Escrow Funds Agreement With Company In Bronx

Description

Form popularity

FAQ

Banks typically require the following to open an escrow account: Personal or business identification: Government-issued ID and EIN (if the deposit is held under an LLC) Property ownership documentation: Deed or property management agreement.

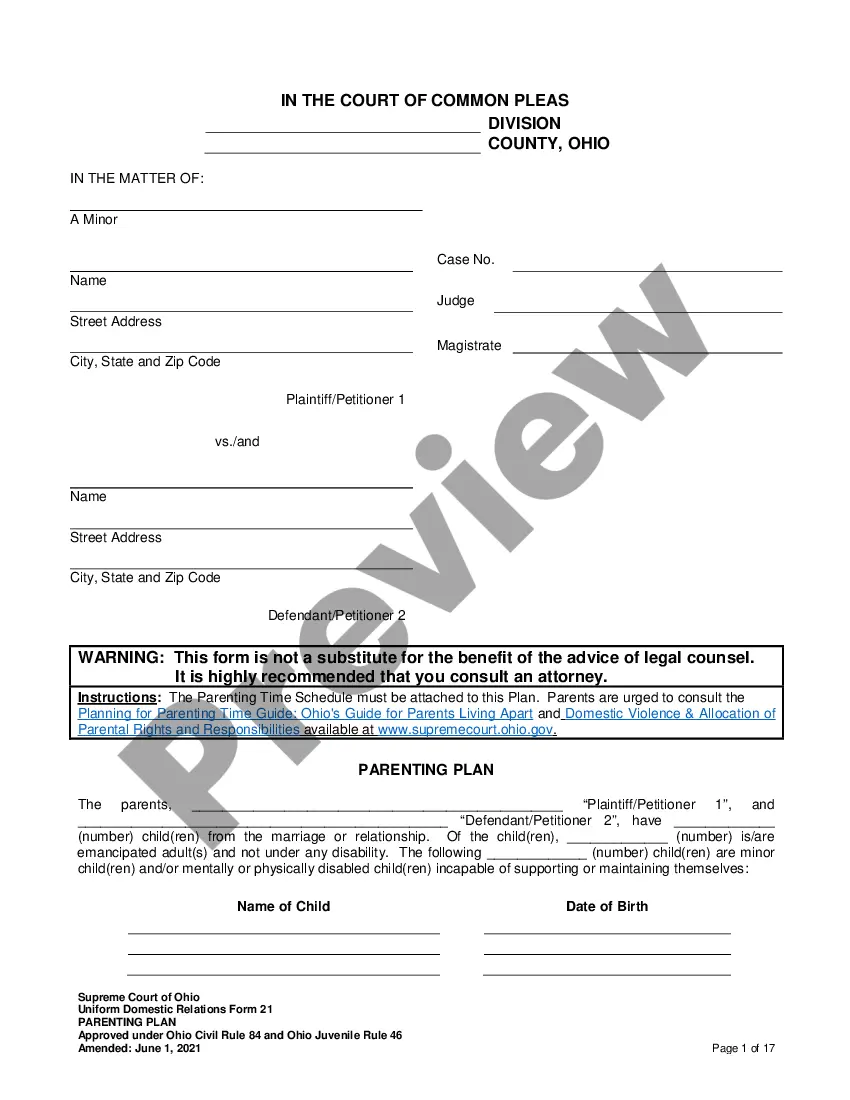

An escrow agreement is a contract that outlines the conditions and terms of a transaction for an asset that is held by a third party, the escrow agent, until all conditions have been met. Such conditions are established by the parties before an escrow agent is appointed.

