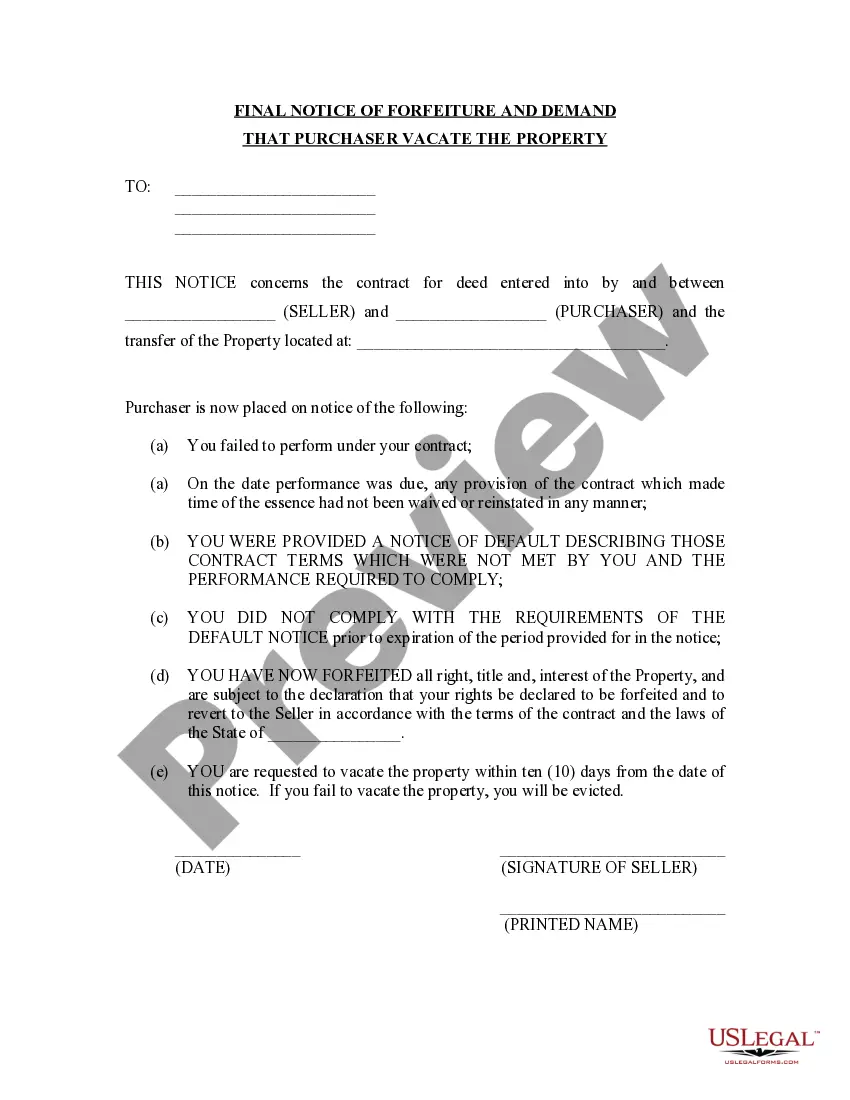

This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Modification Deed Trust Form For Uk In Harris

Description

Form popularity

FAQ

A deed of trust is a legal document that transfers the legal title of a property to a third party. Certain trusts may need to be registered with HMRC, further guidance on trusts can be found here: Register a trust as a trustee.

You cannot apply for a trust deed on your own. A 'trustee' helps you with your application. You must get debt advice to find out if a trust deed is right for you.

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

Where to Get a Deed of Trust? To get a Deed of Trust, you must file the proper paperwork with the proper court as generally outlined above. These documents must be filed with the county clerk or recorder, and the lender typically sends them to the recording office after the property closing.

In England and Wales the trust document usually takes the form of a trust deed. If the trust deed is created by the trustees (which may happen if the trustee is also the settlor, or if the settlor does not wish his name to appear on the trust deed), it is called a declaration of trust.

The trustees are the legal owners of the assets held in a trust. Their role is to: deal with the assets ing to the settlor's wishes, as set out in the trust deed or their will.

Disadvantages of discretionary trusts Trusts are complex. Unless professional trustees are appointed, which will incur costs, lay trustees will have to navigate trust and tax law, and manage the assets of the trust. They will also have to decide how to exercise their discretion as to the beneficiaries of the trust.

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...