Deed Of Trust Modification Form For New York In Houston

Description

Form popularity

FAQ

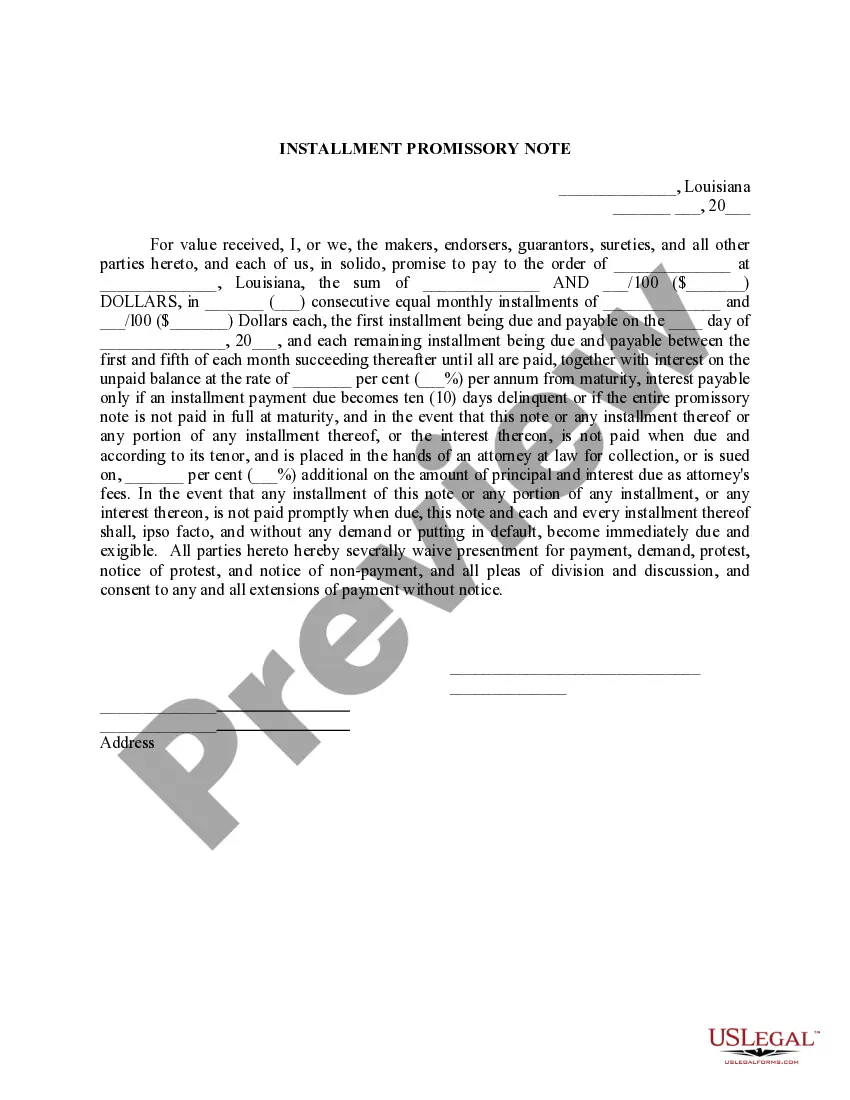

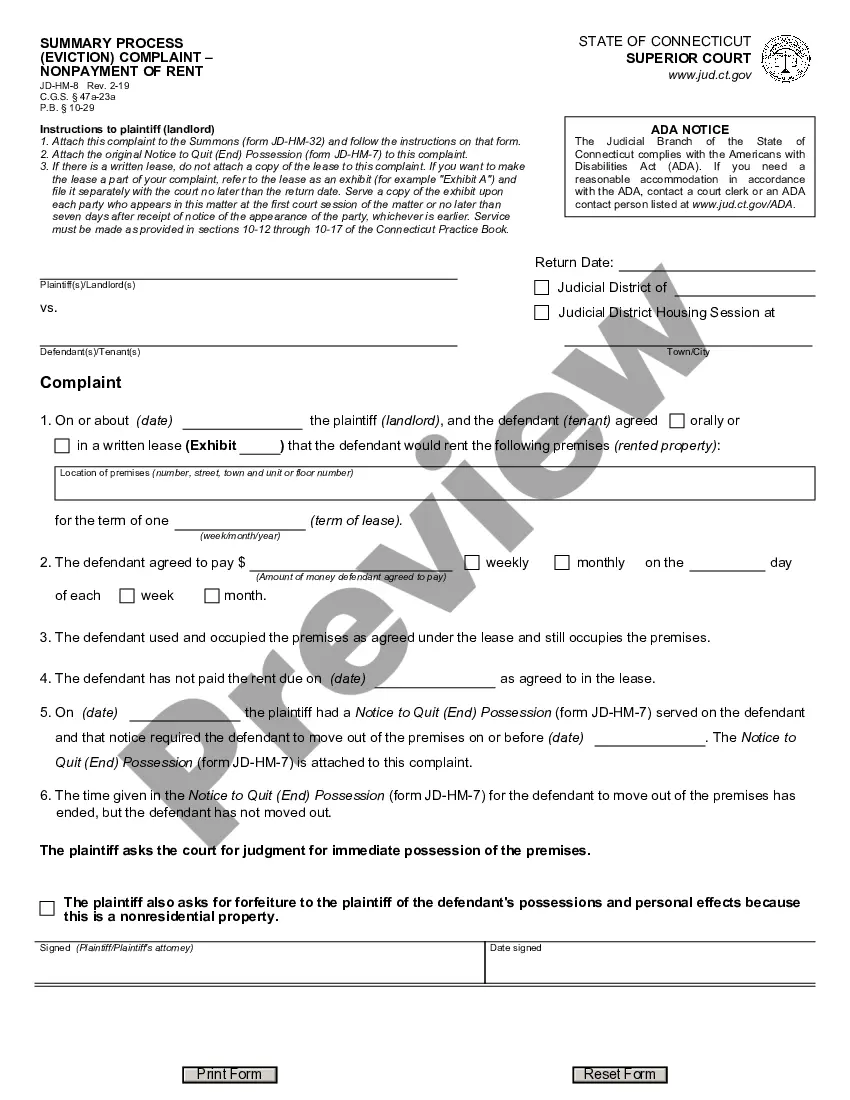

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

A modification is a change or alteration, usually to make something work better. If you want to change something — in other words, modify it — you need to make a modification. Lots of things require modification, because they get older or just because they can be improved.

A deed used to convey New York real property to a revocable trust. This Standard Document contains integrated notes and drafting tips.

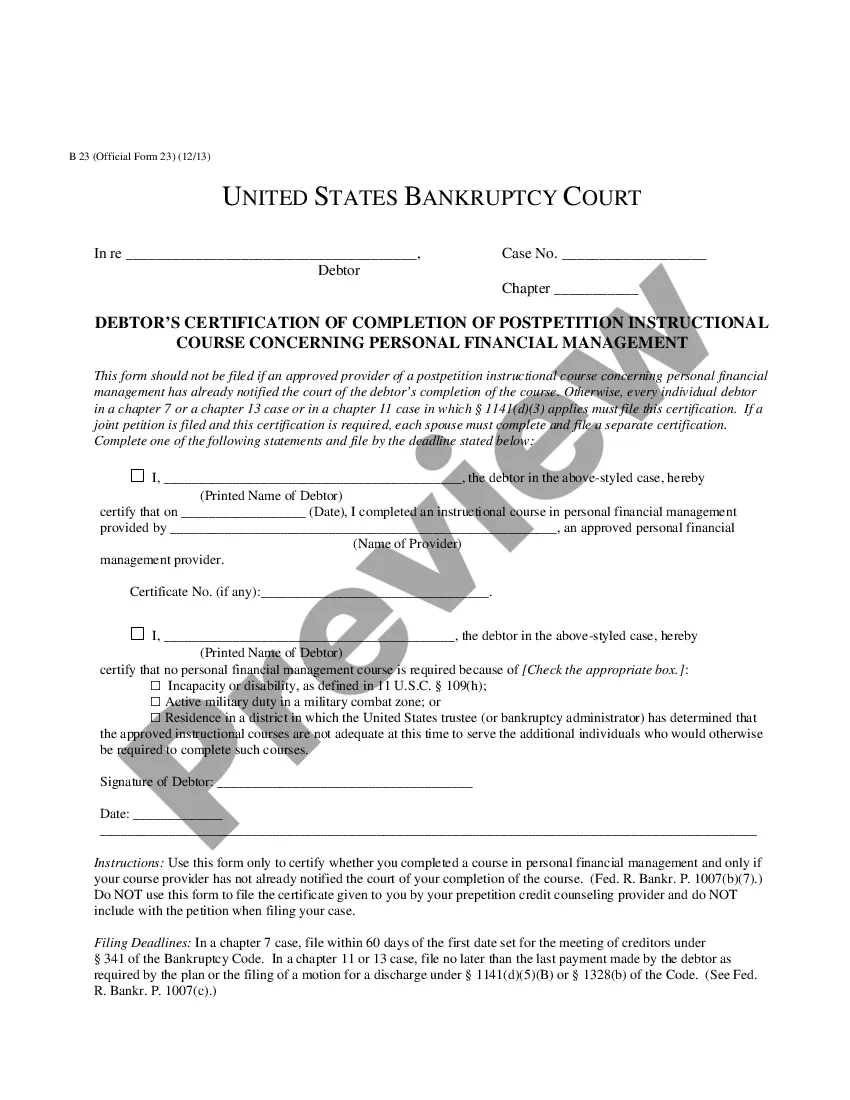

Where to Get a Deed of Trust? To get a Deed of Trust, you must file the proper paperwork with the proper court as generally outlined above. These documents must be filed with the county clerk or recorder, and the lender typically sends them to the recording office after the property closing.

The terms of a trust can only be validly amended when the amendment complies with the existing trust deed and rules. We assist by reviewing the existing trust rules and providing amendment documentation that ensure that the variation of trust terms remain compliant and effective. What's included: letter of advice.

Disadvantages of Putting Your House in a Trust Loss of Direct Ownership. Potential Complexity and Administrative Burden. Potential for Increased Costs. No Asset Protection Benefits. Limited Tax Advantages. No Protection Against Creditors.

Summary. Placing a mortgaged property in a trust is possible and common, although key considerations must be taken into account. Some considerations to keep in mind are mortgage payments, refinancing, and the due-on-sale clause.

Transfer the Deed. To transfer real estate into the trust, you must prepare a new deed that transfers ownership from you to the trustee of the trust. The deed must be signed, notarized, and recorded with the county recorder's office where the property is located.

If the asset is a house, you must execute a new deed giving it to the trust. If the asset is a car, you must transfer the title to the trust. If the asset is a bank account, you must transfer the funds to a new bank account in the name of the trust.