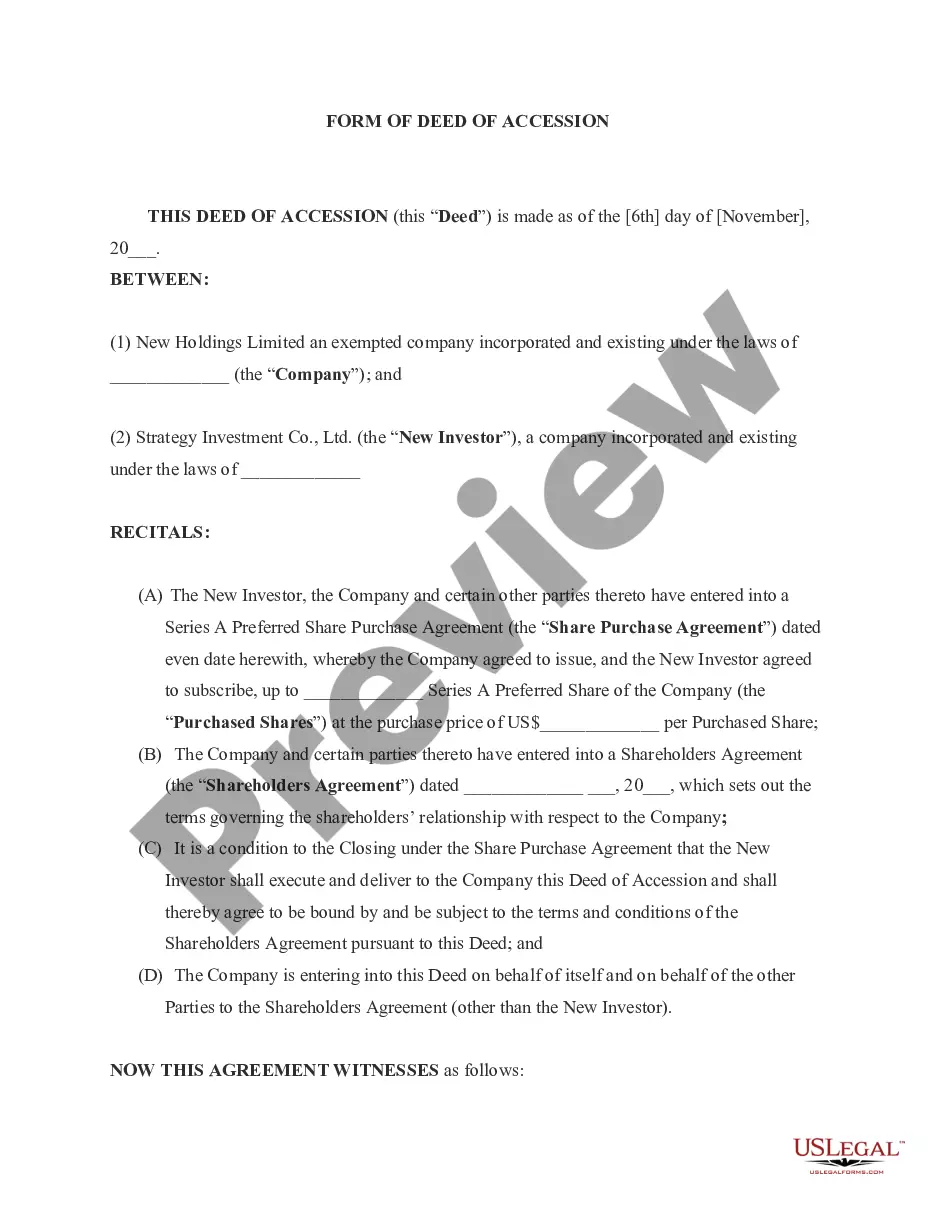

This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Trust Of Deeds For Property In Wake

Description

Form popularity

FAQ

Disadvantages of a Trust Deed For borrowers, if financial circumstances change, default on repayment can result in property foreclosure.

