Forge Trust Deeds In Dallas

Description

Form popularity

FAQ

County Clerk's Office Include the property. Details in a self-ress stamped envelope Enclose a checkMoreCounty Clerk's Office Include the property. Details in a self-ress stamped envelope Enclose a check for the required. Fees. If you need help the Dallas County Clerk's Office offers customer.

Trusts provide much more flexibility, control, and protection for both you and your beneficiaries. They allow you to avoid probate, protect your assets and better ensure your wishes are carried out exactly as you intend.

Disadvantages of a Trust Deed For borrowers, if financial circumstances change, default on repayment can result in property foreclosure.

Let's get started how to get a copy of a deed. In Texas in Texas property Deeds are public records.MoreLet's get started how to get a copy of a deed. In Texas in Texas property Deeds are public records. This means anyone can access them the process to obtain a copy is straightforward.

There are several benefits associated with using a land trust to hold real estate assets. While you might use a living trust to protect assets from creditors or minimize estate taxes, you might consider a land trust if: You want to keep real estate investment property separate from your other assets.

But the good news about setting up a land trust is it's extremely simple. Typically you'll only need two documents: a trust agreement that names a settler (that's you) and a trustee, and a deed that transfers the property's title to the trustee.

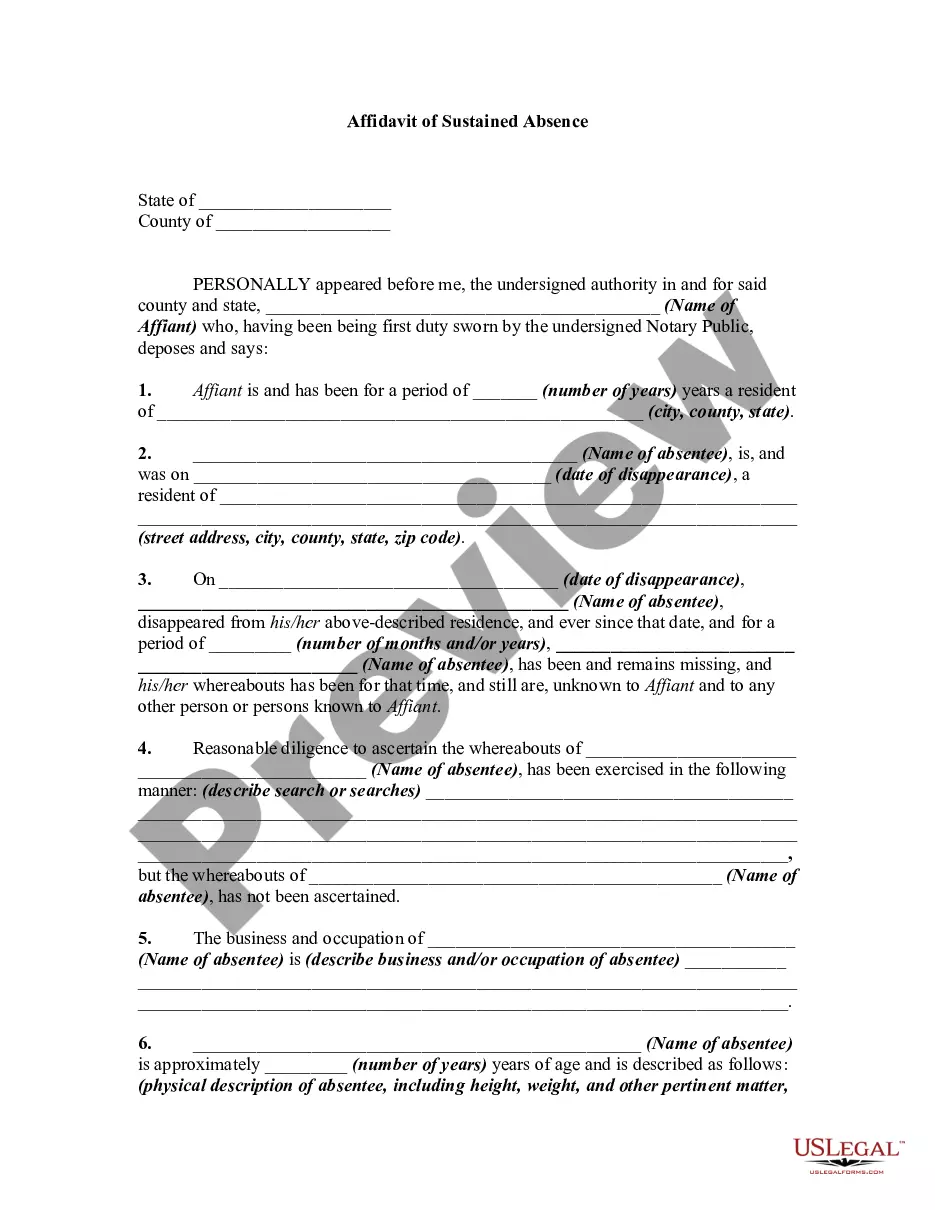

