Sba Loan Agreement With Collateral In Fulton

Description

Form popularity

FAQ

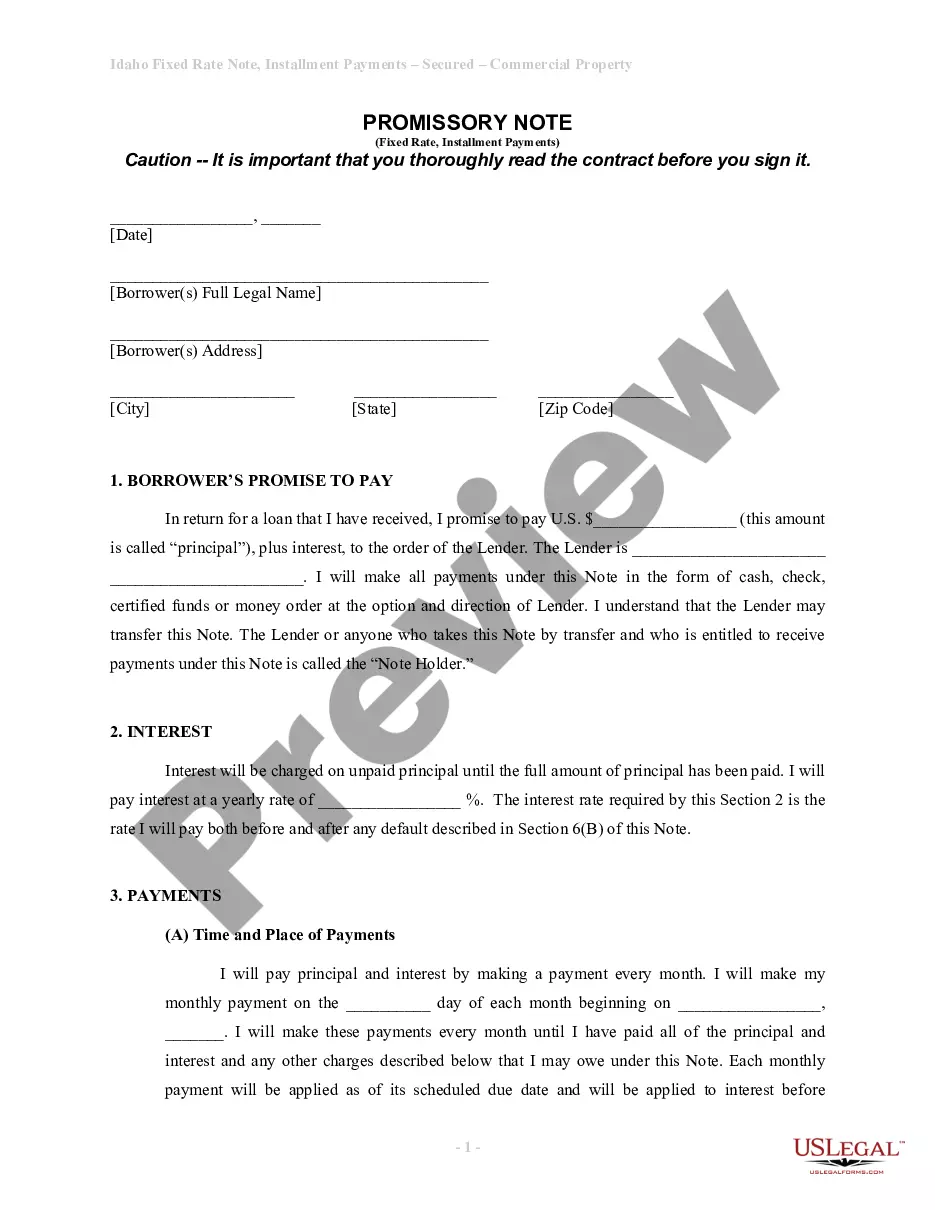

The SBA may consider a release of liens on real or personal property collateral for consideration. In cases where a bankruptcy has been filed, a formal offer in compromise may not be necessary since the underlying Note has been discharged in the bankruptcy proceeding.

