Sba Loan Assumption Process In Bronx

Description

Form popularity

FAQ

All loans insured by the SBA require a personal guarantee from every owner with a 20 percent or greater equity stake in the business.

Services we provide Our office provides help with SBA services including funding programs, counseling, federal contracting certifications, and disaster recovery. We can also connect you to our partner organizations, lenders, and other community groups that help small businesses succeed.

Ing to the SBA Form 1086, non-PPP loans and payments are due at the Fiscal and Transfer Agent (FTA) on the third calendar day of the month, or the next business day if the third is not a business day. The SBA allows a grace period of two business days after the due date.

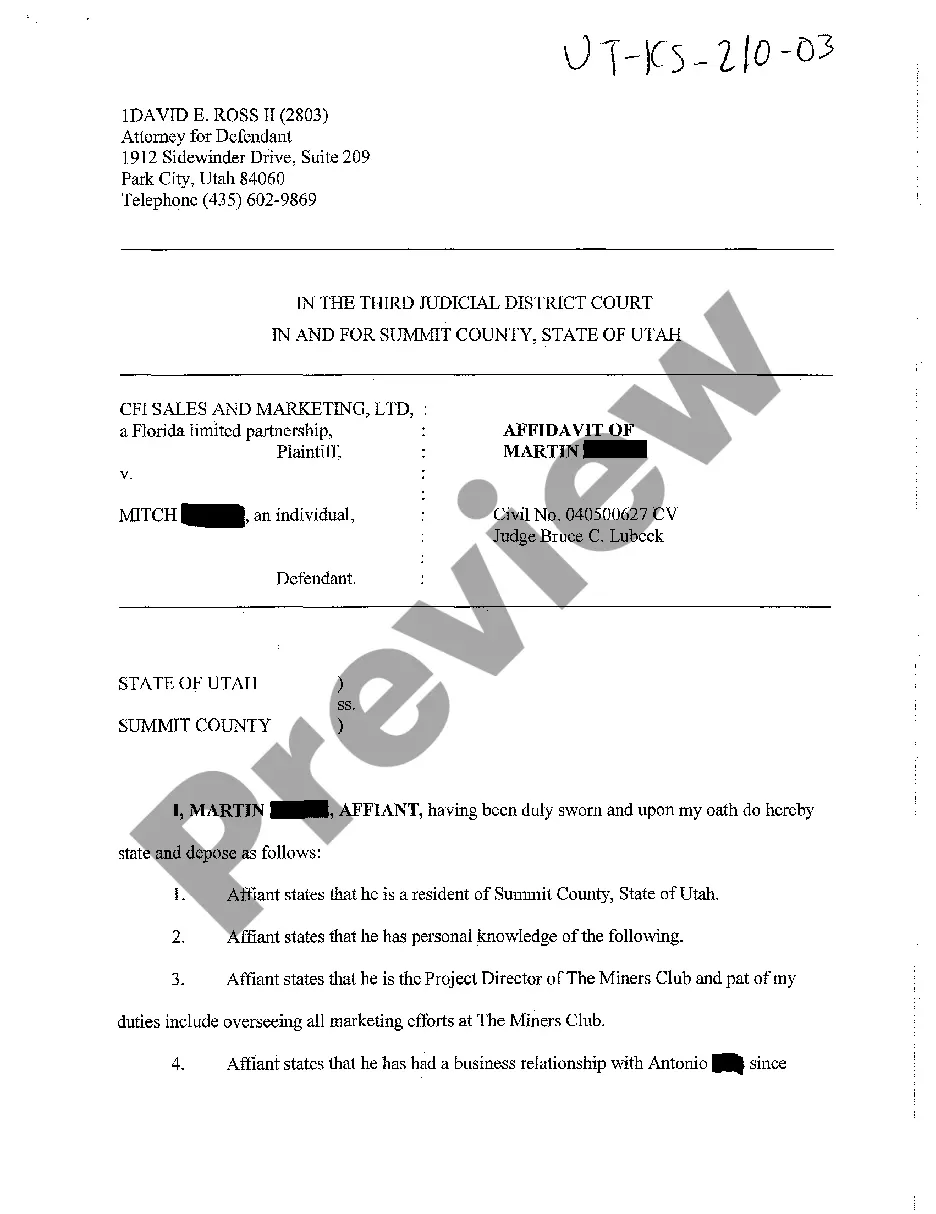

This is a standard form of notice of default and demand for payment provided by a lender to a borrower and a guarantor, if applicable, when a borrower is in default under its mortgage and the lender is ready to accelerate its mortgage and demand repayment.

The NYC Department of Small Business Services (SBS) helps unlock economic potential and create economic security for all New Yorkers by connecting New Yorkers to good jobs, creating stronger businesses, and building thriving neighborhoods across the five boroughs.

SBA is the only cabinet-level federal agency fully dedicated to small business and provides counseling, capital, and contracting expertise as the nation's only go-to resource and voice for small businesses.

New York State Small Business is defined as a company that is a resident to New York State, independently owned and operated, with 100 or fewer employees, and not dominant in its field.

How to fill out SBA form 413 Provide basic business information. Report your assets. Report your liabilities. List your source of income and contingent liabilities to complete section 1. Detail your notes payable to banks and others in section 2. Detail the status of your stocks and bonds for section 3.