Change Deed Trust With Debt In Wayne

Description

Form popularity

FAQ

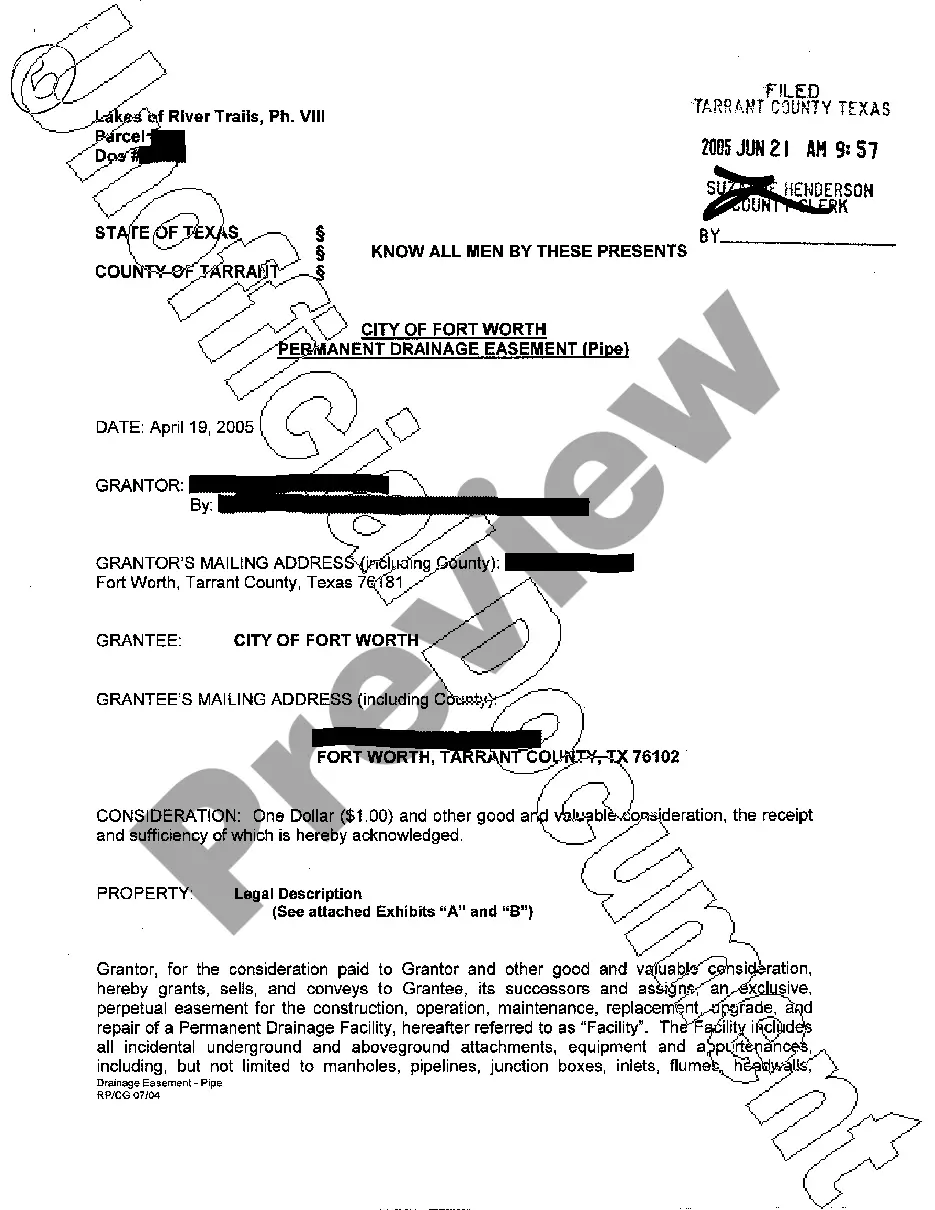

A trust deed gives the third-party “trustee” (usually a title company or real estate broker) legal ownership of the property.

The evidence of a debt that is recorded after a first trust deed is a(n): promissory note.

The Promissory Note is evidence of a promise by the borrower/debtor to repay the mortgagee/chargee/lender at some future time on certain terms.

In real estate law, "assignment" is simply the transfer of a deed of trust from one party to another.

You can cancel your deed of trust by getting a deed of surrender in place. This is a legal document which can be used to waive a previous deed or contract between multiple parties. You can't cancel a deed of trust without the consent of all parties named within the deed.

Disadvantages of a Trust Deed For borrowers, if financial circumstances change, default on repayment can result in property foreclosure.