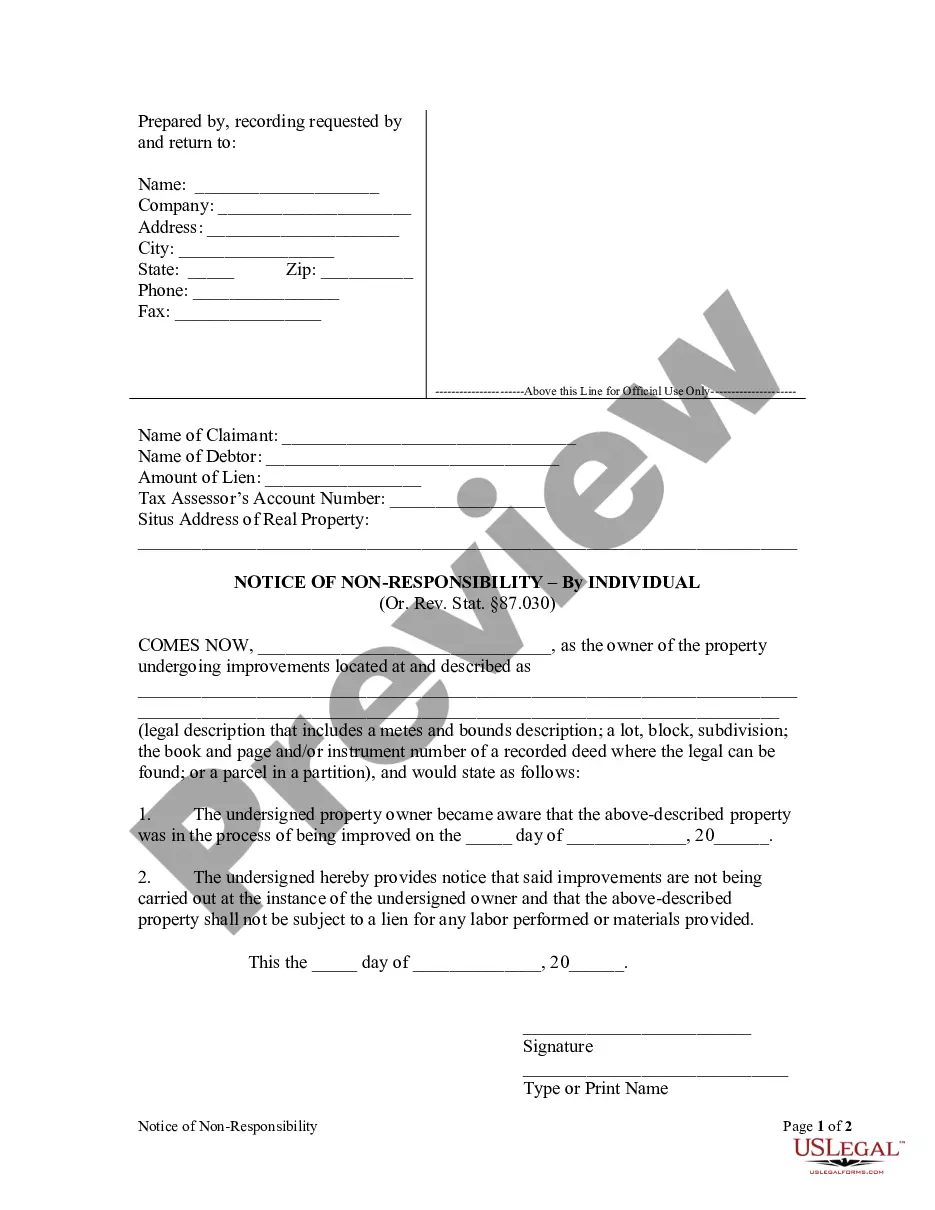

This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Deed Of Trust Records For A House In Nevada

