Mortgage Payoff Statement With Balance In Chicago

Description

Form popularity

FAQ

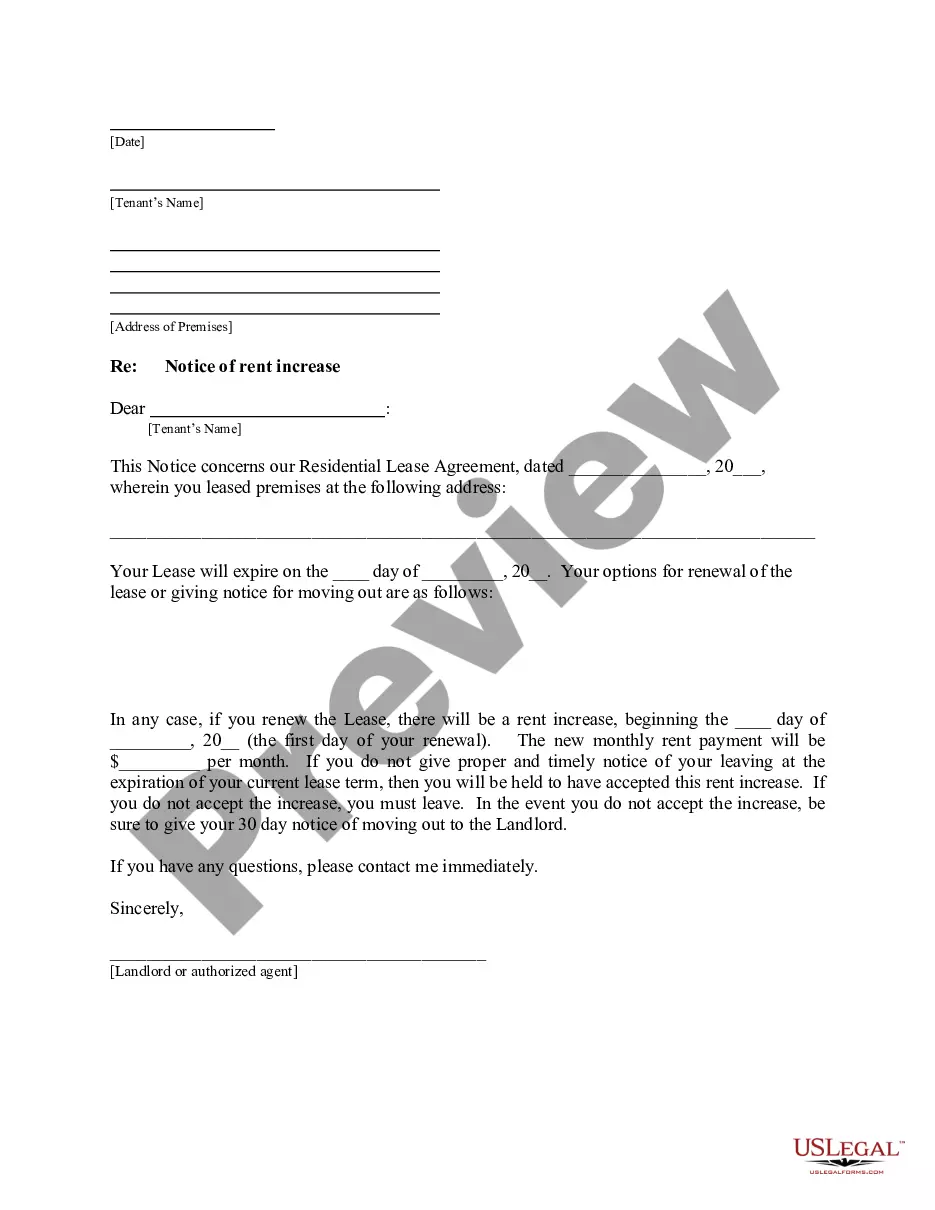

How can I request a payoff statement? Contact your servicing bank (where you make your monthly mortgage payments) and request a payoff statement.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

