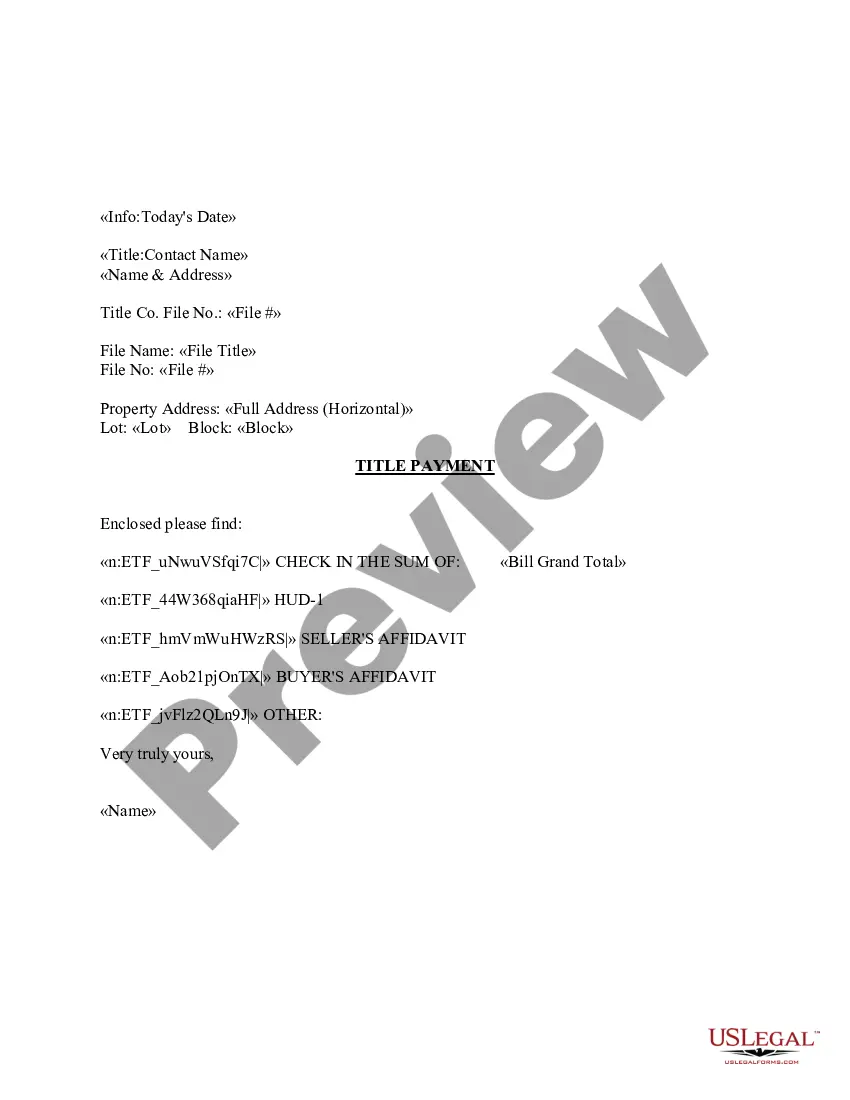

This form is a sample letter in Word format covering the subject matter of the title of the form.

Letter Donation Form With Tax Id In Massachusetts

Description

Form popularity

FAQ

Yes, you can receive a donation without be a nonprofit. In the United States and many other nations, there are tax benefits to the donor when donating toward a certified nonprofit. Regardless of your nonprofit status, someone can give you a donati...

All businesses are required to have an Employer Identification Number (EIN) or Federal Employer Identification Number (FEIN). Even though nonprofit organizations don't conduct business in the traditional sense, they do employee staff. Therefore, the IRS considers them a business entity and requires them to get an EIN.

Schedule A (Form 1040) required. Generally, to deduct a charitable contribution, you must itemize deductions on Schedule A (Form 1040). The amount of your deduction may be limited if certain rules and limits explained in this publication apply to you.

When to use Form 8283. Federal tax law allows you to claim a deduction for the value of all property you donate to a qualified charity during the year provided you itemize your deductions.

Who must file a form PC? Every public charity organized or operating in Massachusetts or soliciting funds in Massachusetts must file a Form PC, except organizations which hold property for religious purposes or certain federally chartered organizations.

A federal tax ID number is not required if you are self-employed, operate a sole proprietorship, or own a limited liability company (LLC) with no employees. In those situations, you would simply use your own Social Security number (SSN) as a tax ID.

What do you need to include in your donation acknowledgment letter? The donor's name. The full legal name of your organization. A declaration of your organization's tax-exempt status. Your organization's employer identification number. The date the gift was received. A description of the gift and the amount received.

At least 51% of the organization's Board of Directors and Voting Membership must be either women, veterans, and/or members of one of our statutorily defined minority groups. The same Board of Directors and Voting Membership must control the NPO's daily and long-term operations.

Massachusetts Exempts the Following from Charitable Solicitation Registration: Less than $5,000 nationwide contributions per year. Less than 10 contributors. Religious organizations.

501(c)(3) nonprofits apply using Form 1023 or Form 1023-EZ. Review the criteria for each application and make sure you meet the eligibility requirements set out by the IRS. Other types of nonprofits, including 501(c)(4)s and 501(c)(6)s, apply using Form 1024.