Deed Of Trust Records With Alcohol In Suffolk

Description

Form popularity

FAQ

Office this office keeps public records of real estate transactions. You can visit the countyMoreOffice this office keeps public records of real estate transactions. You can visit the county recorder's office in person provide the property address and the owner's name to request the document.

Yes, you can sell a home with a Deed of Trust. However, just like a mortgage, if you're selling the home for less than you owe on it, you'll need approval from the lender.

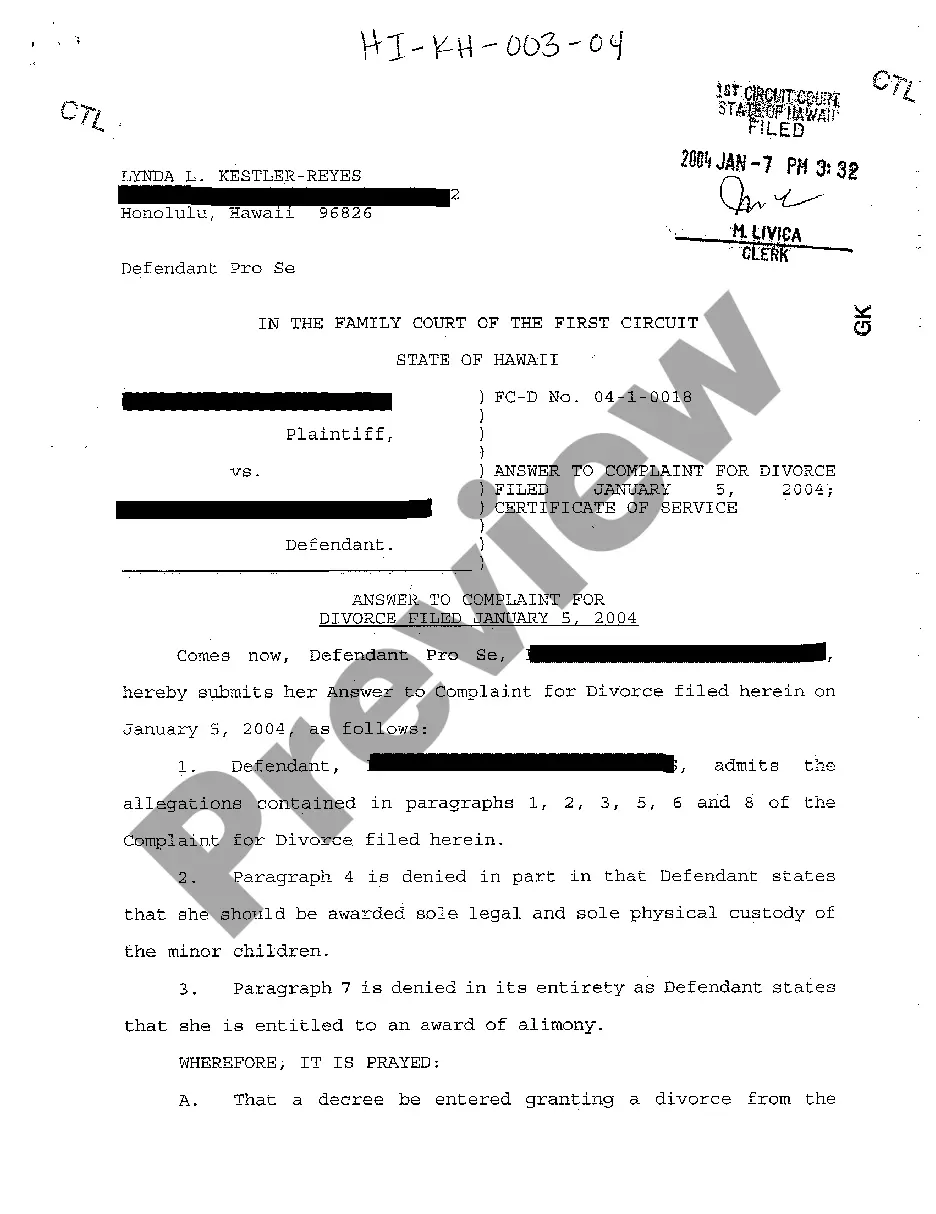

How do I obtain a copy of my property deed? Property deeds are recorded in the Suffolk County Clerk's Office in Riverhead, NY. The direct phone number is (631) 852-2000.

Individuals and organizations seeking public records may submit a request using the Public Records Request Form available here. Requests may be directed to the DA's Records Access Officer (RAO) at SCDAOPRR@state.ma. The RAO can be reached by phone at 617-619-4176 or 617-619-4192.

