Escrow Agreement For Repairs In Illinois

Description

Form popularity

FAQ

The 3 Requirements of a Valid Escrow The Contract between the Grantor and the Grantee. Delivery of the Deposited Item to a Depositary. Communication of the Agreed Conditions to the Depositary.

The Escrow Holder: prepares escrow instructions. requests a preliminary title search to determine the present condition of title to the property.

In conclusion, escrow holdbacks for repairs can be a valuable solution in real estate transactions, providing a structured way to address necessary repairs while keeping the sale on track.

The 3 Requirements of a Valid Escrow The Contract between the Grantor and the Grantee. Delivery of the Deposited Item to a Depositary. Communication of the Agreed Conditions to the Depositary.

An escrow holdback for repairs is a financial arrangement where a portion of the homebuyer's funds is withheld by the lender or escrow agent until specific repairs or improvements are completed. This arrangement is typically used when there are issues with the property that need attention before the sale can close.

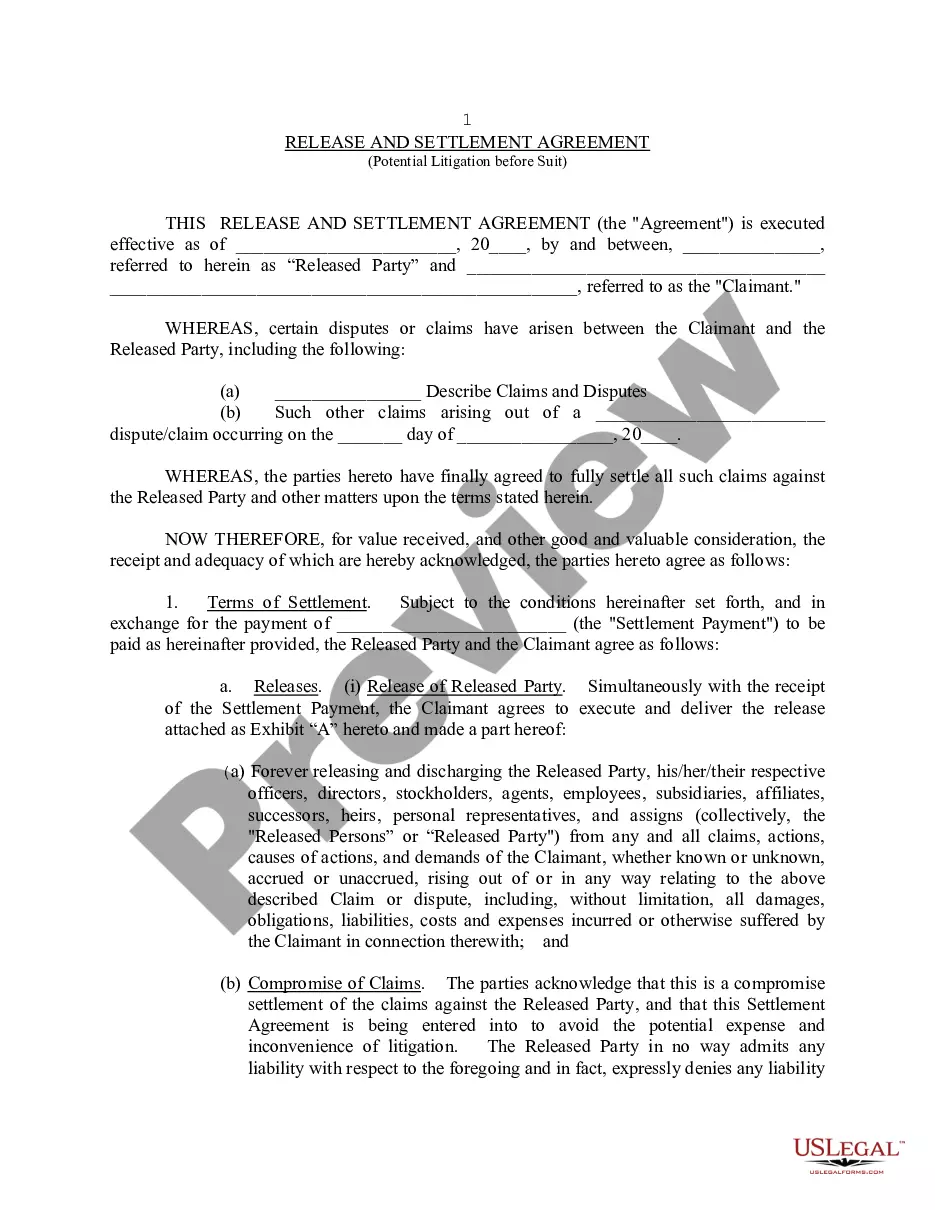

An escrow agreement normally includes information such as: The identity of the appointed escrow agent. Definitions for any expressions pertinent to the agreement. The escrow funds and detailed conditions for the release of these funds.

The Illinois Mortgage Escrow Act controls lenders' conduct with respect to escrow accounts and the information the lenders provide to their mortgage customers about such accounts. The Act requires that the lender inform the borrower of his rights under the Act in writing at the time of closing.

Another potential downside to escrow accounts lies in the risk of mishandling or mismanagement. In some cases, errors or discrepancies in managing escrow funds can lead to a shortage of funds when it's time to settle property taxes or insurance premiums.