Deed Of Trust Modification With Agreement In Fulton

Description

Form popularity

FAQ

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

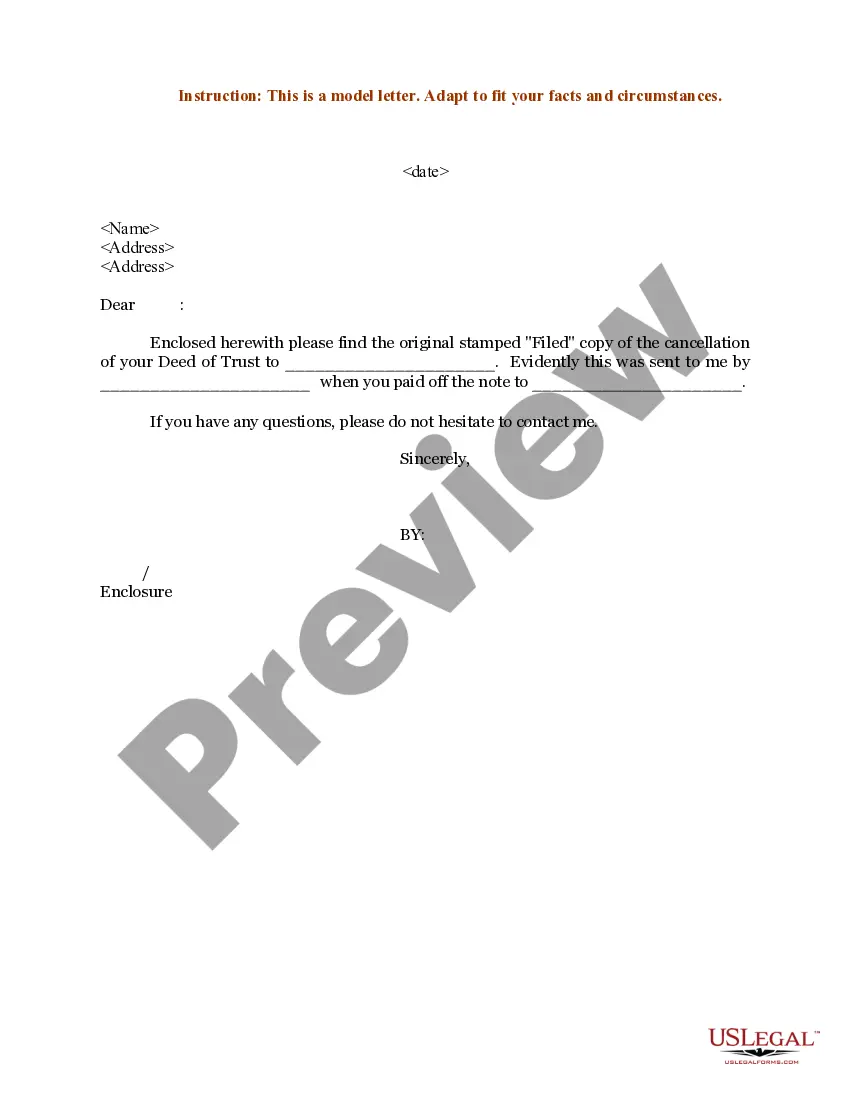

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

In the trust deed where there is no mention about amendment, the amendment has to be done with the permission of a civil court. Even the Civil Courts do not have unlimited powers of amendment. The Civil Courts permit amendment under the doctrine of Cy pres, which means the original intent of the settlor should prevail.

A deed of trust will include the same type of information stated in a mortgage document, such as: The identities of the borrower, lender, and trustee. A full description of the property to be placed in trust. Any restrictions or requirements on the use of the property while it is in trust.

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

Yes, you can sell a home with a Deed of Trust. However, just like a mortgage, if you're selling the home for less than you owe on it, you'll need approval from the lender.

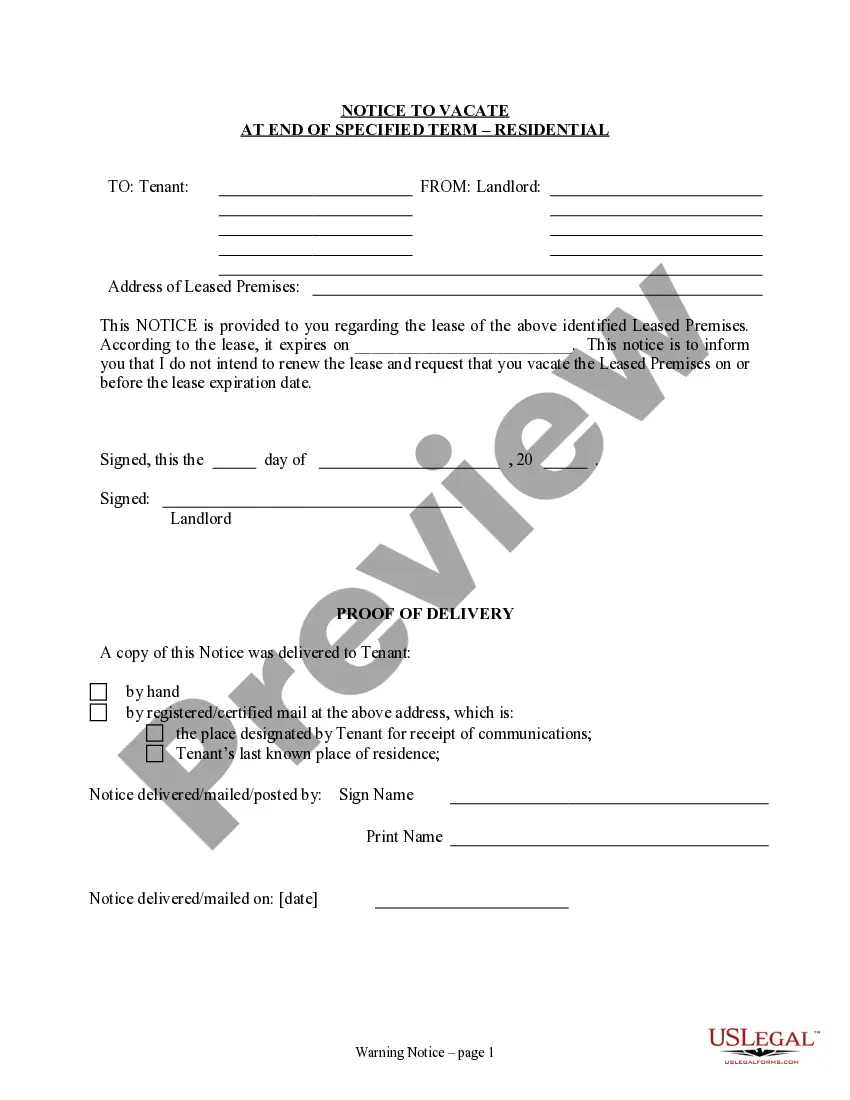

There are situations where property may need to be transferred out of a trust during the lifetime of the grantor, such as required or voluntary distributions to beneficiaries, refinancing, or for business purposes. If you need to transfer real property out of a trust, preparation of a Trust Transfer Deed is required.

The biggest difference between a title and a deed is the physical component. A deed is an official written document declaring a person's legal ownership of a property, while a title is a legal concept that refers to ownership rights.

Instead of an agreement directly between a lender and a borrower, a trust deed places the title of a property in the hands of a third party, or trustee. Only after the borrower has satisfied the terms of their debt to the lender will the property be fully transferred to the borrower.