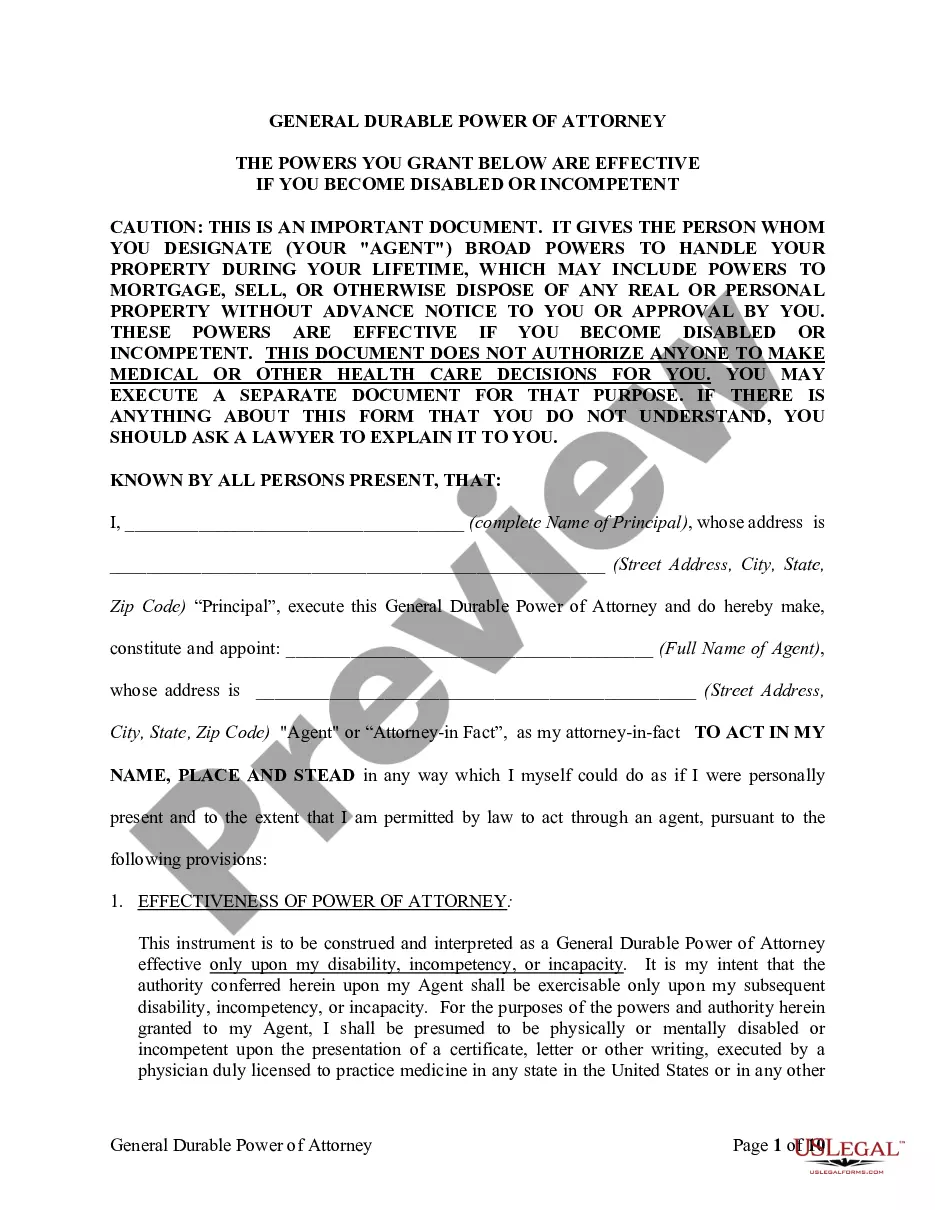

The grantor must sign the deed form and that signature must be properly acknowledged by a notary public. All signatures must be original; we cannot accept photocopies. A complete description of the property including the village, town, county and state where the property is located must also be included on the form.

How do I obtain a copy of my property deed? Property deeds are recorded in the Suffolk County Clerk's Office in Riverhead, NY. The direct phone number is (631) 852-2000.

The County Clerk as Recorder of Deeds/Official Public Records: Texas Government Code, Local Government Code, Property Code, Uniform Commercial Code, Civil Practice and Remedies Code, Business and Commercial Code.

The answer is the buyer. Who typically pays for recording fees to record the deed and deed of trust? The answer is the buyer.