Payoff Statement Template With Interest In Georgia

Description

Form popularity

FAQ

The Late Payment penalty is 0.5% of the unpaid tax due and an additional 0.5% of the outstanding tax for each extra month. The maximum is up to a maximum of 25% of the tax due.

A: Georgia has no specific passive activity loss rules. Therefore, whatever is recognized federally would be recognized for Georgia purposed based upon Georgia's starting with the federal AGI. There is no Georgia equivalent form to the federal form 8582.

The Georgia Department of Revenue's Offer in Compromise program allows a taxpayer to settle a tax liability for less than the total amount owed. Generally, the Department approves an offer in compromise when the amount offered represents the most the Department can expect to collect within a reasonable period of time.

The Georgia Department of Revenue's Offer in Compromise program allows a taxpayer to settle a tax liability for less than the total amount owed. Generally, the Department approves an offer in compromise when the amount offered represents the most the Department can expect to collect within a reasonable period of time.

30% limitation on business interest (Georgia follows the provisions of I.R.C. Section 163(j) that existed before enactment of federal Public Law 115-97).

What is prepaid estimated tax (also known as “prepaid tax”)? If the tax liability of a dealer in the preceding calendar year is greater than $60,000 excluding local sales taxes, the dealer must remit prepaid estimated tax. The amount of “prepaid” tax that must be remitted is 50% of the estimated tax.

It is an open auction and bids are taken from all interested registered parties. Tax bidders cannot bid on properties they or their Corporation/LLC own. Bidders MUST register online before the tax sale begins. Payment is required at the time of sale and all sales are final.

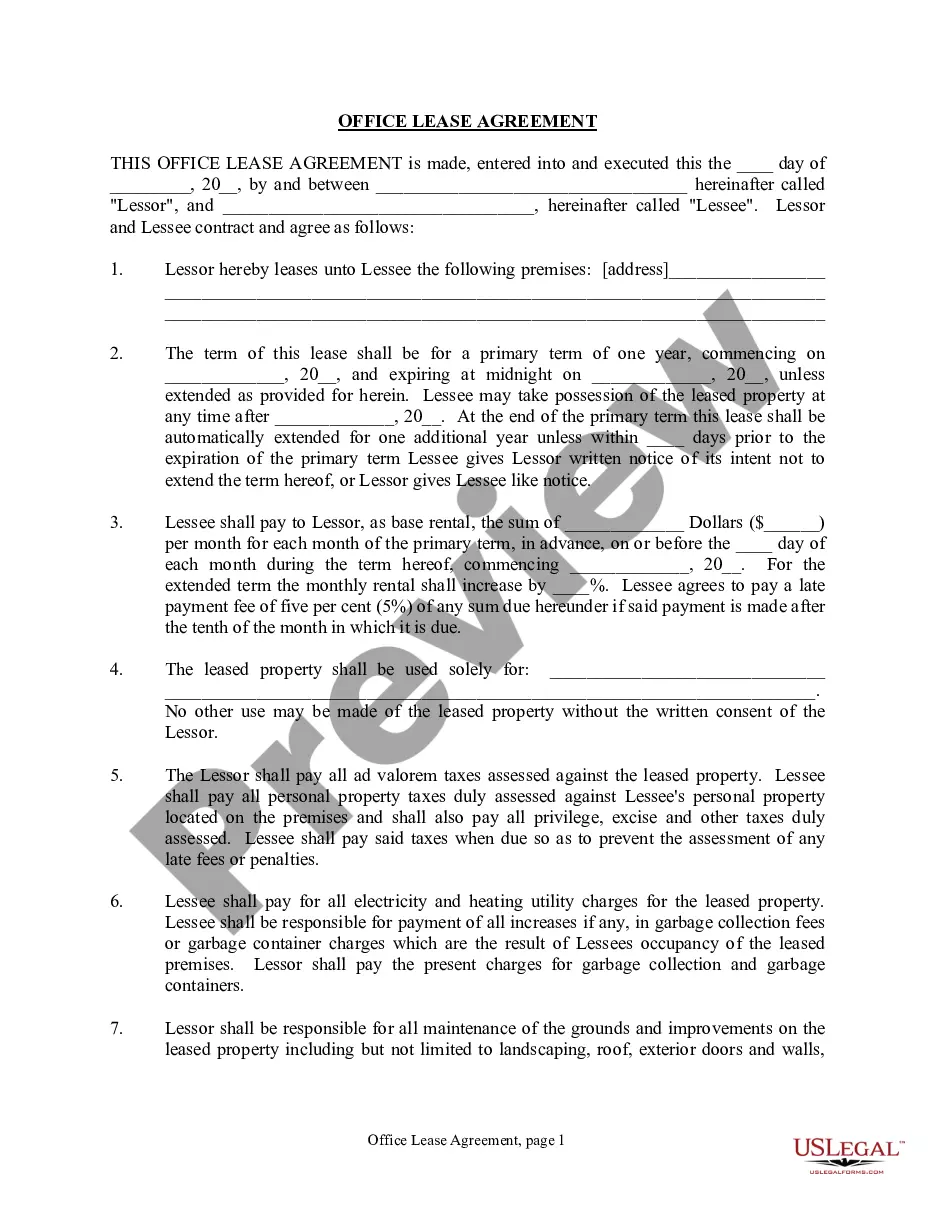

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.