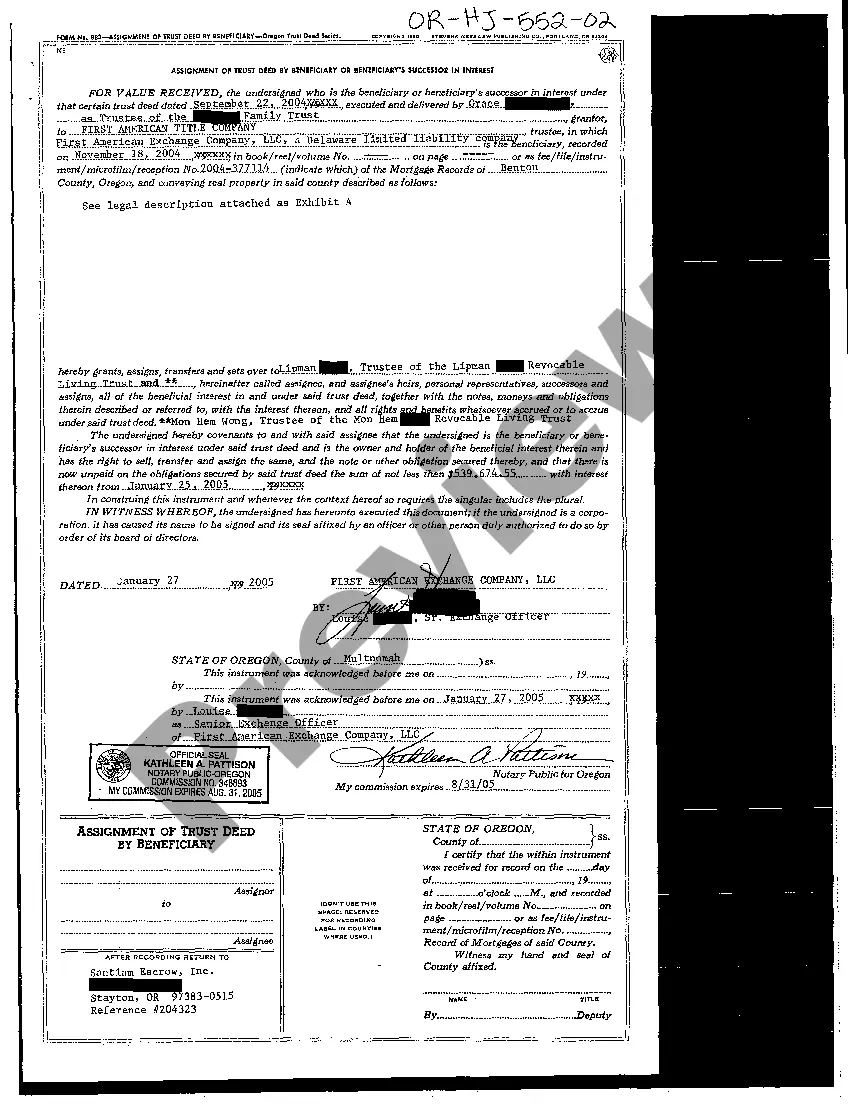

This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Trust Of Deeds For Property In Salt Lake

Description

Form popularity

FAQ

(1) A trust may be created by: (a) transfer of property to another person as trustee during the settlor's lifetime or by will or other disposition taking effect upon the settlor's death; (b) declaration by the owner of property that the owner holds identifiable property as trustee; or (c) exercise of a power of ...

You transfer your home to the trust by signing a deed that names the trust as the new owner of the property. The deed then needs to be recorded with the local county recorder's office. Once recorded, the trust is now "on title" as the legal owner of the property.

"Trust deed" means a deed executed in conformity with Sections 57-1-20 through 57-1-36 and conveying real property to a trustee in trust to secure the performance of an obligation of the trustor or other person named in the deed to a beneficiary.

Disadvantages of a Trust Deed For borrowers, if financial circumstances change, default on repayment can result in property foreclosure.

Where to Get a Deed of Trust? To get a Deed of Trust, you must file the proper paperwork with the proper court as generally outlined above. These documents must be filed with the county clerk or recorder, and the lender typically sends them to the recording office after the property closing.