Description

Form popularity

FAQ

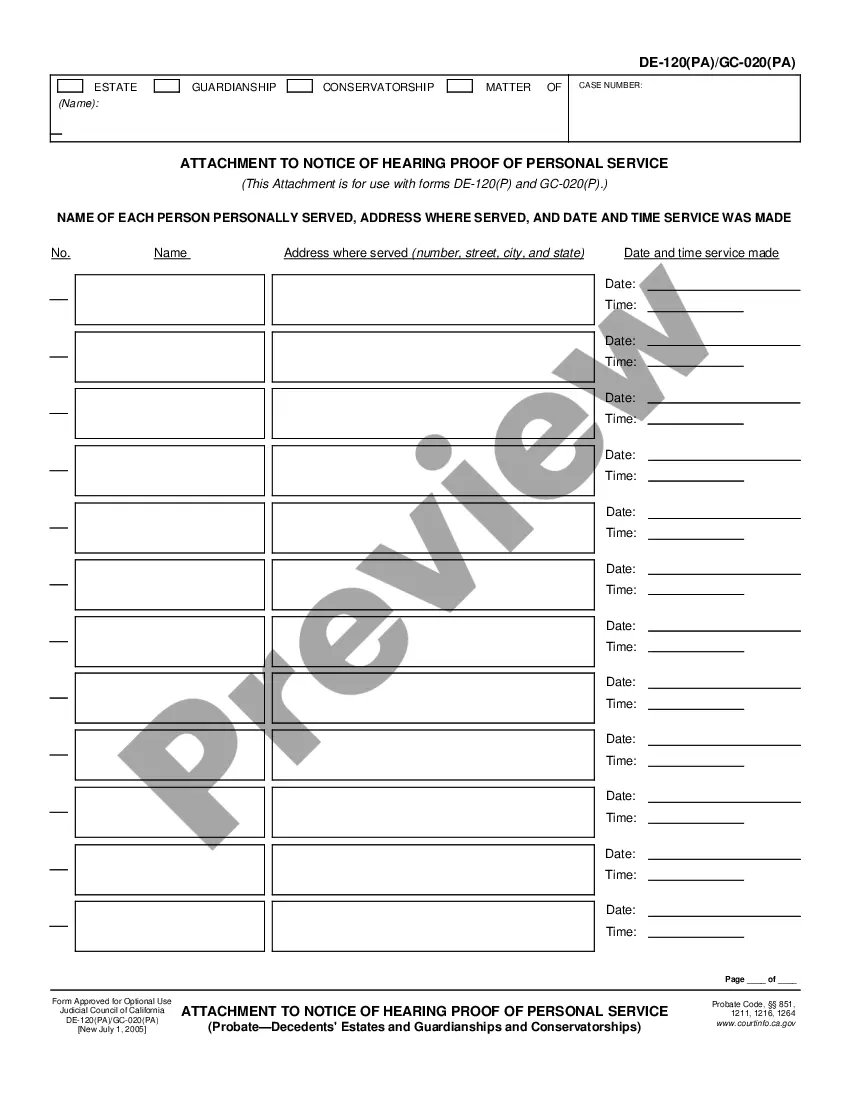

The law requires any transferee acquiring an interest in real property or manufactured home subject to local property taxation, and that is assessed by the county assessor, to file a change in ownership statement with the county recorder or assessor.

For Deeds, Mortgages or other property related records, consult the County Recorder of the county where the transaction occurred. See for county recorder contact information.

In Nevada, trust documents are not filed with the court, which means the terms of the trust and the identities of the beneficiaries can remain confidential. This can be an important consideration for individuals who value their privacy.

The deed of trust must then be recorded with the county where the property is located, and each of the parties (the trustor, trustee, and lender) should keep a copy of the recorded document.

The deed of trust transfers title to the land to the trustee, but the transfer is subject to certain conditions. The conditions are: 1. If the borrower pays, reconvey title back to the borrower.

Nevada law allows for the creation of Nevada Asset Protection Trusts, which can protect assets from creditors, lawsuits, and bankruptcy. By placing assets in a trust, the grantor can ensure they are protected, as well as their beneficiaries from potential creditors while still retaining some control over the assets.

In 2011, the State of Nevada passed the Uniform Real Property Transfer on Death Act, which can be found at NRS 111.655 to 111.699 (the “Deed upon Death Act”).

No state income taxes. No distributions from trust or consumption of principal or income.

230, 710.159, 711.600, sections 35, 38 and 41 of chapter 478, Statutes of Nevada 2011 and section 2 of chapter 391, Statutes of Nevada 2013 and unless otherwise declared by law to be confidential, all public books and public records of a governmental entity must be open at all times during office hours to inspection by ...

Nevada is a Deed of Trust state.