Deed In Trust Vs Deed Of Trust In San Jose

Description

Form popularity

FAQ

The short answer is that a living trust is a private document and does not need to be recorded in California. The only time a trust is in a public record is when it contains real estate.

In California, a deed of trust must come with security, typically a promissory note. To be valid, a deed of trust must be (1) in writing, (2) with a description of the property, and (3) signed by the trustor of the deed of trust.

Yes, you can sell a home with a Deed of Trust. However, just like a mortgage, if you're selling the home for less than you owe on it, you'll need approval from the lender.

If the deceased had a trust agreement that says you (or others along with you) get the house upon their death, it passes directly to you (and any other potential co-owners). If, however, the deceased leaves behind a spouse or minor children, you have to go through the probate process to move the title to your name.

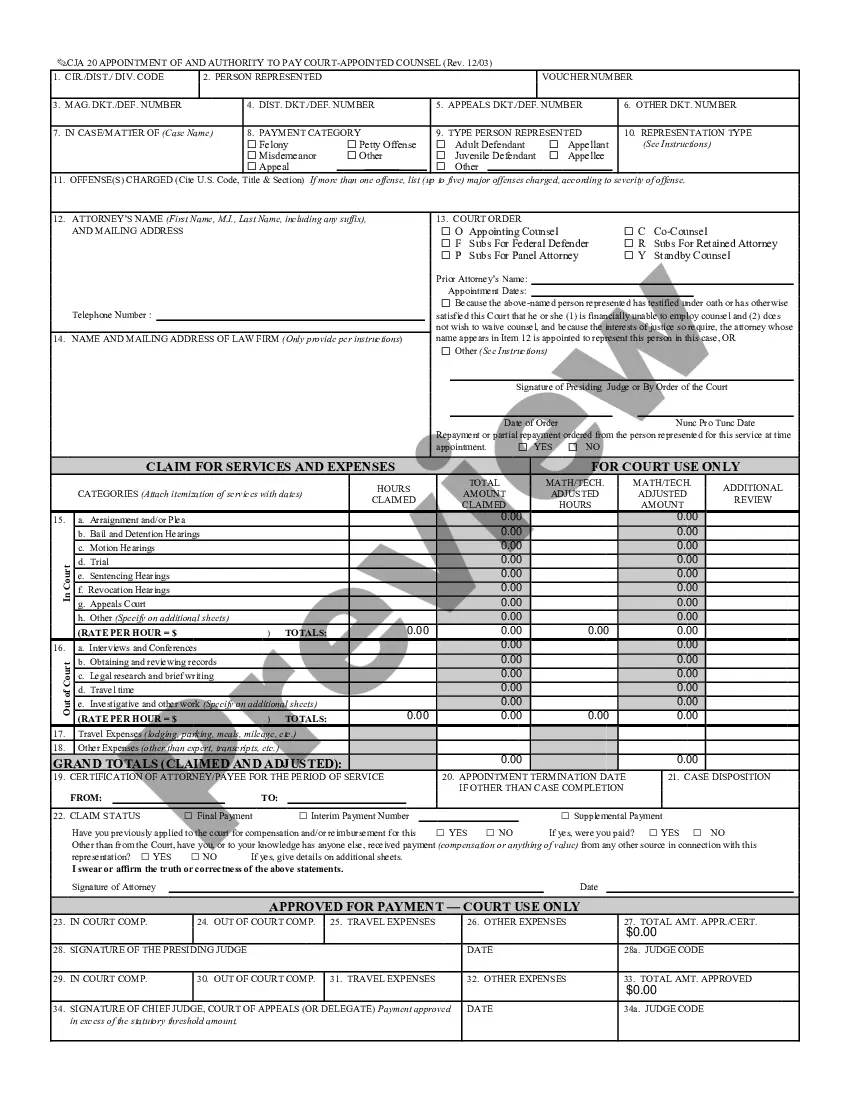

A deed of trust will include the same type of information stated in a mortgage document, such as: The identities of the borrower, lender, and trustee. A full description of the property to be placed in trust. Any restrictions or requirements on the use of the property while it is in trust.

Here is the rough outline: Select the trust that is best suited to your needs, such as a revocable living trust. Draft a trust deed and have it notarized so that it is legally binding. Record the deed at the county recorder's office. Notify the relevant parties, such as your mortgage lender and insurance provider.

Where to Get a Deed of Trust? To get a Deed of Trust, you must file the proper paperwork with the proper court as generally outlined above. These documents must be filed with the county clerk or recorder, and the lender typically sends them to the recording office after the property closing.

Example Scenario Obtain the Current Deed: Get a copy of your existing deed from the county recorder's office. Prepare a New Deed: Draft a grant deed transferring the property to “John Doe, as Trustee of The John Doe Living Trust, dated January 1, 2024.” Notarize the Deed: Sign the new deed before a notary public.

One disadvantage of placing your house in a trust is the loss of direct ownership. Transferring your property to a revocable living trust makes the trust the legal owner. While you retain control as the trustee, this change in ownership may affect your ability to mortgage or refinance the property.

Transferring a property into a living trust does not typically affect its assessed value. In fact, California law explicitly states that property taxes will not be reassessed if a house is transferred into a revocable trust 3.