The term personal guarantee refers to an individual's legal promise to repay credit issued to a business for which they serve as an executive or partner. Providing a personal guarantee means that if the business becomes unable to repay the debt, the individual assumes personal responsibility for the balance.

Advance payment guarantees This type of guarantee also acts as a collateral to ensure that the buyer/client's advance payment would be reimbursed should the seller fail to deliver their end of the bargain per the agreed contract.

Business owners are often put off with required SBA personal guarantees and even pledging a residence as collateral. First, unlike almost any other banking product, SBA loans have no covenants, so a default is virtually impossible so long as payments are made.

It's important to note that all SBA loans require some form of collateral from the borrower.

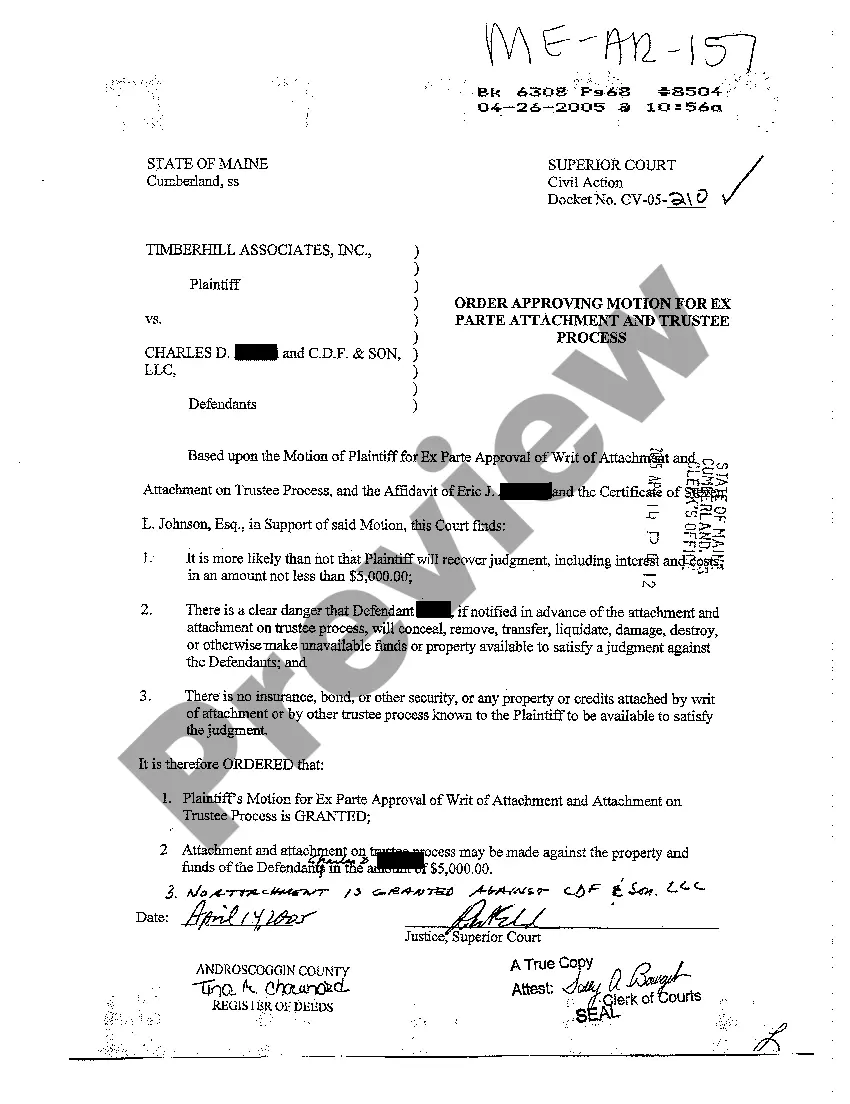

Approaching and Negotiating Lien Release When seeking a lien release, borrowers should approach the SBA with a well-prepared case that highlights the equity in their assets and the potential for a fair settlement.

