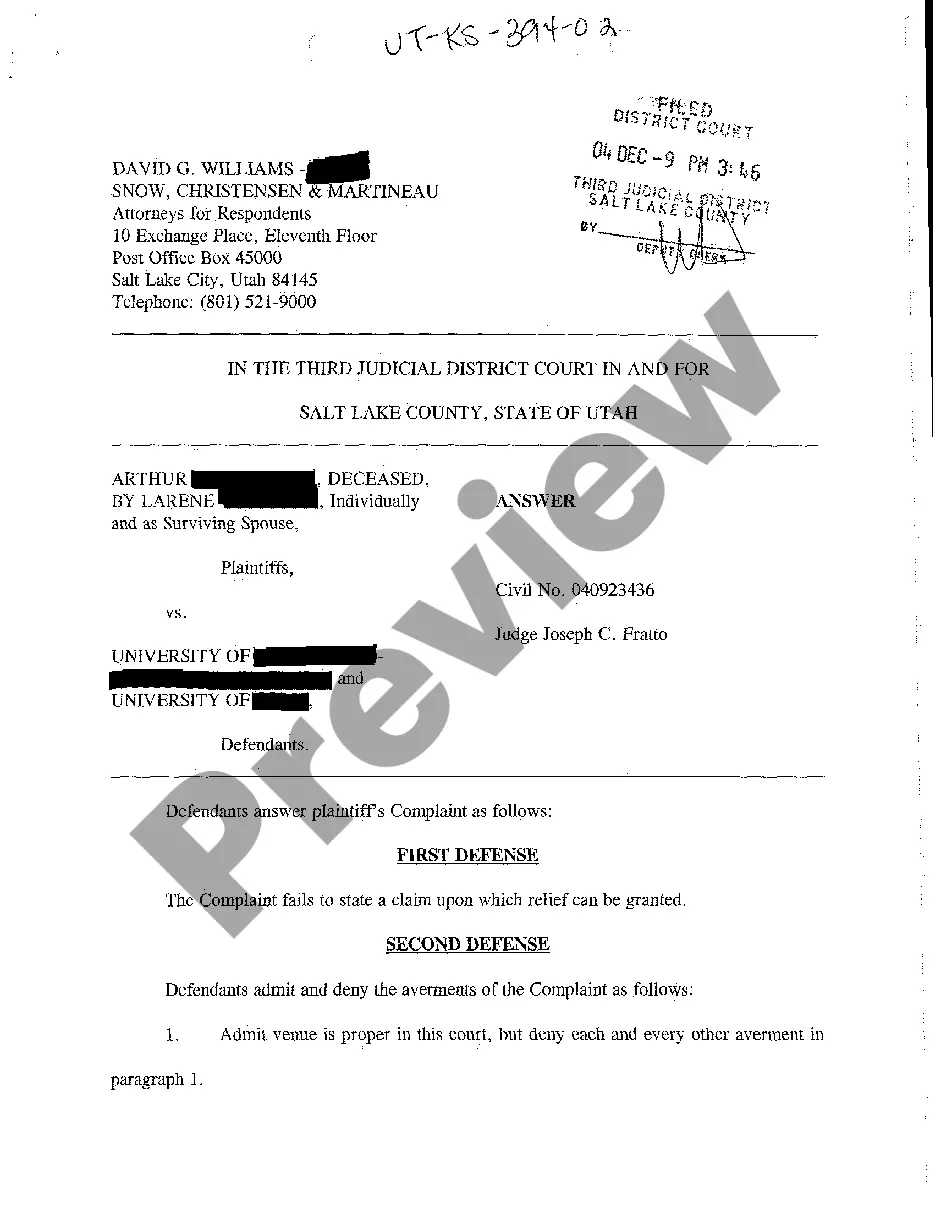

This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Amend Deed Of Trust In Illinois

Description

Form popularity

FAQ

If you have an irrevocable trust, it is extremely difficult to make changes to it because the trust was set up to be permanent and not alterable. Most people, however, create a revocable living trust. A living revocable trust is designed to be flexible so you can make any change you want to it.

Here are two potential costs to consider: Simple amendments, like changing a beneficiary or trustee, can range between $300 to $500. More substantial changes, such as a complete restatement of the trust to reflect significant alterations, could exceed $2,000.

In California, you can modify your living trust to reflect changes in your life circumstances or wishes. To amend a living trust in California, you'll need to create a written amendment document that clearly states the changes you want to make to your trust.

Beneficiaries can make changes without heading to court in some situations. If the beneficiaries consent, then the trust can be modified or terminated. However, all beneficiaries must agree to this course of action. If there are disputes, the Illinois courts may need to become involved.

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

The terms of a trust can only be validly amended when the amendment complies with the existing trust deed and rules. We assist by reviewing the existing trust rules and providing amendment documentation that ensure that the variation of trust terms remain compliant and effective. What's included: letter of advice.

Rectification is available at the court's discretion. It is unlikely to be granted if the mistake in the trust deed and rules is too fundamental or extensive. If you are unsure, take advice. What Considerations Would the Court Take Into Account?