Deed In Trust Vs Deed Of Trust In Montgomery

Description

Form popularity

FAQ

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

Disadvantages of a Trust Deed For borrowers, if financial circumstances change, default on repayment can result in property foreclosure.

Deeds of trust transfer the legal title of a property to a third party—such as a bank, escrow company, or title company—to hold until the borrower repays their debt to the lender.

Is Alabama a Mortgage State or a Deed of Trust State? Alabama is a Mortgage state and Deed of Trust state.

A deed of trust can benefit the lender because it allows for a faster and simpler way to foreclose on a home — typically months or even years faster.

Maryland is a Mortgage state and Deed of Trust state.

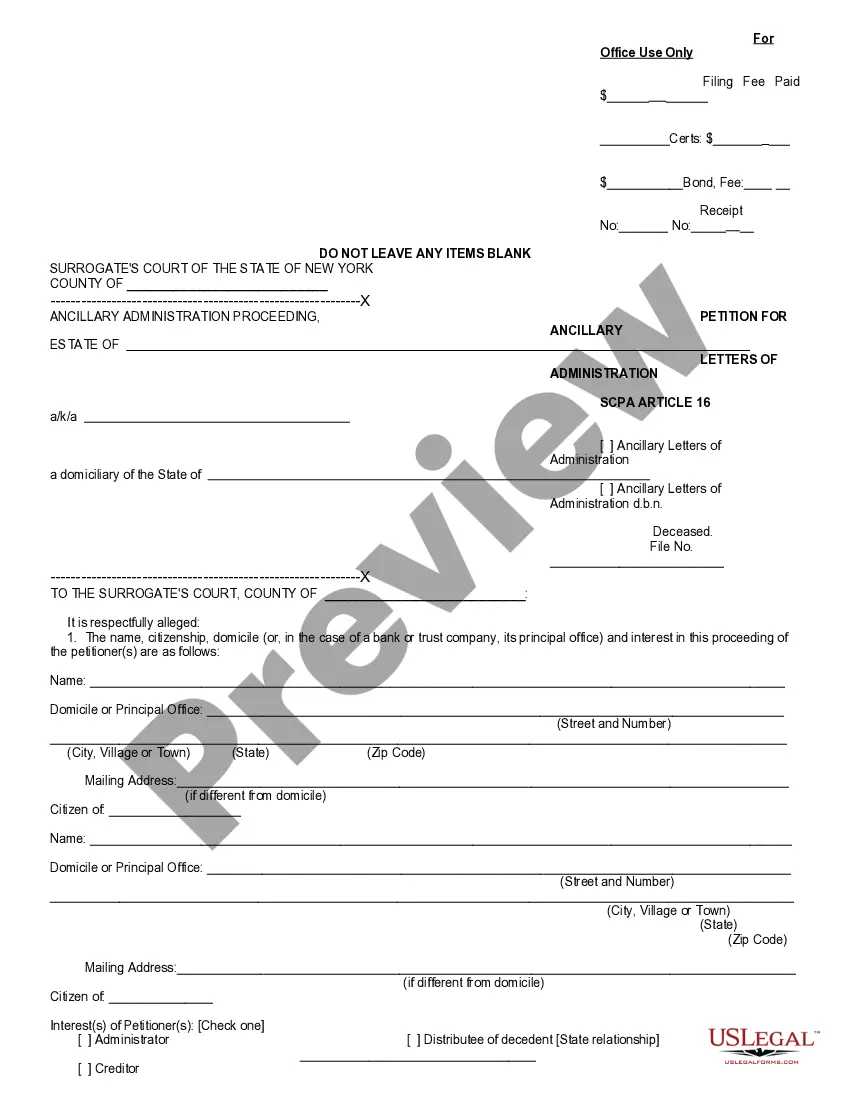

Where to Get a Deed of Trust? To get a Deed of Trust, you must file the proper paperwork with the proper court as generally outlined above. These documents must be filed with the county clerk or recorder, and the lender typically sends them to the recording office after the property closing.

Yes, you can sell a home with a Deed of Trust. However, just like a mortgage, if you're selling the home for less than you owe on it, you'll need approval from the lender.

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

Recording a deed in Montgomery County is a two step process. First, bring the deed to the County Transfer/Recordation Tax Office located at: 27 Court House Square, Suite 200, Rockville, for processing. Second, visit the Courthouse at 50 Maryland Avenue, Rockville 2nd floor Recording Office.