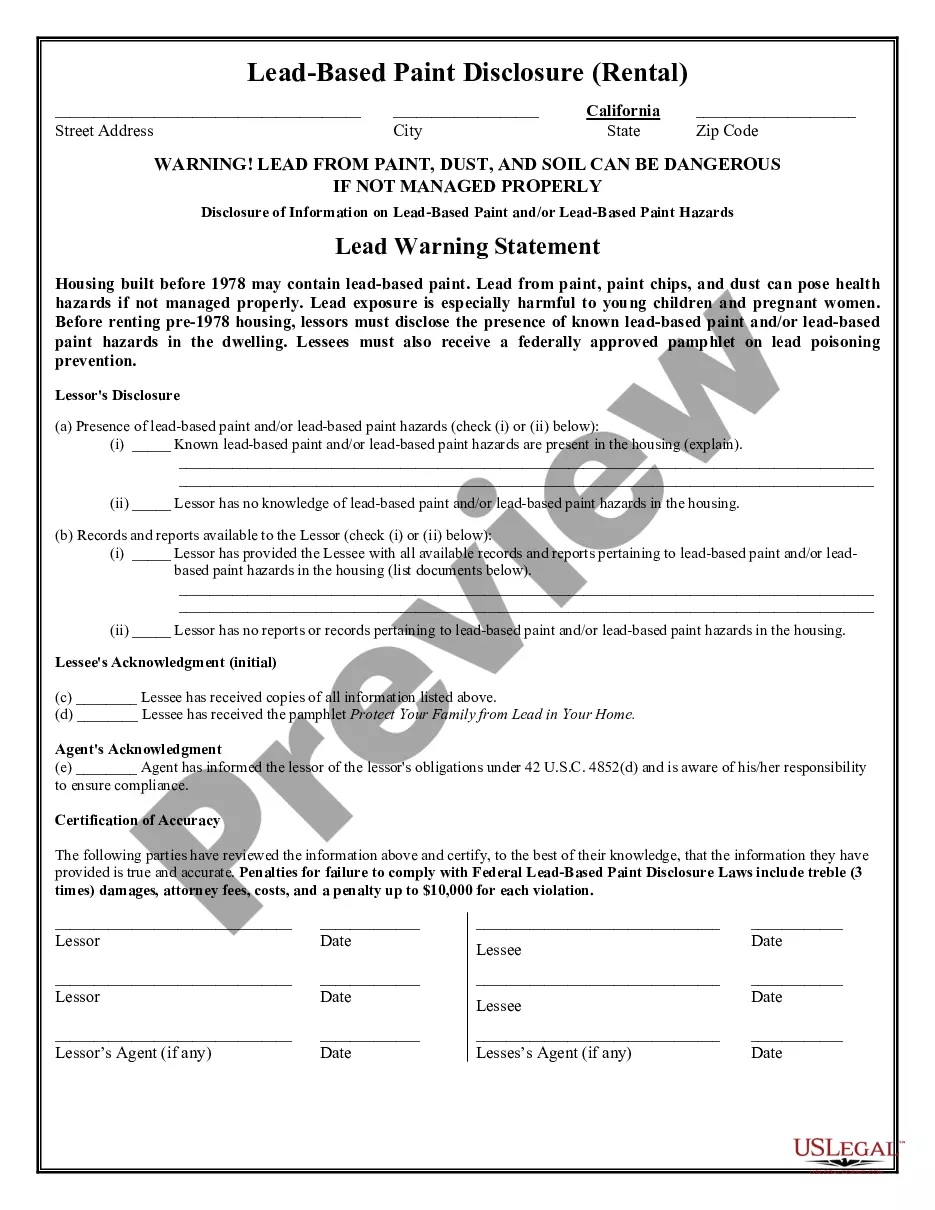

In California, the escrow agreement is usually handled by a licensed Escrow Officer or Escrow Agent.

An escrow agent is a third party charged with the responsibility of holding all monies and papers until all conditions of the escrow are observed. They are also sometimes called settlement agents, closing agents, and escrow officers. Escrow is often required if third-party (e.g., bank) financing is involved.

County Clerk: Know About the Commission Escrow Act This law enables real estate brokers with a Brokerage Agreement in place with a seller to have commission funds placed in an escrow account when there is a dispute.

