Form with which the Directors of a corporation waive the necessity of an annual meeting of directors.

Annual Meeting Do For Llc In Allegheny

Description

Form popularity

FAQ

The Basics of Maintaining Your LLC Decennial Report: Required filing in Pennsylvania to keep your LLC in good standing. Certificate of Organization: Updating of your LLC information in Pennsylvania. Operating Agreement: Legal document outlining the internal rules and procedures of a Limited Liability Company.

Owners may allow the LLC to expire through inaction rather than the legal dissolution and termination process1, but there are risks involved. Allowing the company to expire because of inaction may save members the costs associated with dissolution, but taxes, fees, and penalties will continue to accrue.

Yes. Starting in 2025, every Pennsylvania LLC (Limited Liability Company) must file an Annual Report every year. It is a state requirement in order to keep your LLC in good standing.

Pennsylvania used to require that LLCs file a report every 10 years (called a Decennial Report). However, starting in 2025, every Pennsylvania LLC will be required to file a report every year (called an Annual Report).

Starting 2025, all Pennsylvania corporations, nonprofits, non-professional LLCs, and LPs will need to file an Annual Report with the Pennsylvania Department of State, Bureau of Corporations and Charitable Organizations. It costs $7 for for-profit companies, $0 for nonprofits.

Yes. Starting in 2025, every Pennsylvania LLC (Limited Liability Company) must file an Annual Report every year. It is a state requirement in order to keep your LLC in good standing.

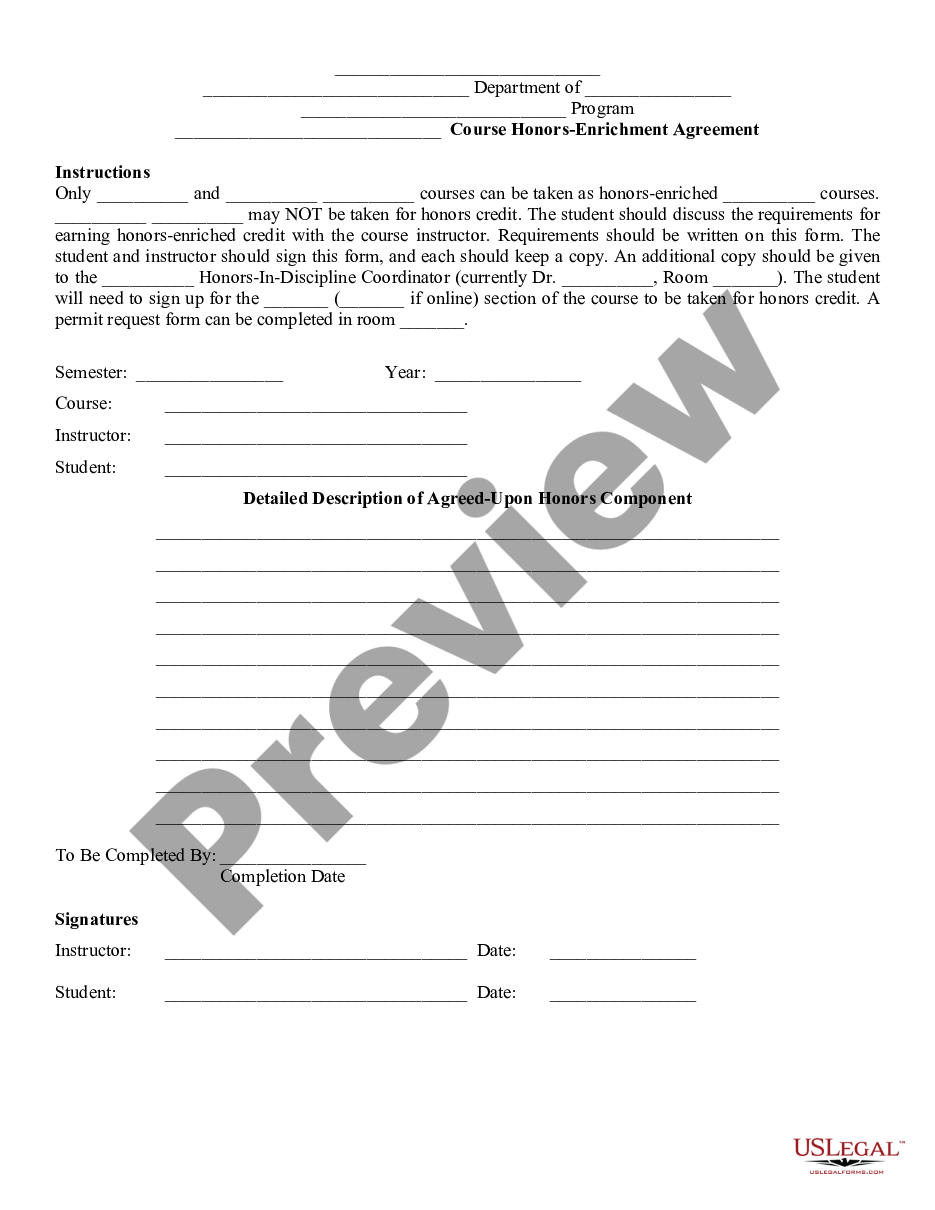

Other Items of Business: The template includes space to record any additional items of business conducted at the meeting. Signatures: Members sign the meeting minutes. The secretary who recorded the minutes also provides a final signature.

The following types of domestic and foreign businesses must now file annual reports with the Pennsylvania Department of State: Business corporations. Nonprofit corporations. Limited liability companies.

They provide a legal record of the meeting members' actions and decisions, and taking corporate minutes is also a legal and regulatory requirement. There are various laws regarding which types of meetings require minute-taking.

Information captured in an LLC's annual meeting minutes usually includes: The meeting's date, time, and location. Who wrote the minutes. The names of the members in attendance. Brief description of the meeting agenda. Details about what the members discussed. Decisions made or voting actions taken.