Deed Of Trust Modification With No Maturity Date In Oakland

Description

Form popularity

FAQ

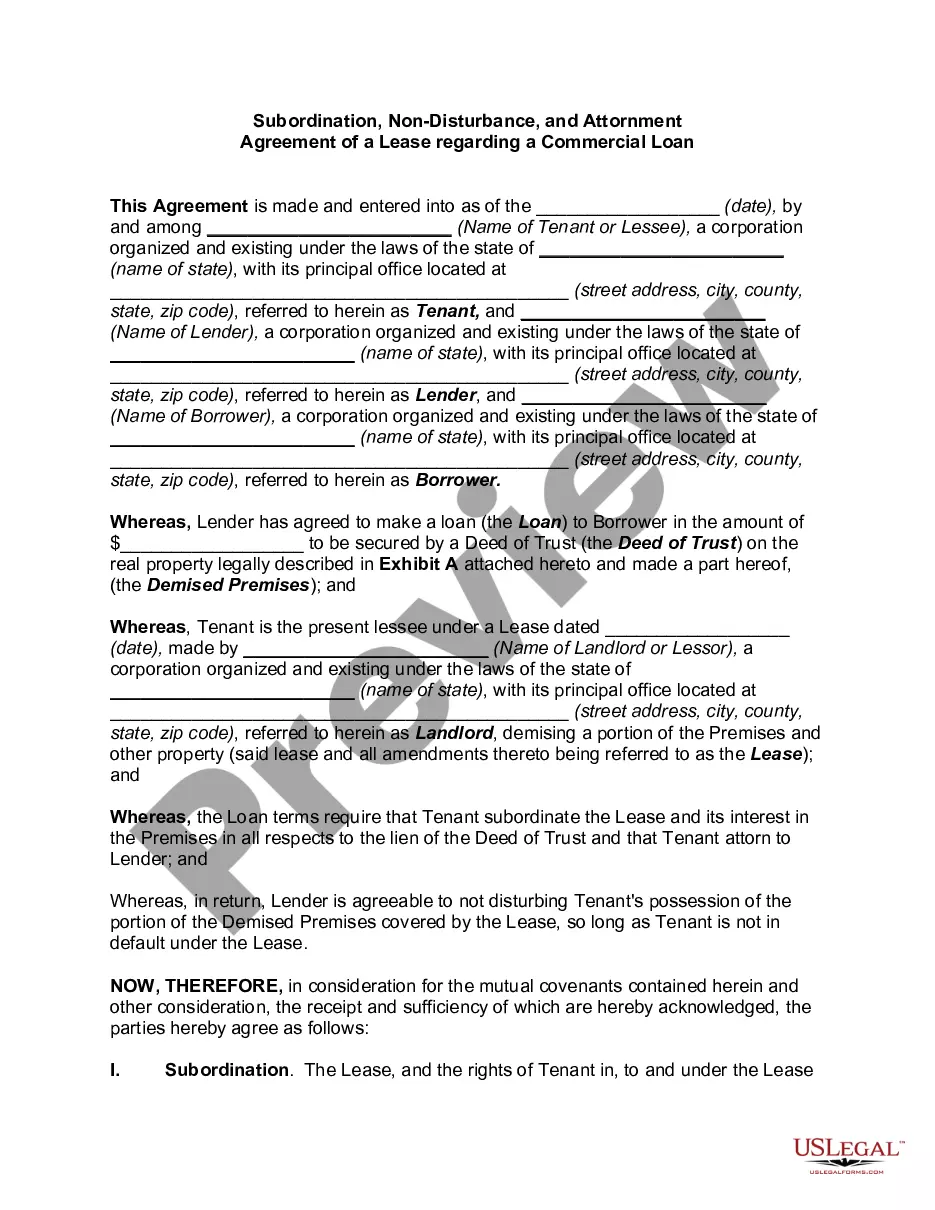

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

If a deed of trust recorded in California does not contain a maturity date, then the lender has up to 60, and possibly even 64 years to foreclose non-judicially, but the longer the lender waits, the more likely it is that a borrower could successfully raise a defense of equitable estoppel or laches.

This document may also be known as a trust revocation declaration. The idea here is that you present a formal document that irrevocably states your wish to dissolve the trust. From there, you should have the document signed by the grantor, notarized, and potentially filed in court.

Disadvantages of a Trust Deed For borrowers, if financial circumstances change, default on repayment can result in property foreclosure.

The terms of a trust can only be validly amended when the amendment complies with the existing trust deed and rules. We assist by reviewing the existing trust rules and providing amendment documentation that ensure that the variation of trust terms remain compliant and effective. What's included: letter of advice.

The general answer is yes—but you need the person's permission. However, there are certain situations where you can remove someone from a deed without their authorization. Whether you have the person's consent or not, you should consult with a lawyer who can help you with the process.

There are two main reasons a deed of trust may be considered invalid: (1) lack of required formalities in executing the deed of trust, or (2) there is some fact outside execution that makes the deed of trust invalid.

A trust deed expires and is extinguished from the record: 10 years after the entire debt becomes due; or. 60 years after the trust deed is recorded if the due date cannot be ascertained by records of the transaction.