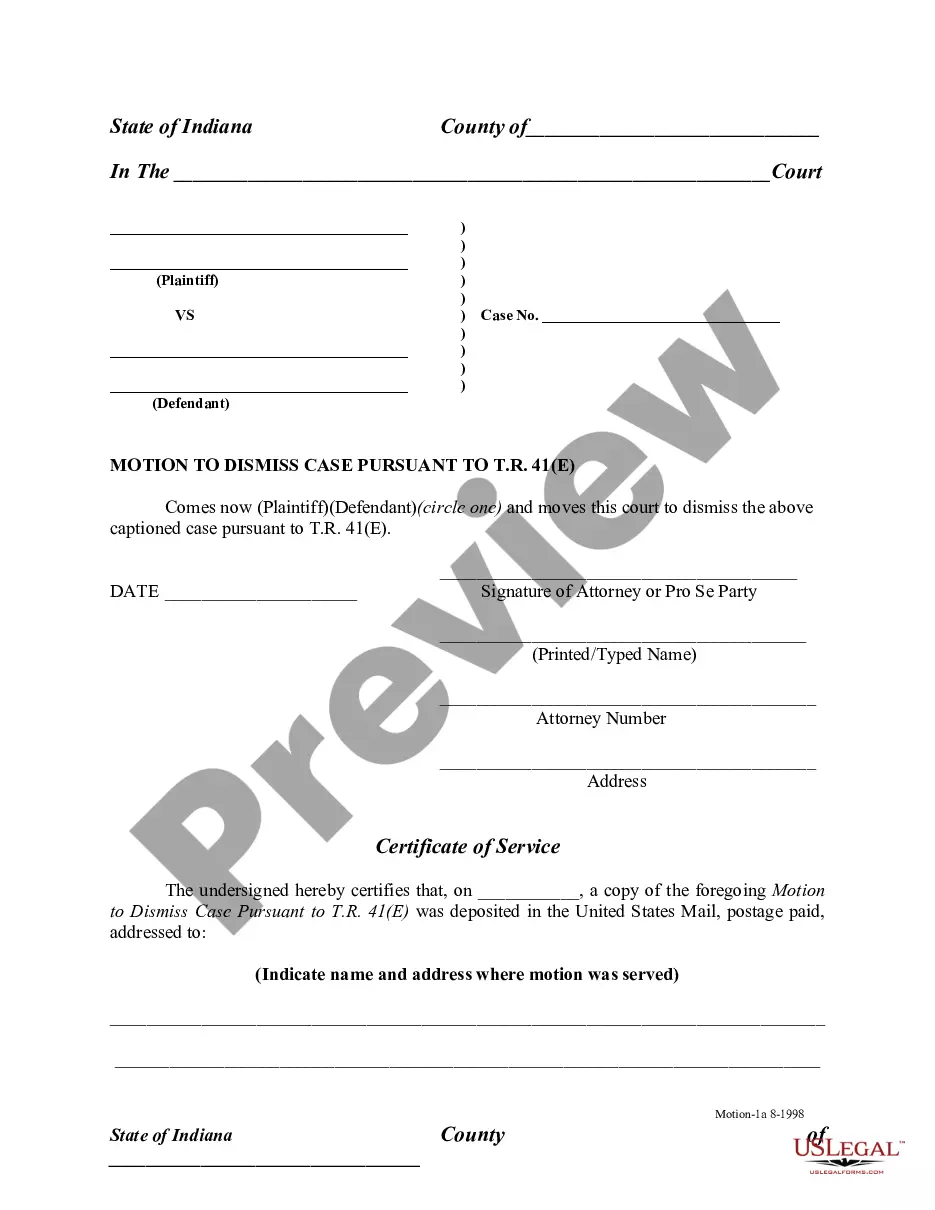

Escrow instructions are written directions to an escrow agent which state the duties of the parties and the escrow holder. Note that an existing agent or an attorney of grantor or grantee cannot act as an escrow agent due to the conflict of interest in the duties.

