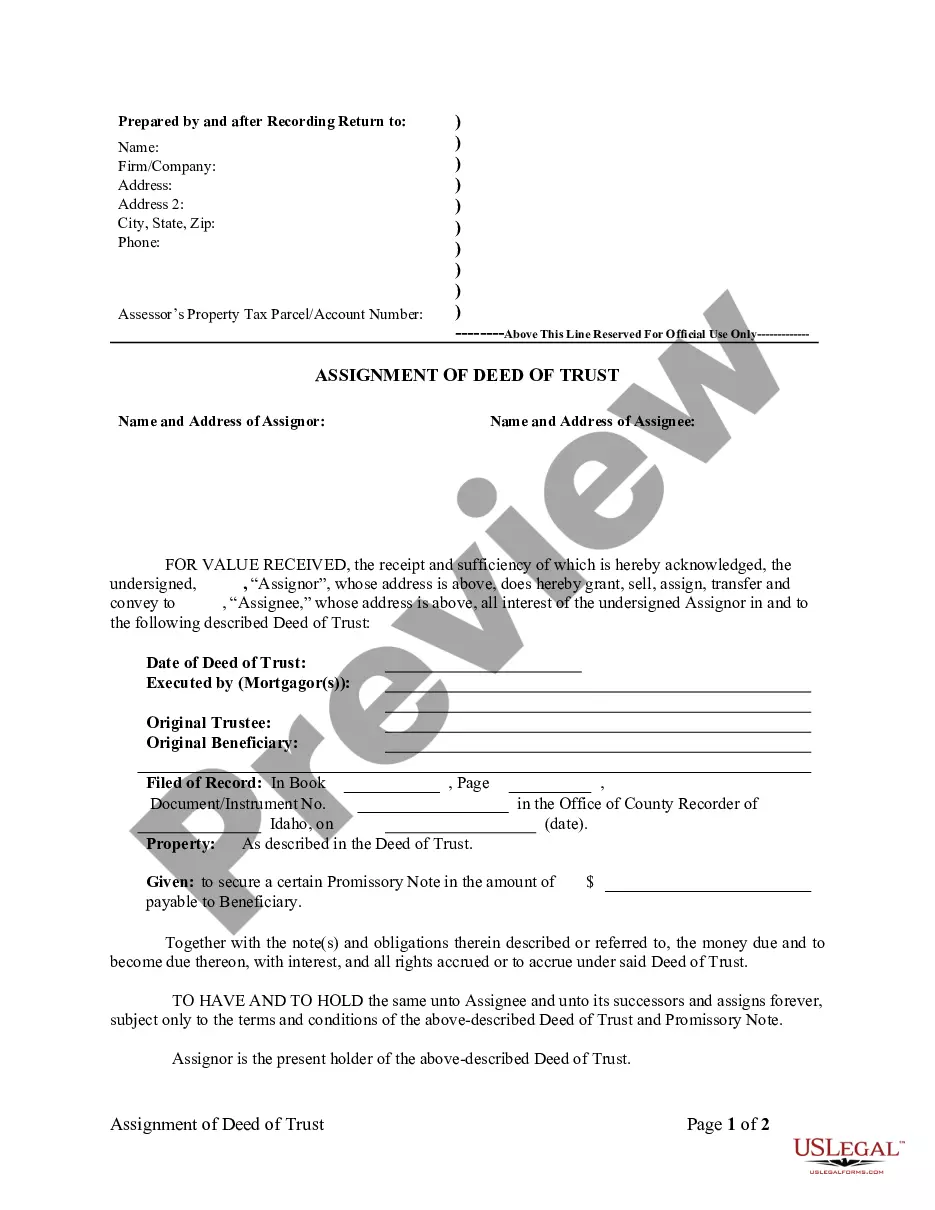

This form is a sample letter in Word format covering the subject matter of the title of the form.

Mortgage Payoff Letter Form With Tax In Hennepin

Description

Form popularity

FAQ

Apply by November 1 to defer your property taxes the following year. You may apply in the year you turn 65. Once accepted, you do not need to reapply yearly. For Torrens property, the report is a copy of the current certificate of title, available from your county recorder's office.

Looking for your property tax statement? You can get a copy of your property tax statement from the county website or county treasurer where the property is located. For websites and contact information, visit County Websites on Minnesota.

The Senior Citizens Property Tax Deferral Program allows property taxpayers who are 65 years or older, and whose total household income is $96,000 or less, to defer a portion of their homestead property taxes until some later time.

Hennepin County Property Tax Rates Hennepin County's 1.16% average effective property tax rate is higher than Minnesota's state average effective rate of 1.05%. The median home value in Hennepin County is $358,000, and the median annual property tax payment is $4,142.

There are two types of property tax refunds in Minnesota. One is income based and you may apply for this if your household income is less than $128,280; you owned and occupied a home in Minnesota; are filing a refund for 2021 or later; did not rent out your home; and did not use your home for business.

Minnesota has a graduated state individual income tax, with rates ranging from 5.35 percent to 9.85 percent. Minnesota has a 9.8 percent corporate income tax rate. Minnesota also has a 6.875 percent state sales tax rate and an average combined state and local sales tax rate of 8.04 percent.

Common examples include: Clothing for general use, see Clothing. Food (grocery items), see Food and Food Ingredients. Prescription and over-the-counter drugs for humans, see Drugs.

Looking for your property tax statement? You can get a copy of your property tax statement from the county website or county treasurer where the property is located. For websites and contact information, visit County Websites on Minnesota.