Deed In Trust Vs Deed Of Trust In Queens

Description

Form popularity

FAQ

Where to Get a Deed of Trust? To get a Deed of Trust, you must file the proper paperwork with the proper court as generally outlined above. These documents must be filed with the county clerk or recorder, and the lender typically sends them to the recording office after the property closing.

General warranty deeds give the grantee the most legal protection, while special warranty deeds give the grantee more limited protection. A quitclaim deed gives the grantee the least protection under the law.

Visit the City Register Office in the borough where the property is located. Visit the Queens City Register Office to view Brooklyn property record books. If you have the Liber/Reel and page, date recorded, type of document, and number of pages, you should visit the Brooklyn City Register Office for microfilm records.

Is New York a Mortgage State or a Deed of Trust State? New York is a Mortgage state.

A deed used to convey New York real property to a revocable trust. This Standard Document contains integrated notes and drafting tips.

The biggest difference between a deed and a title is physical: a deed is an official written document declaring a person's legal ownership of a property, while a title refers to the intangible concept of ownership rights.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

Disadvantages of a Trust Deed For borrowers, if financial circumstances change, default on repayment can result in property foreclosure.

A deed of trust, also called a trust deed, is the functional equivalent of a mortgage. It does not transfer the ownership of real property, as the typical deed does.

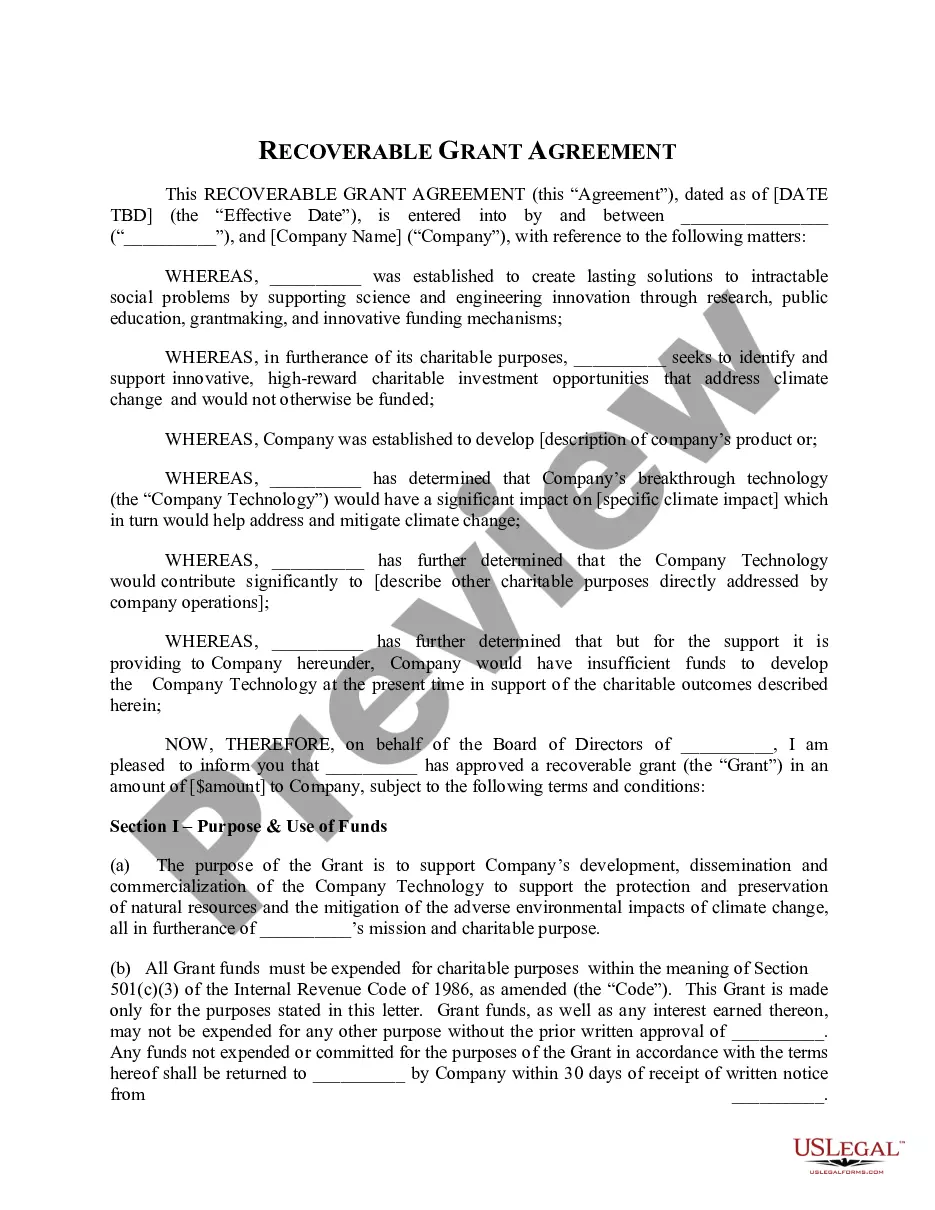

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...