This form is a simple Notice of Satisfaction of Escrow Agreement. To be tendered by Escrow Agent to the parties to a transaction upon satisfaction of escrow agreement. Modify to fit your specific circumstances.

Notice Of Satisfaction Companies House In Arizona

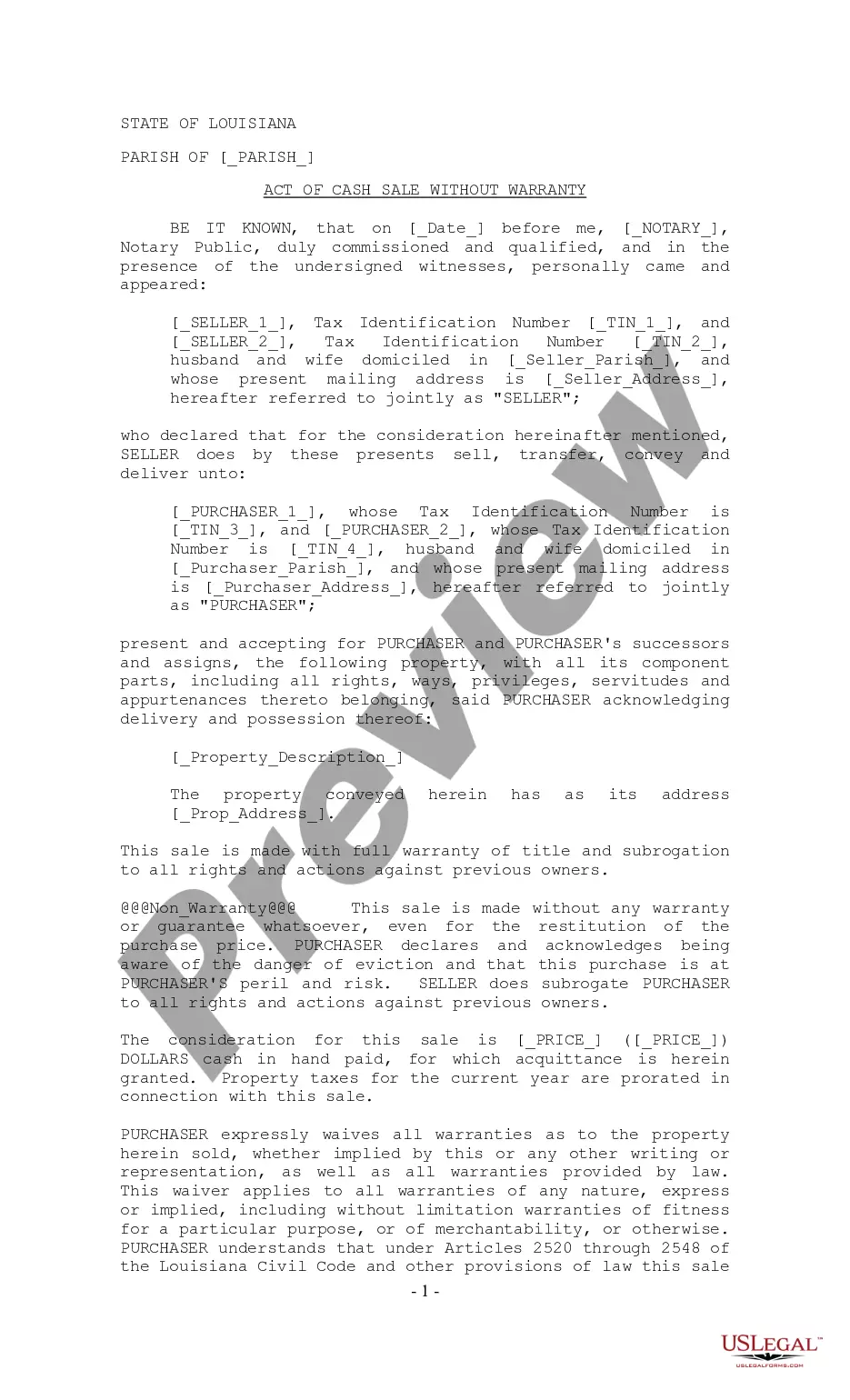

Description

Form popularity

FAQ

Once you've decided that you want to revoke a trust, you must take the following steps to dissolve it: Review the Trust Agreement. You will want to make sure that you are aware of any specific requirements contained in the trust. Consult an Estate Planning Attorney. Defund the Trust. Complete a Written Revocation.

You will usually be discharged after four years, but some trust deeds can last for longer. This information will be included in the terms of the trust deed. If the trust deed does not become protected, your discharge will only be binding on those creditors who agreed to the arrangement.

Once you have made all your payments and your arrangement has been completed, you will be discharged from the trust deed. At this stage, the debts included will be written off and the companies are no longer able to chase you for payments.

Requirements for Release of Deed of Trust Accurate Information: The release must include precise details of the original deed of trust, including recording information and property description. Authorized Signatures: The lender or an authorized representative must sign the release, and it often requires notarization.

Satisfied judgments make it easier to get loans. They still hurt your credit score under the FICO formulas used for home loans, car loans, and credit card applications.

A small claims lawsuit is a claim against another party for damages of an amount less than $3,500.00. These lawsuits are designed to resolve civil disputes in front of a small claims hearing officer or a Justice of the Peace.

You must file a Garnishee's Answer with the Court Clerk within 10 business days after you receive the Writ of Garnishment and Summons. Within 10 business days after you receive the paperwork listed above, fill out a Garnishee's Answer (Earnings)(FORM 6) and file it with the Court Clerk.

How does a creditor go about getting a judgment lien in Arizona? To attach the lien, the creditor files and records a judgment with the county recorder in any Arizona county where the debtor owns property now or where they may own property in the future.

The plaintiff files a document (complaint) with the clerk of the court stating the reasons why the plaintiff is suing the defendant, and what action the plaintiff wants the court to take. A copy of the complaint and a summons are delivered to (served on) the defendant.

How does a creditor go about getting a judgment lien in Arizona? To attach the lien, the creditor files and records a judgment with the county recorder in any Arizona county where the debtor owns property now or where they may own property in the future.