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

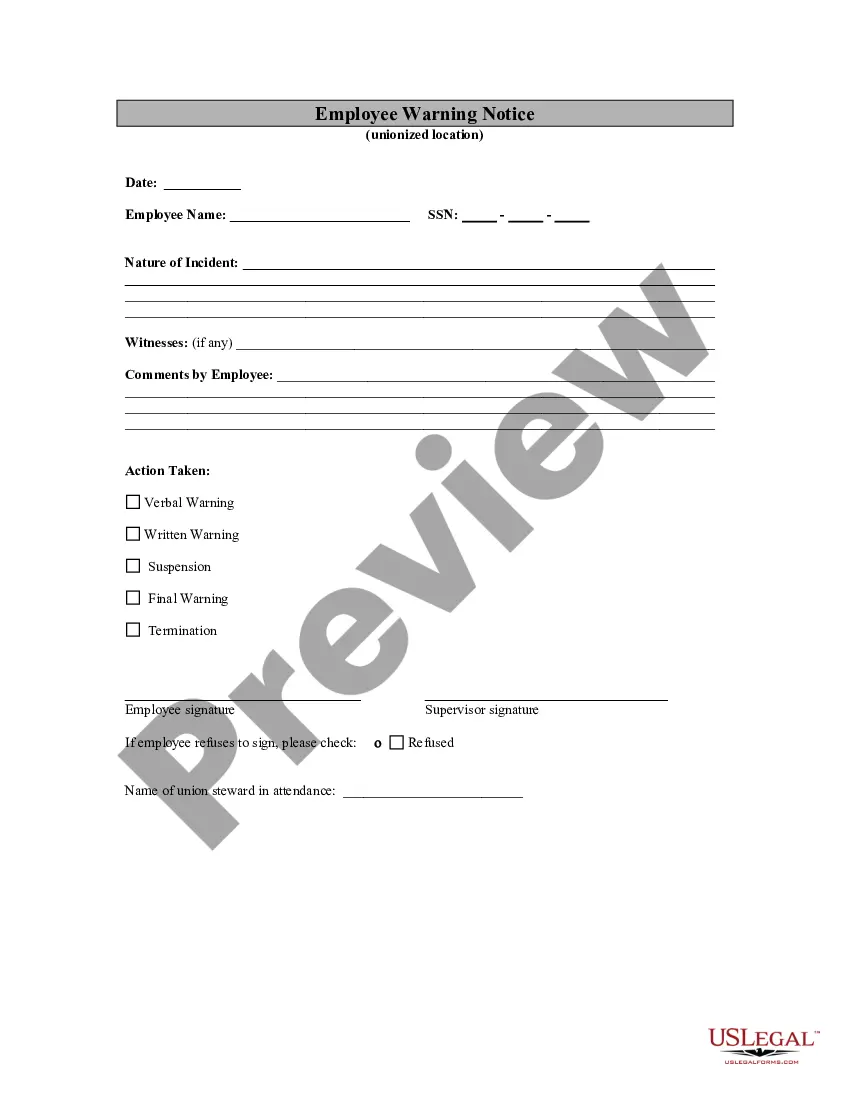

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

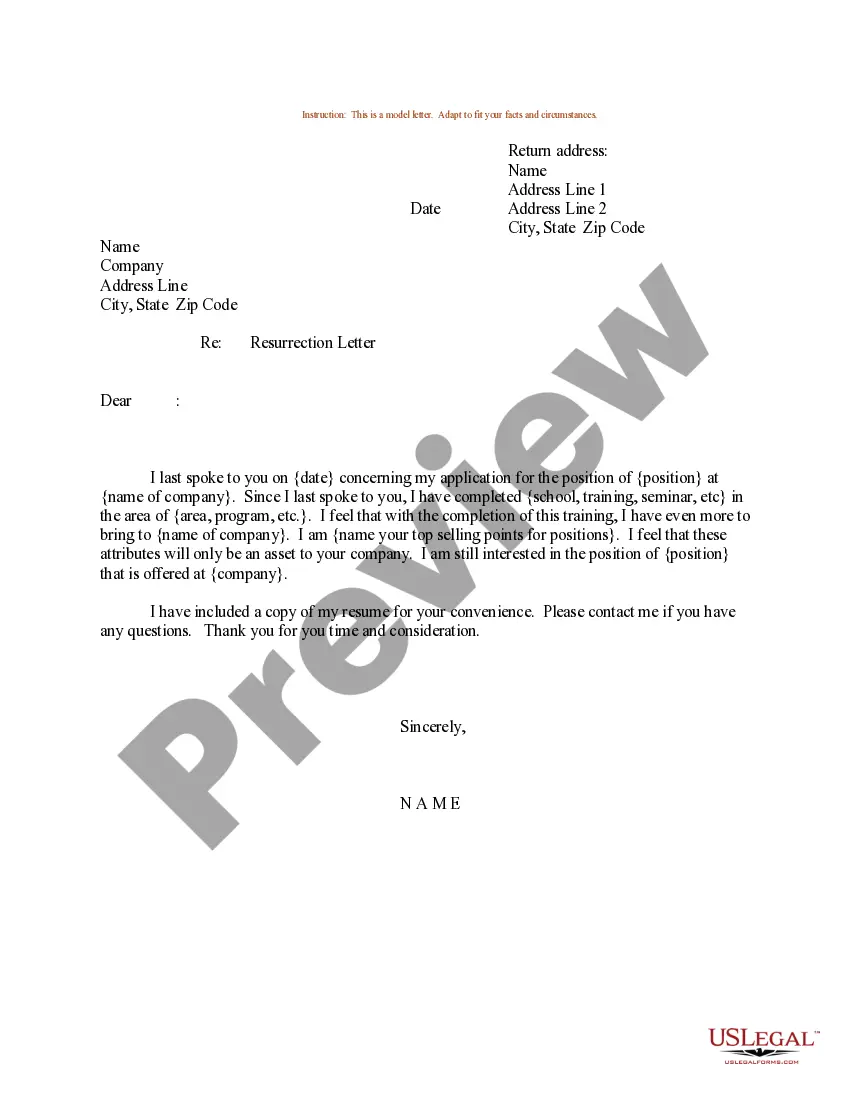

How to fill out warranty deed texas: Begin by obtaining the correct form for a warranty deed in Texas. Fill in the necessary information on the form, including the names and addresses of both the grantor (current owner) and the grantee (new owner). Provide a detailed legal description of the property being transferred.

Instead, Texas uses Deeds of Trust. The document is referred to as a Deed of Trust because there is a Trustee named for the property. Even though there is a Trustee named, the Trustee does not do anything unless there is a default or a failure to comply with the promissory note or deed of trust.