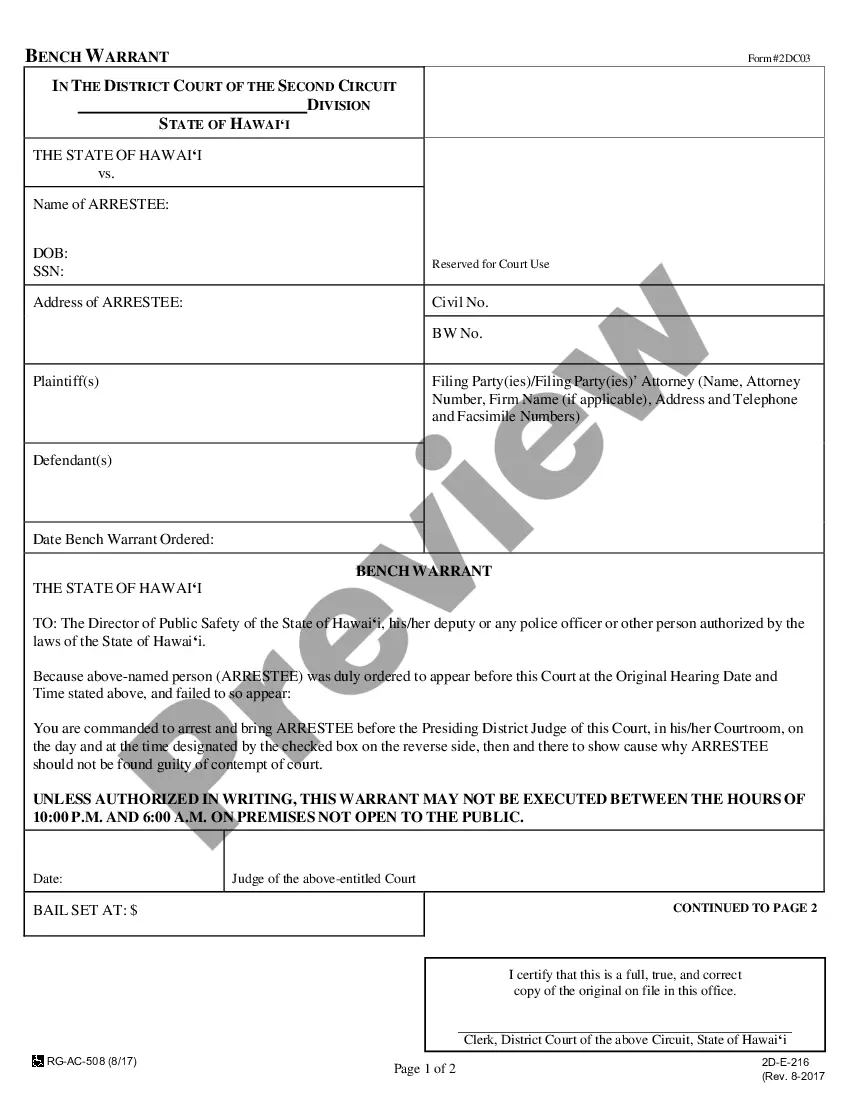

New York is an attorney state.

How to Set Up a Business Escrow Account Contact an escrow company. You'll want to work with a company that specializes in business escrow accounts and transactions. Provide relevant business documents. Determine account specifics. Fund the account. Complete the transaction. Disburse funds.

Because of these responsibilities, escrow agents in New York are often professionals like attorneys or title companies who understand the law and the real estate process.

Unlike traditional closings where parties meet face-to-face, New York's escrow-style closing involves a neutral third party who holds all necessary documents and funds until all conditions are met. This approach not only minimizes risks but also streamlines the entire process, making it a preferred choice for many.