Lien Payoff Letter Template With Sample In Illinois

Description

Form popularity

FAQ

The document is a 'Release of Lien Claim' form for the state of Illinois, which allows a claimant to formally discharge a lien that was previously filed against a property. It includes sections for the claimant's information, details about the lien being released, and requires notarization.

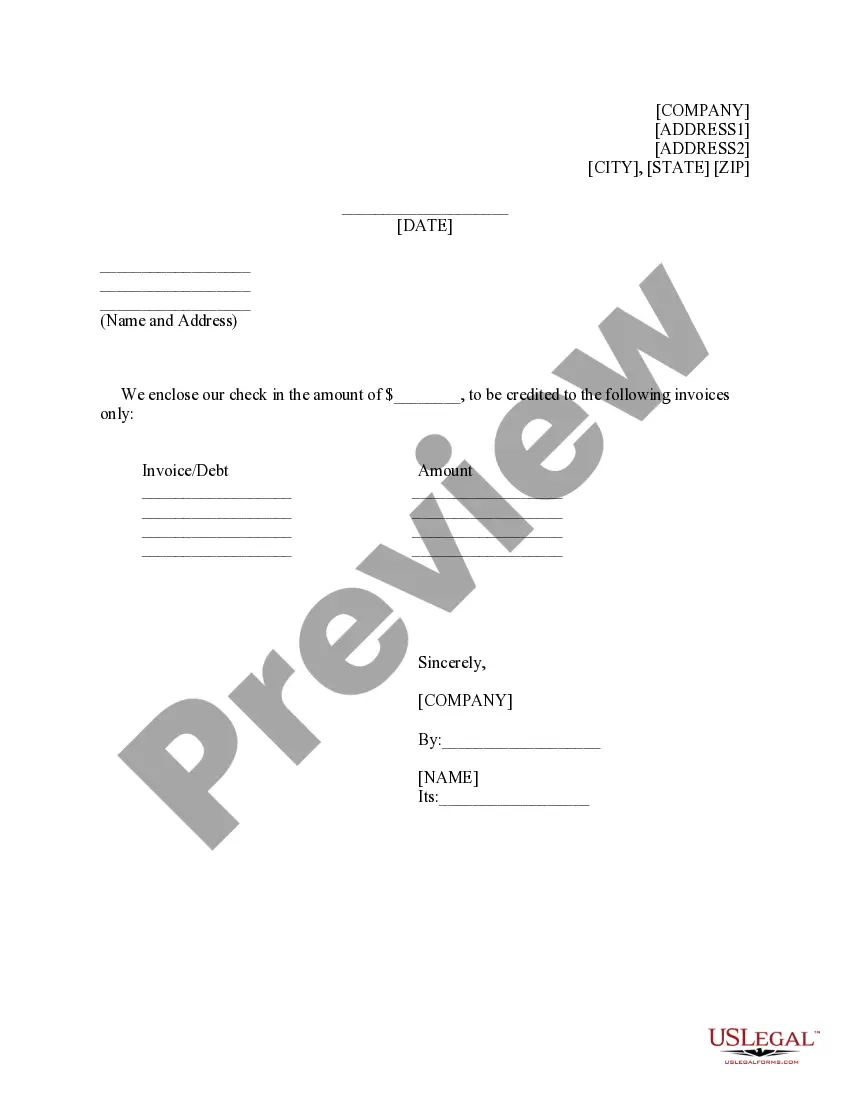

Request a lien removal Contact the FDIC directly to request a release letter. You will need the title and proof of payoff. Once you have the necessary documentation, you can file it with the DMV and register the car.

A payoff request allows a third party to receive the current balance due to release a lien or facilitate a business transfer (bulk sale transfer or liquor license). To release a lien or facilitate a bulk sale transfer, businesses must be in good standing to receive a payoff request.

Notarization Not Required Illinois lien waivers are not required to be notarized in order to be effective.

Generally, a written contract isn't required in Illinois to be able to file a mechanics lien. However, its always a good idea to get a contract in writing at the outset of each and every construction project.

A lien attaches to real estate that you own. In Illinois, a court judgment must first be recorded with the Recorder of Deeds in the county where the property is located. The creditor must record the judgment even if the property is located in the same county where the judgment was entered.

A judgment is not a lien on real estate for longer than 7 years from the time it is entered or revived, unless the judgment is revived within 7 years after its entry or last revival and a new memorandum of judgment is recorded prior to the judgment and its recorded memorandum of judgment becoming dormant.

An Illinois Notice of Intent to Lien must be sent within 90 days of last furnishing labor or materials to the project. Illinois is one of the few states which requires a Notice of Intent to Lien be sent before a lien can be filed.