Deed Of Trust Records Format In New York

Description

Form popularity

FAQ

What is an example of deed? A warranty deed is the most common example of a deed. A warranty deed is a deed that indicates that the property has been fully researched, and the grantor guarantees (warrants) that the grantor has full legal rights to sell the property with no liens or other encumbrances.

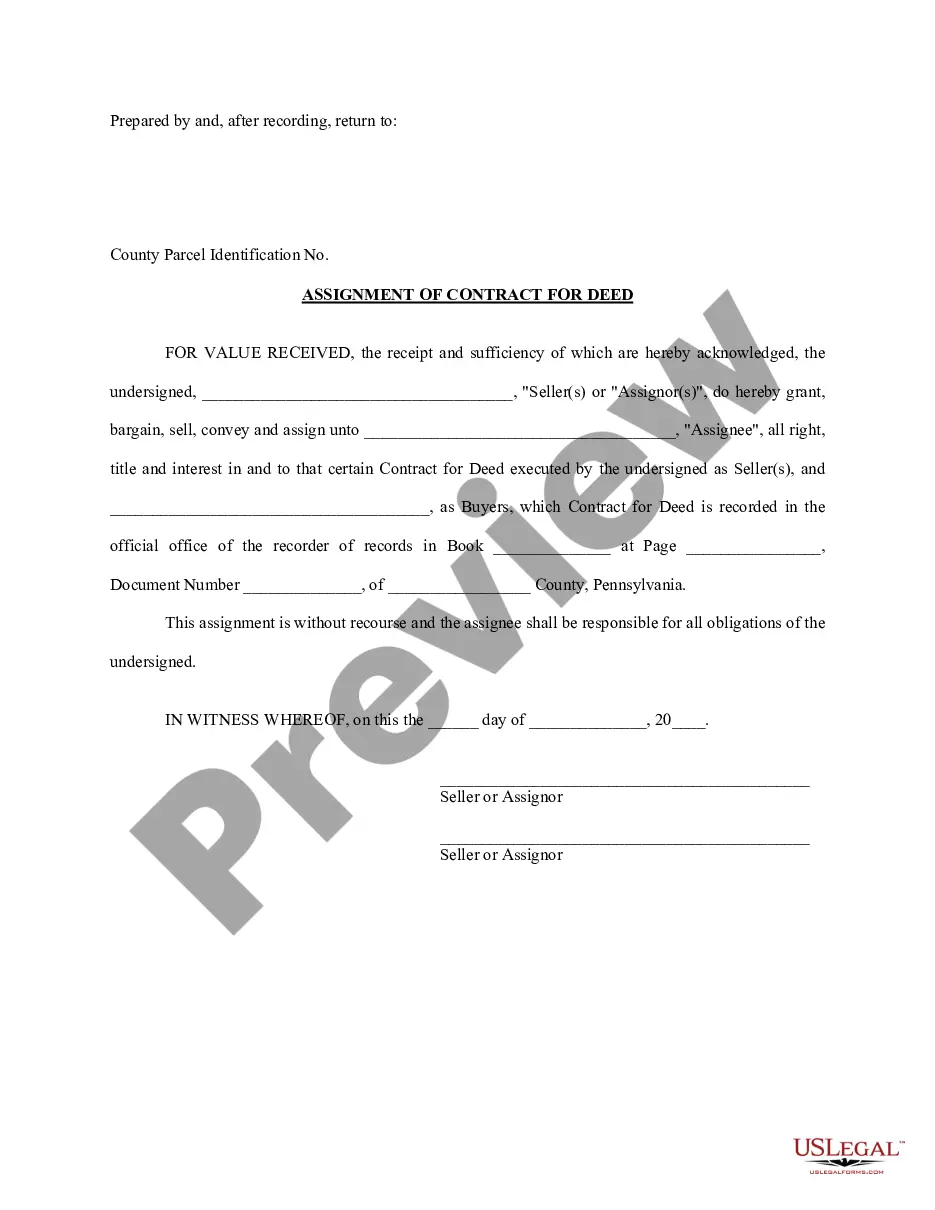

For a deed to be legal, it must state the name of the buyer and the seller, describe the property being transferred, and include the signature of the party transferring the property. In addition to being either official or private, deeds are classified as general warranty, special warranty, or quitclaim.

You may not need to involve an attorney to create a particular deed if you already have all the information. This is especially true if you are transferring property between family members or into or out of a trust. We provide several real estate forms that can help you transfer property validly in your state.

For a deed to be legal, it must state the name of the buyer and the seller, describe the property being transferred, and include the signature of the party transferring the property. In addition to being either official or private, deeds are classified as general warranty, special warranty, or quitclaim.