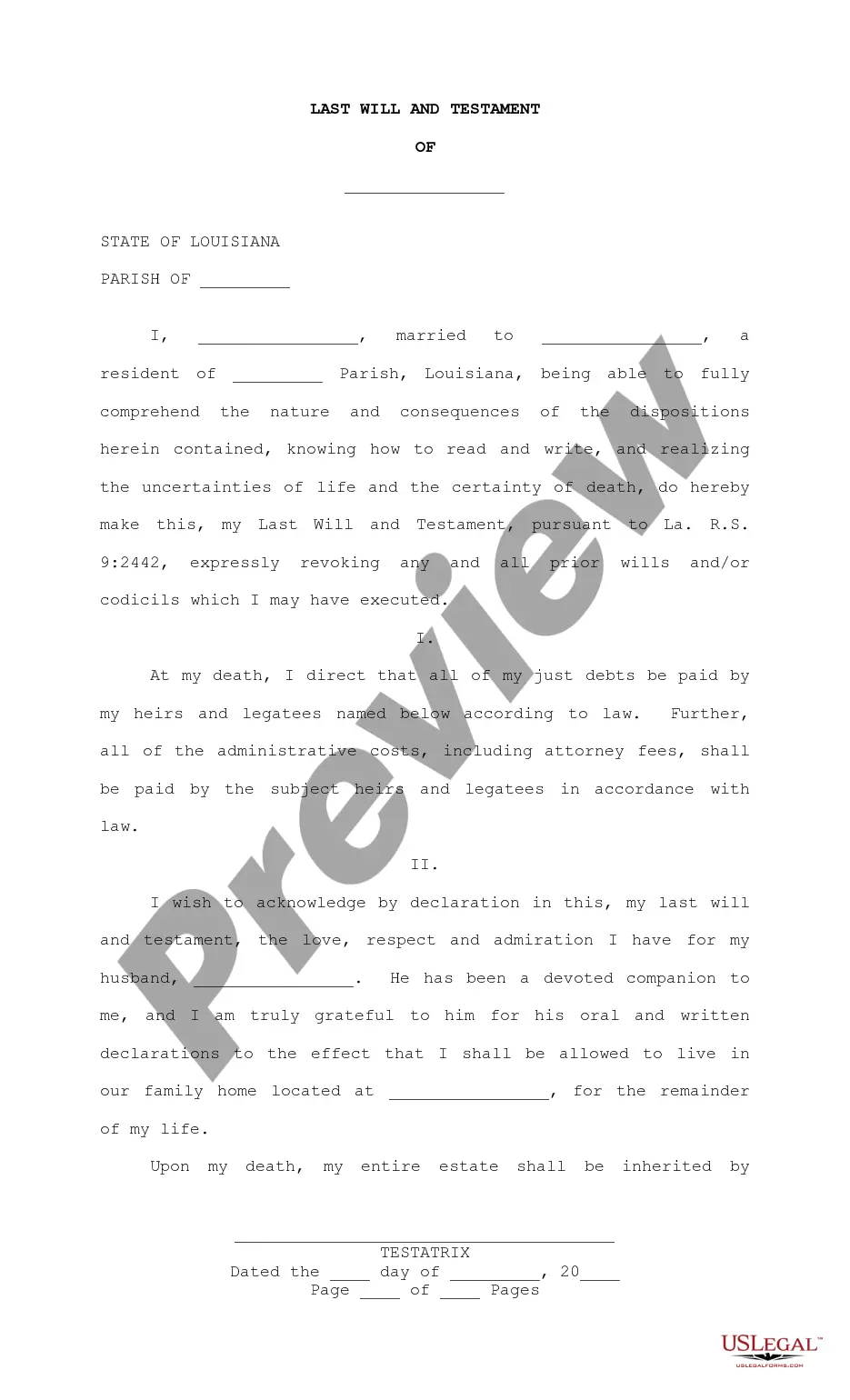

The difference between this figure and your outstanding balance is the interest saved and is known as a rebate of interest. When you request a settlement figure you will also receive the information in writing.

Definition of a Mortgage Balance. A mortgage balance is the full amount owed at any period of time during the duration of the mortgage, and is the sum of the remaining principal owing and accrued interest.

The number you see on your mortgage statement is the principal balance, not the payoff amount. The payoff amount showing on the settlement statement takes into account the principal balance plus interest accrued for the number of days between the statement and a few days after the closing.