Sba Loan Agreement Form In Clark

Description

Form popularity

FAQ

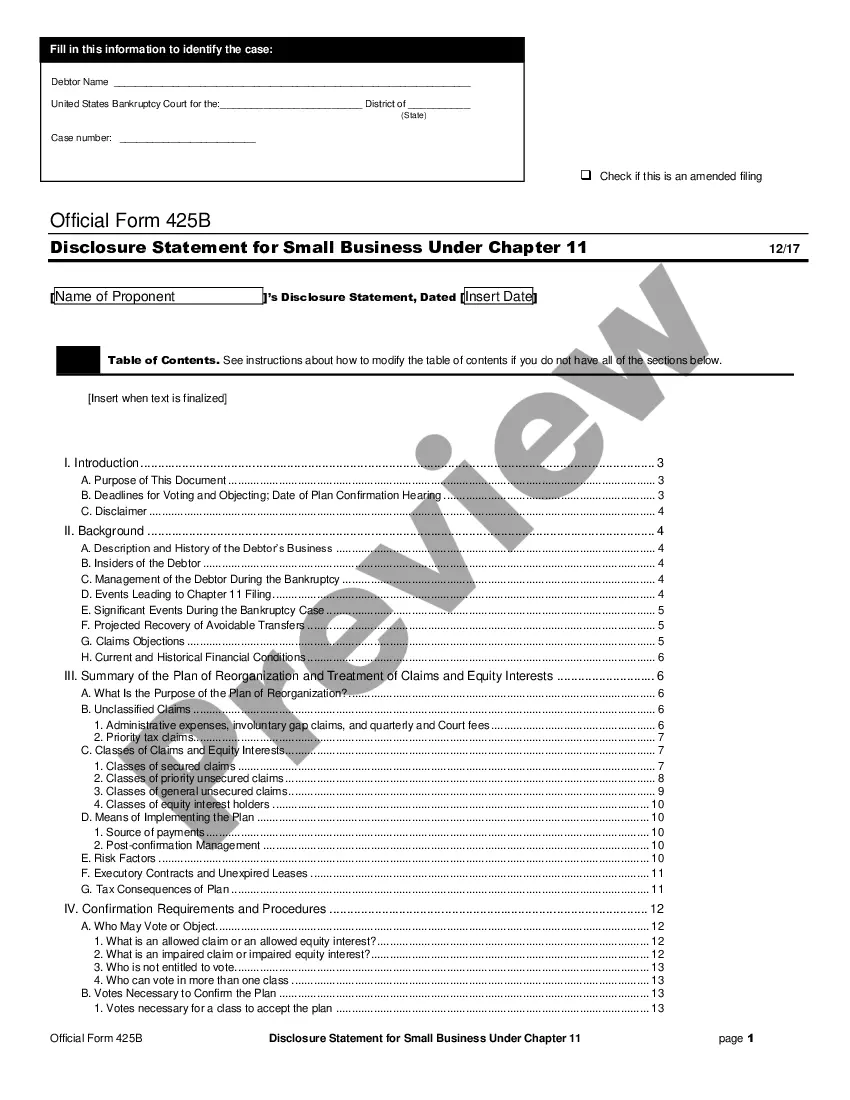

Here's the 10-step process for how to fill out SBA Form 1919: Fill In Your Business Identifying Information for Section 1. Answer Questions in Section 1 (Questions 1 - 16) Review Section 1: Sign and Date. Fill In Your Business Identifying Information for Section 2. Answer Questions in Section 2 (Questions 17 - 26)

How to fill out SBA form 413 Provide basic business information. Report your assets. Report your liabilities. List your source of income and contingent liabilities to complete section 1. Detail your notes payable to banks and others in section 2. Detail the status of your stocks and bonds for section 3.

How to fill out the SBA 7(a) Borrower Information Form Instructions? Gather necessary documents and business information. Complete Section I with Applicant details. Fill Sections II and III for individual and entity owners. Review the form for accuracy. Submit the completed form to your lender.

Completed applications should be mailed to: U.S. Small Business Administration, Processing and Disbursement Center, 14925 Kingsport Road, Fort Worth, TX 76155.

The partnership agreement represents the delegation of the SBA's 8(a) contract execution authority to other federal agencies. The purpose of the partnership agreement is to streamline the contract execution process between the SBA, the participating federal agency and the 8(a) participant.

Form 1919 gives the SBA crucial information about you, the borrower, and also facilitates a background check. Once you fill it out, you'll submit it to your participating lender (not to the SBA itself). You must answer each of its 22 questions, and the SBA may review your answers.

During the SBA 7(a) Connect Quarterly Update on January 9, 2024, SBA clarified that two of the forms that were recently updated and posted to the Agency website are no longer required in connection with SBA-guaranteed loans: SBA Form 1050, Settlement Sheet (posted to SBA website on December 20, 2024)