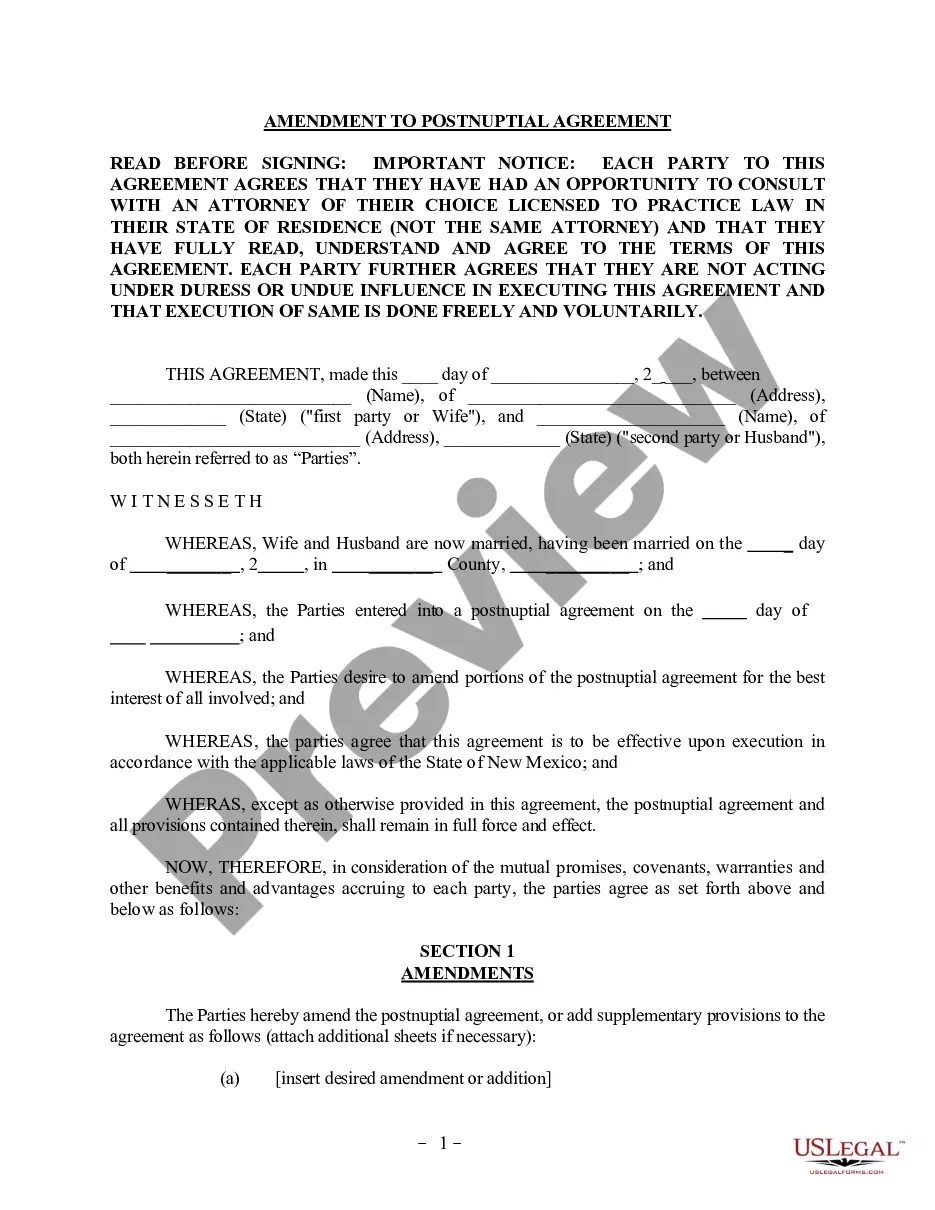

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

The grantor must sign the deed form and that signature must be properly acknowledged by a notary public. All signatures must be original; we cannot accept photocopies. A complete description of the property including the village, town, county and state where the property is located must also be included on the form.

A New York deed must be filed with a Real Property Transfer Report (Form RP-5217). Form RP-5217 documents the details of the real estate transfer. The current owner and new owner must both sign the completed form.

Is New York a Mortgage State or a Deed of Trust State? New York is a Mortgage state.

You can search for property records and property ownership information online, in person, or over the phone with a 311 representative. Property owners of all boroughs except Staten Island can visit ACRIS. To search documents for Staten Island property, visit the Richmond County Clerk's website.

A deed used to convey New York real property to a revocable trust. This Standard Document contains integrated notes and drafting tips.