Mortgage Payoff Statement With Multiple Conditions In Contra Costa

Description

Form popularity

FAQ

Documents are recorded within two (2) business days of receipt of the document. The average turnaround time for a document submitted for recording is 30 days.

To be legally effective, a grant deed must include certain basic information, including the name of the new owner, the signature of the person conveying title, and a proper legal description of the property. In California, both grant deeds and quitclaim deeds are recorded at the county recorder's office.

Recording the Deed If the deed is not recorded, the party holding the deed may not be recognized under the law as the legal property owner to third parties, though the deed may be legally effective to transfer the property from the grantor to the grantee.

It might seem like a long time. But remember good things come to those who wait. The first step isMoreIt might seem like a long time. But remember good things come to those who wait. The first step is to prepare the deed. This involves drafting the document. Getting it notarized.

A: Anywhere between 14 to 90 days after closing. A properly recorded deed can take anywhere from 14 days to 90 days. That may seem like a long time, but your local government office goes over every little detail on the deed to make sure the property is correct and there are no errors.

The average turnaround time for a document submitted for recording is 30 days. Documents recorded electronically through an agent will not be returned from our office. You may check to see if your document has been recorded and indexed into the system by clicking on Search Property Documents.

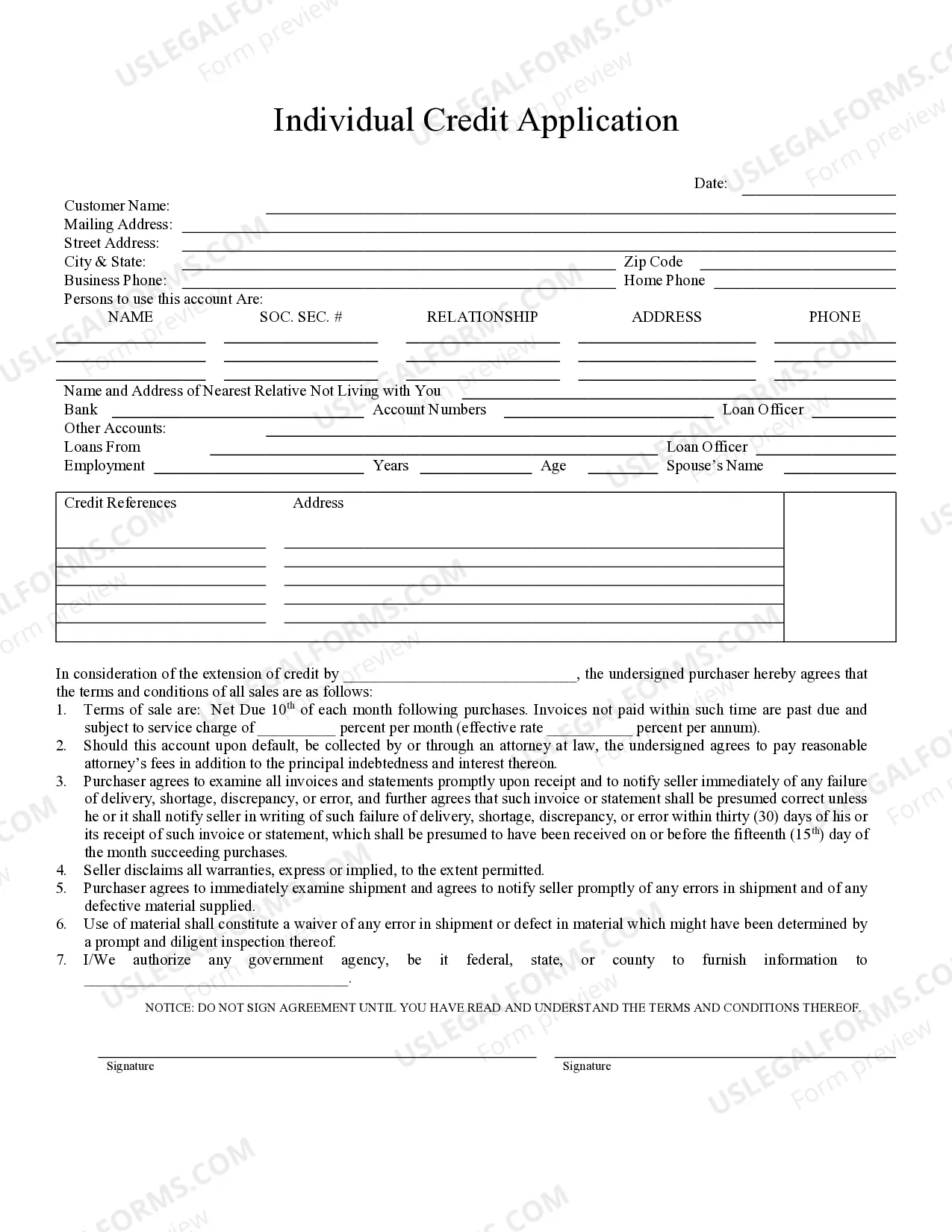

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions. (12 C.F.R. § 1026.36.)

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

The statement is provided by the mortgage servicer and can be requested at any time. Accurate payoff information is crucial for managing financial decisions related to property ownership.