Loan Payoff Letter Example Format In Alameda

Description

Form popularity

FAQ

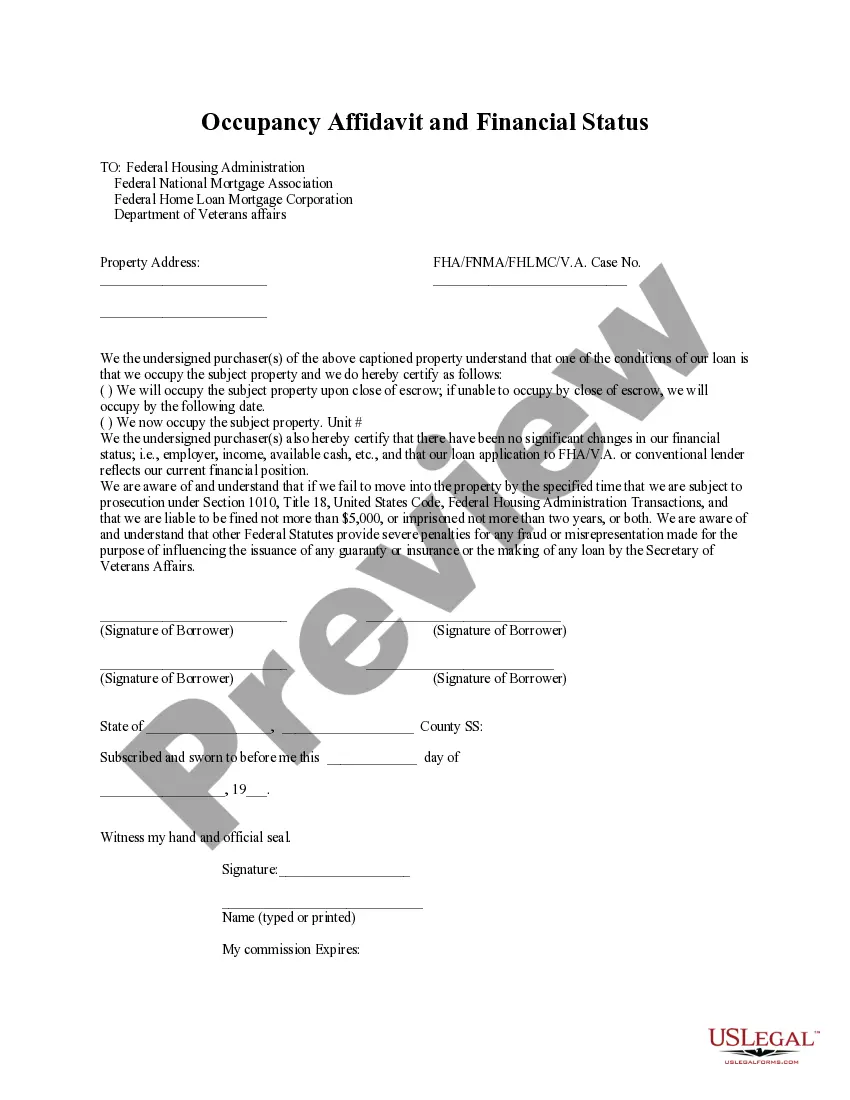

This is a standard form of mortgage payout statement provided by a lender to a borrower. This mortgage payout statement sets out the monies owed by the borrower to the lender as of the date of the statement. This Standard Document has integrated notes with important explanations and drafting and negotiating tips.

Purpose, Process, Payoff Having a purpose, process, and payoff statement prepared beforehand can enable you to immediately articulate the benefit of holding a quick conversation and/or capture the attention of everyone participating. It's also a good idea to send this information in the agenda (see point 3).