Recording and Document Fees Document TypeFee Details Deeds of Trust and Mortgages $64 first 35 pages $4 each additional page Amendment to Deed of Trust $26 first 15 pages $4 each additional page All other Documents / Instruments / Assumed Name (DBA) $26 first 15 pages $4 each additional page3 more rows

How do I add or remove names from a deed? Deed name changes require the submittal of a new deed to the Register of Deeds office. We suggest that you consult an attorney unless you are familiar with creating legal documents. Click to look up recording fees.

Actual physical document versus concept In short, a deed is something you can hold in your hand, whereas a title is just the term for the person or persons who own the property. The way I like to remember the difference between the two is based off of their first letters.

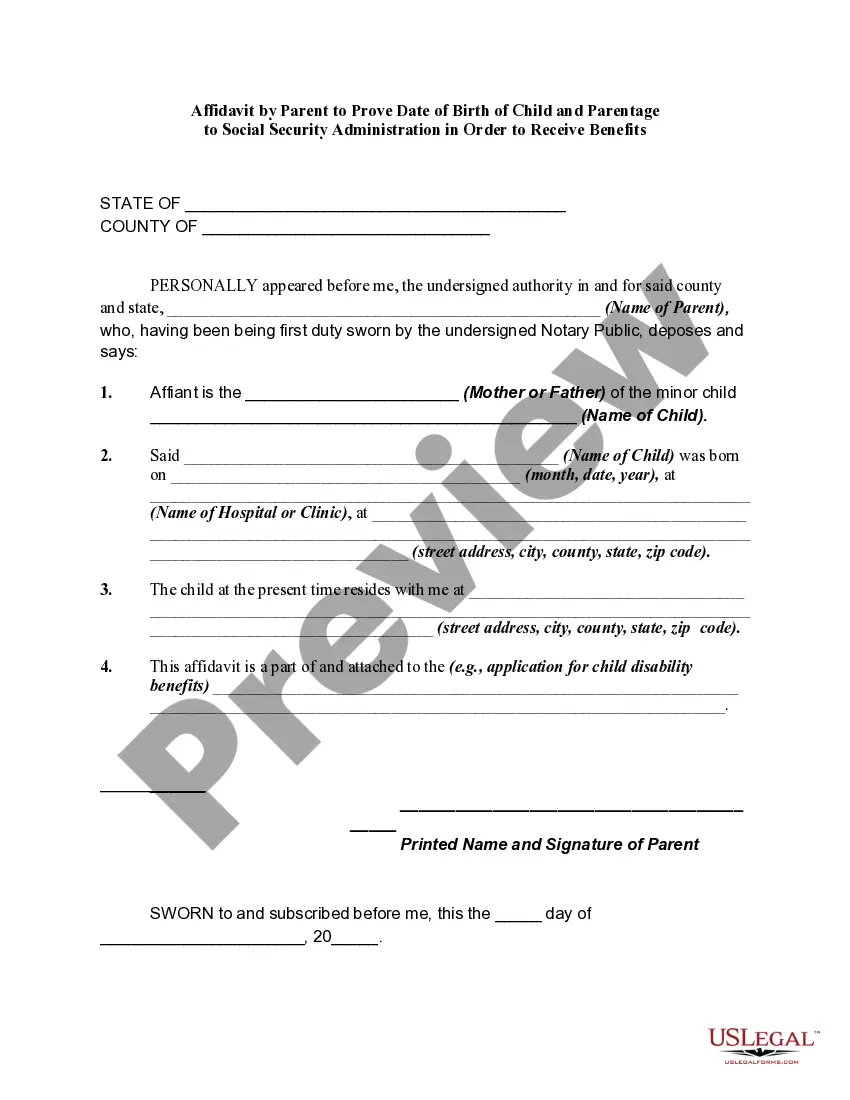

In North Carolina, a deed of trust or mortgage acts as a conveyance of the real estate. Upon repayment of the debt or performance of the obligation, the conveyance becomes void.

A deed of trust will include the same type of information stated in a mortgage document, such as: The identities of the borrower, lender, and trustee. A full description of the property to be placed in trust. Any restrictions or requirements on the use of the property while it is in trust.

A trust deed gives the third-party “trustee” (usually a title company or real estate broker) legal ownership of the property.

The deed of trust must then be recorded with the county where the property is located, and each of the parties (the trustor, trustee, and lender) should keep a copy of the recorded document.