Modification Deed Trust Form With Trust In Nevada

Description

Form popularity

FAQ

To make a living trust in Nevada, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries—that is, who will get the trust property. Create the trust document.

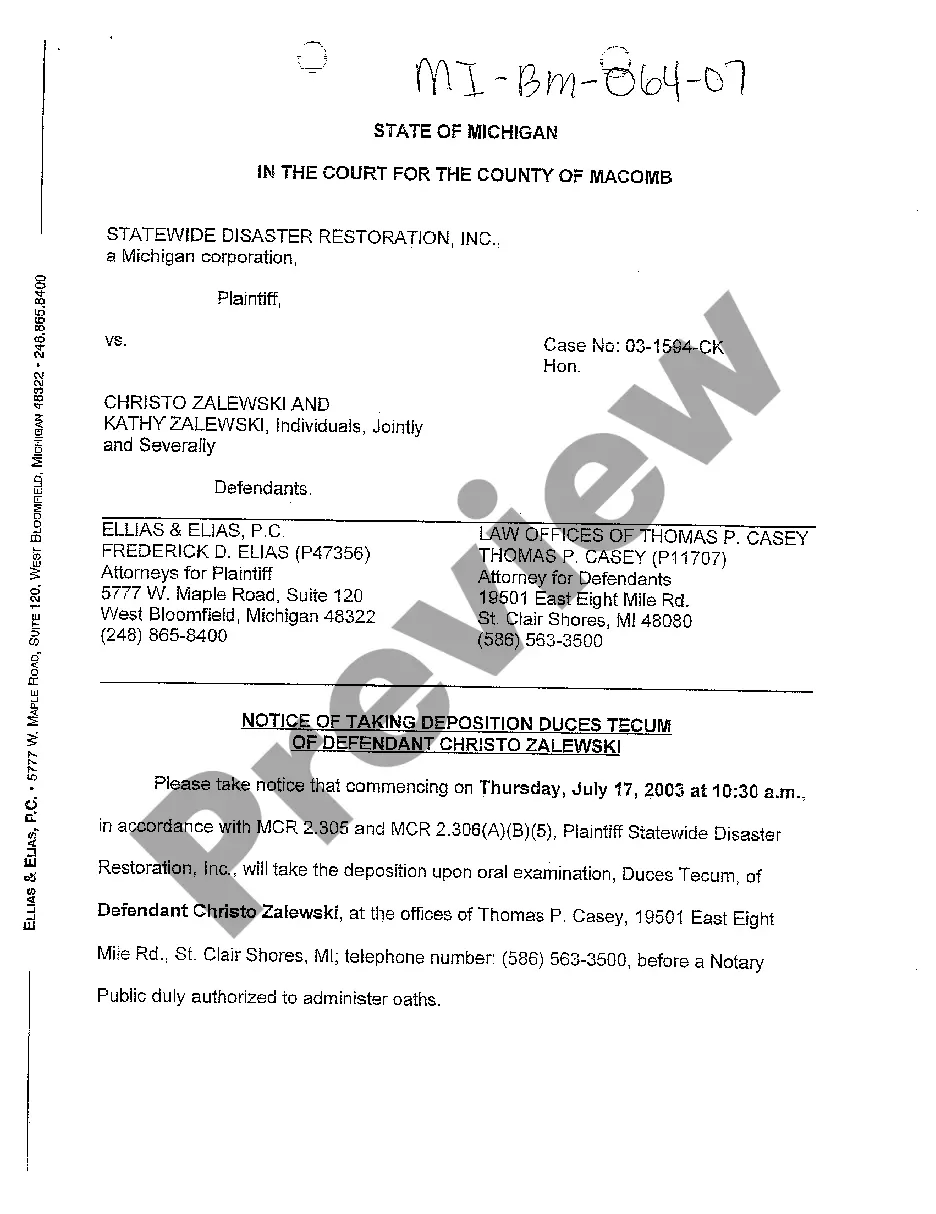

Also, to create a valid Trust, the Grantor (or creator) of the Trust should have his or her signature witnessed by a Notary. However, Nevada law now allows a Will and Trust to be signed, witnessed, and notarized electronically, or virtually, and still be legally valid.

Unlike many other states, Nevada allows trustees and beneficiaries to modify irrevocable trusts. With some limits under the law, as long as the trustor, trustee, and beneficiaries agree to the modifications, the process can be relatively straightforward.

In Nevada, lenders like a deed of trust (or “trust deed”) to give them security in case the borrower defaults. Some states use a mortgage for security, which is a two-party transaction involving both the lender and the borrower. A mortgage usually needs a lawsuit for oversight of the sale.

The terms of a trust can only be validly amended when the amendment complies with the existing trust deed and rules. We assist by reviewing the existing trust rules and providing amendment documentation that ensure that the variation of trust terms remain compliant and effective. What's included: letter of advice.

However, modifications of such trusts are possible under Nevada law through certain legal mechanisms, including: Seeking Court Approval: Irrevocable trusts can be amended with court approval. However, the party seeking the amendment must be able to establish why the amendment is necessary.

Notarize and Record the Deed After completing the deed, sign and date it in front of a notary public for the state where the real estate is located. All current owners transferring their interest in the real estate to the trustee must also sign the deed.

In the trust deed where there is no mention about amendment, the amendment has to be done with the permission of a civil court. Even the Civil Courts do not have unlimited powers of amendment. The Civil Courts permit amendment under the doctrine of Cy pres, which means the original intent of the settlor should prevail.