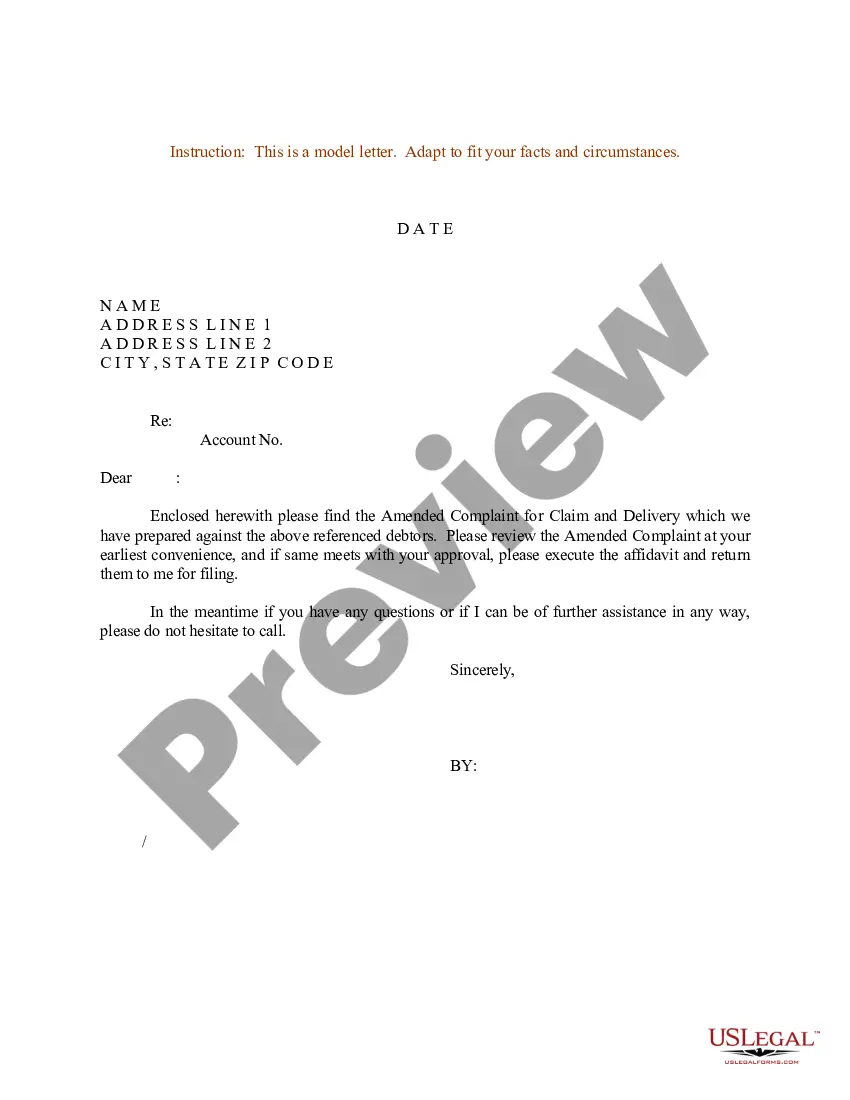

First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

Frequently Asked Questions (FAQ) Type your letter. Concisely review the main facts. Be polite. Write with your goal in mind. Ask for exactly what you want. Set a deadline. End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand. Make and keep copies.

No uniform timeframe exists between sending the demand letter and arriving at a settlement. In addition to the insurance company's review, there will be negotiations between the insurance company and your attorney, and those can take a long time. You can count on the process taking more than two months.

Your letter must clearly identify all involved parties and their relationship to the dispute. Include your full name, your status (such as customer, patient, or tenant), and the complete legal name and location of the recipient. In cases involving businesses, ensure you're addressing the correct legal entity.

(10-Day Demand Letter) (When a person is given permission to operate a motor vehicle for any reason, but refuses to return it.) The DALLAS COUNTY DISTRICT ATTORNEY'S OFFICE mandates, the following procedure MUST be taken to confirm the offender has been officially notified to return the vehicle and declines to do so.

Don't forget legal requirements. Maintain a polite, neutral tone. Outline the facts clearly. Explain the costs or "damages" you've incurred. Make your total demand explicit. Ask for more than you want to allow for negotiation. Specify a response deadline. Explain what you will do if the demand isn't met.

Frequently Asked Questions (FAQ) Type your letter. Concisely review the main facts. Be polite. Write with your goal in mind. Ask for exactly what you want. Set a deadline. End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand. Make and keep copies.

A bank confirmation letter serves to assure all concerned parties in a business transaction that the bank's customer (the borrower) has, or has available, the necessary financial resources to conclude the transaction.