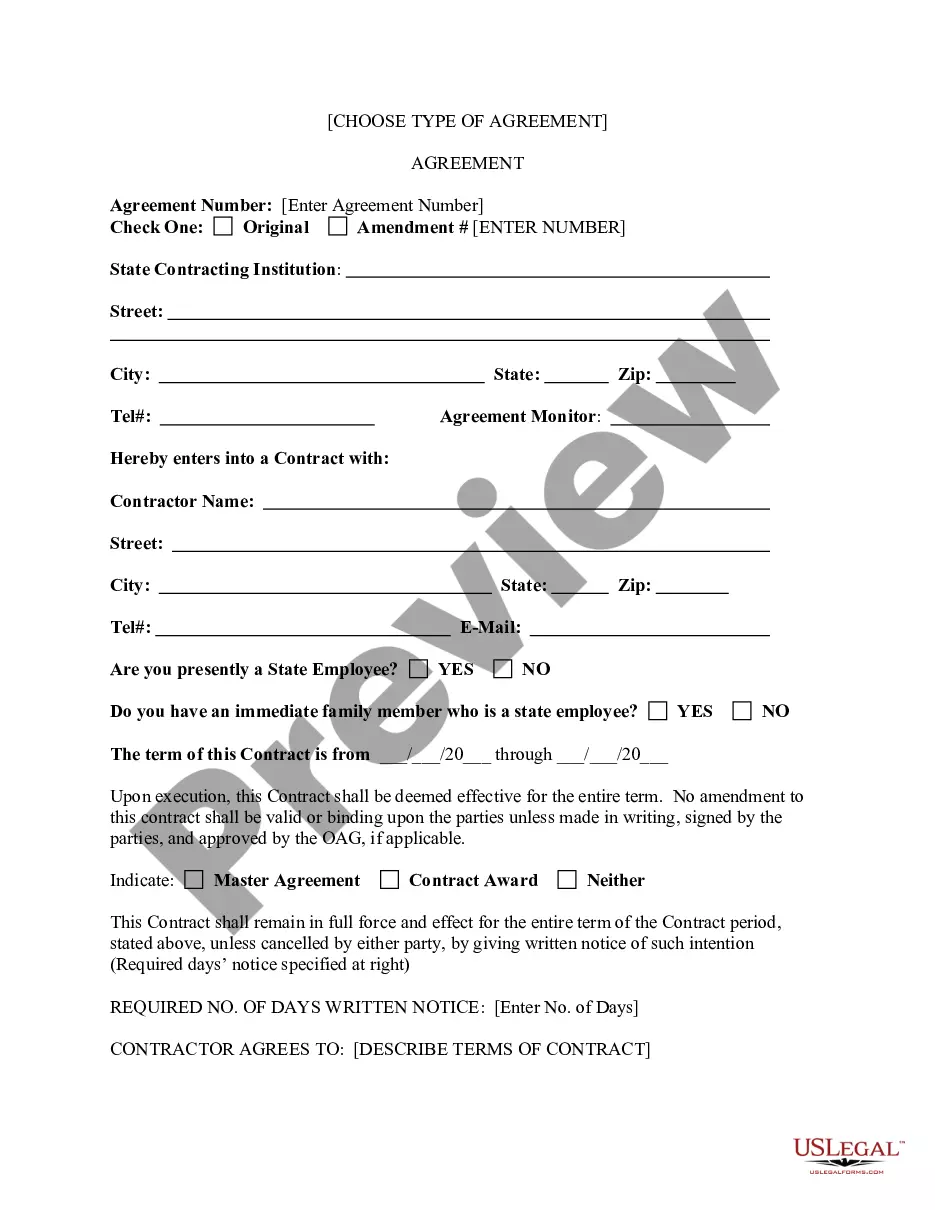

How to write a contract agreement in 7 steps. Determine the type of contract required. Confirm the necessary parties. Choose someone to draft the contract. Write the contract with the proper formatting. Review the written contract with a lawyer. Send the contract agreement for review or revisions.

How to write an agreement letter Title your document. Provide your personal information and the date. Include the recipient's information. Address the recipient and write your introductory paragraph. Write a detailed body. Conclude your letter with a paragraph, closing remarks, and a signature. Sign your letter.

Dated at (place), (province or territory) this (date) day of (month), (year).

Ing to Boundy (2012), typically, a written contract will include: Date of agreement. Names of parties to the agreement. Preliminary clauses. Defined terms. Main contract clauses. Schedules/appendices and signature provisions (para. 5).

A comprehensive guide on how to draft a contract Know your parties. Agree on the terms. Set clear boundaries. Spell out the consequences. Specify how you will resolve disputes. Cover confidentiality. Check the legality of the contract. Open it up to negotiation.

This is what generally goes in there: I sign at name of town and county, on __ this day of __, 20__. The first part is for name of place, however it is normal to do that in your jurisdiction.

How to write a contract agreement in 7 steps. Determine the type of contract required. Confirm the necessary parties. Choose someone to draft the contract. Write the contract with the proper formatting. Review the written contract with a lawyer. Send the contract agreement for review or revisions.

Settling debt can have both a negative and a positive effect on your credit scores. You're most likely to see a drop in points up-front, but over time you can regain everything you lost and more. Regardless of the setback, you can always work to experience the benefits of better credit.