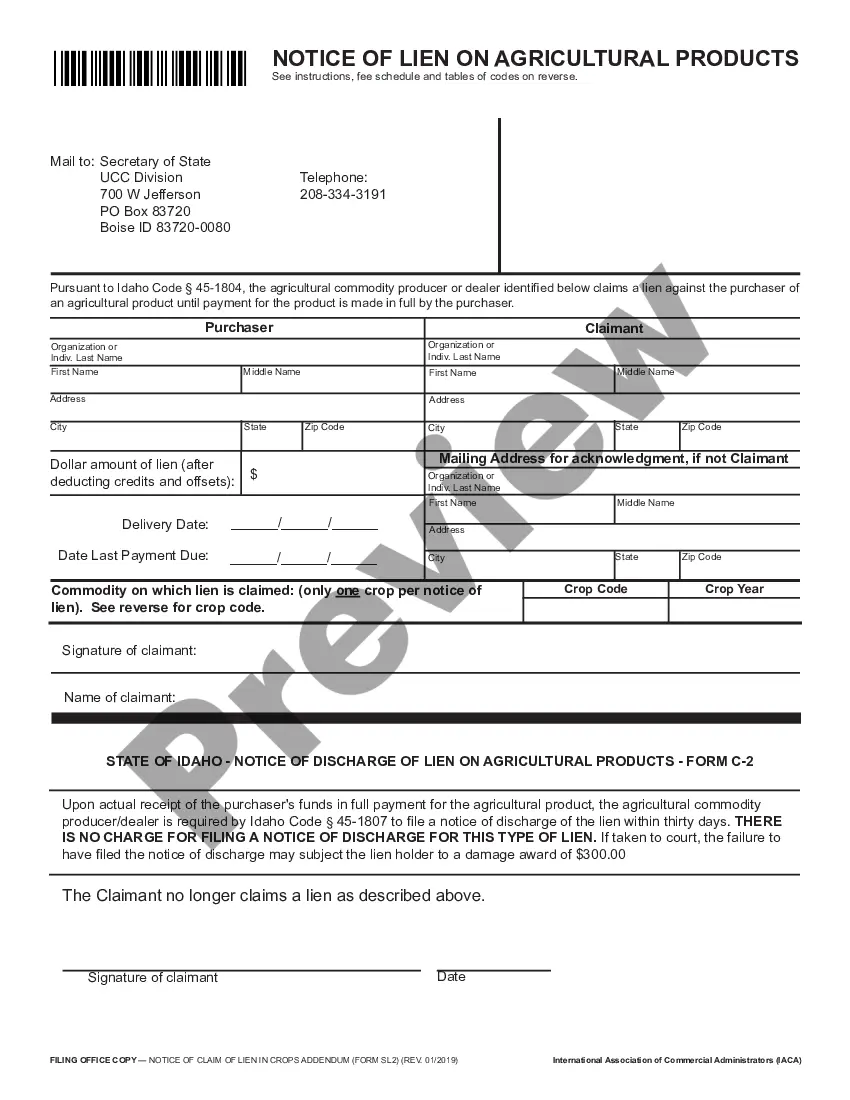

Contact Your Lender Submit a termination demand letter, known as an “authenticated demand.” A UCC termination demand letter is a signed request you send to the lender asking them to cancel the UCC filing. Be sure to list the name and address of the lender, as noted on your financing statement.

When seeking a lien release, borrowers should approach the SBA with a well-prepared case that highlights the equity in their assets and the potential for a fair settlement. It is essential to gather documentation and evidence that supports your position and demonstrate your willingness to resolve the debt.